I’ve had good luck over the years trading penny stocks. And I mean penny stocks. Trading under a dollar, if not ten cents, no trading volume, and a lousy balance sheet.

Yesterday I spent some time at the Planet Microcap Showcase conference in Vancouver, checking out various companies listed on the Toronto Venture Exchange and the Canadian Securities Exchange.

But before we begin:

Forget about “value investing” metrics. We are not looking for stocks with increasing sales, soaring profitability, and zero debt. That’s for the other guys.

The first question I ask with these kinds of stocks is: What is the chance of the stock going to zero in the next year?

The second question I ask is how close is the company to hitting rock bottom? Does nobody, and I mean absolutely nobody, pay any attention to the stock anymore?

There are two kinds of penny stocks I look for, legitimate companies that have fallen on hard times and outright frauds.

The second is not too hard to figure out if you are willing to spend some time in SEDAR reading the boring documents nobody else wants to read.

That leaves you with the real companies with hard-luck stories. If you buy them, and you are prepared to hold them for anywhere from six months to two years, their luck will change, and you will profit.

That’s been my experience anyway, in the last decade or so.

Three Companies Not Getting Any Love

I attended a presentation by Neil Wiens, CEO of Replenish Nutrients, which is a subsidiary of EarthRenew Inc. (ERTH-CSE).

The stock is trading today at around 6.5 cents. Its daily volume this month has been anywhere from 2 million to ten thousand shares. It has a market cap of $9.2 million CAD. In the last six months, it’s showing a loss of $800K.

The company sells naturally-sourced, regenerative fertilizers that re-establish soil health and increase crop yield.”

Basically, these guys are into fertilizers that are beloved by tree-huggers.

Coincidentally, I just happen to know a little bit about the business of fertilizers. I am treasurer of our local Scout Group, 46th Chown, in Vancouver.

Every year, we hold a fundraiser where we buy organic fertilizer from a farm in Abbotsford, bag it, and sell it in the city.

Let me tell you, the markup is incredible. We do five figs in sales on just one day with gross margins touching 80%.

Urban gardeners just LOVE “green” fertilizer and can be quite passionate about it. I know this because my wife is one of those gardeners as well as not few of the neighbours.

Vancouver has a huge number of urban gardeners who love what companies like Replenish Nutrients can offer.

It’s worth keeping an eye on the company to see if they can break into that market.

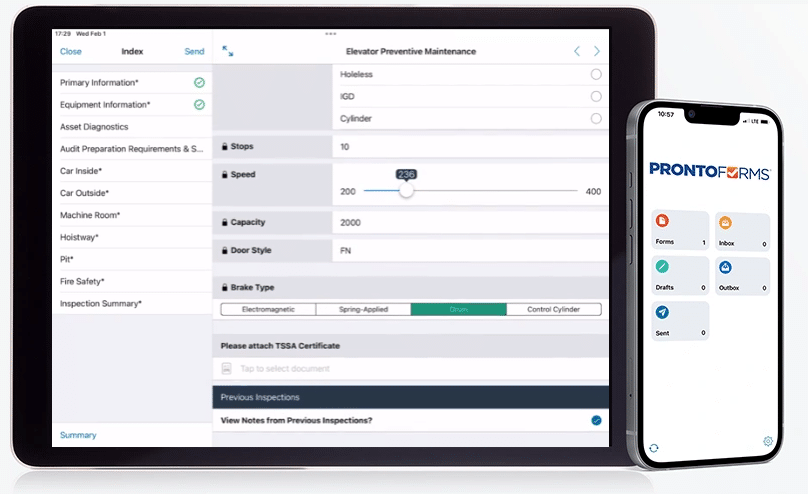

Another company on my watchlist is Prontoforms (PFM – TSXV). The stock is trading up today at 66 cents but only on 9800 shares of trading volume.

Prontoforms (soon to be renamed to “TrueContext”) is a software company that:

” offers the leading mobile forms solutions and customizable forms for the field. The ProntoForms mobile solution makes it easy for remote workers to collect data, access company data in the field that can be used to populate offline or online mobile forms, and automatically share the results with back-office systems, cloud services, and people.”

The company has a market cap of $90 million CAD. Sales have been growing for five years, with $28 million in sales in 2022, but EBITDA has been in the red for those five years as well.

Even though the operating loss has been coming down, it’s still close to a $1 million on a quarter.

The relatively new Co-CEO, Philip Deck, has 20 years in managing technology company operations, and spent much of his time talking about the overhaul of the marketing and sales team, during his presentation at the Microcap conference.

What’s the upside for this stock? Well, I’m not going to hold my breath that it will be a ten-bagger anytime soon.

But it’s a tech company with a software-as-a-service (SAAS) business model. That means a lot of recurring revenue opportunities.

SAAS companies, once they make it into the black, always have a place in my portfolio.

Trading today at 16 cents it has a market cap of $14.5 million.

With locations all over the US, ARCpoint Labs offers a variety of health and wellness testing solutions. They made good money during COVID-19 as a result of demand for certified COVID testing.

However, since the end of the epidemic, it’s been a tough ride. Last April they announced a headcount reduction of 30%.

“The majority of these cuts took place at the upper management and executive levels and involved $485 thousand in one-time severance costs that were accrued in Q1, 2023, but paid in Q2, 2023. As part of the cost-cutting process, the company also undertook significant operational cost-saving measures representing approximately 20 percent of the then current operating costs. Concurrently, the Company also incurred additional software expenditures to refine the new technology platforms in preparation for full roll out.”

Yep, that’s ugly.

However, in the presentation, the CEO made a point that under the new president, new franchise sales are taking off.

So, there’s a turnaround in the works, hopefully.

Conclusion

I’m not buying any of these stocks anytime soon, for two reasons.

One, I just need to do more research. I’ve just scratched the surface so far.

Secondly, and more importantly, with all three companies, there are catalysts in the months ahead that could ensure a successful turnaround on the balance sheet.

With any sort of luck, I can get my buys in before the rest of the market notices, if any of these companies show an operating profit or at least positive cashflow.

I think 2024 is going to be the year where you want to be all-in on equities (and crypto, of course).

As I said at the beginning of this story, I’ve had good luck buying into these types of companies, but only at the right time in the cycle.

DJ