There are two people in the finance space I watch very carefully.

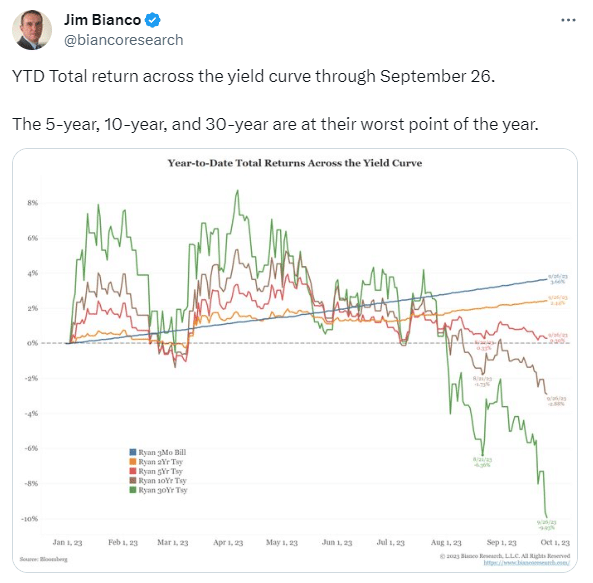

One is Jim Bianco. He monitors the bond market very closely. It doesn’t look good (again):

I also remember an email I got after writing that article, which said that I was completely wrong and that everything was fine (from a stockbroker, no less).

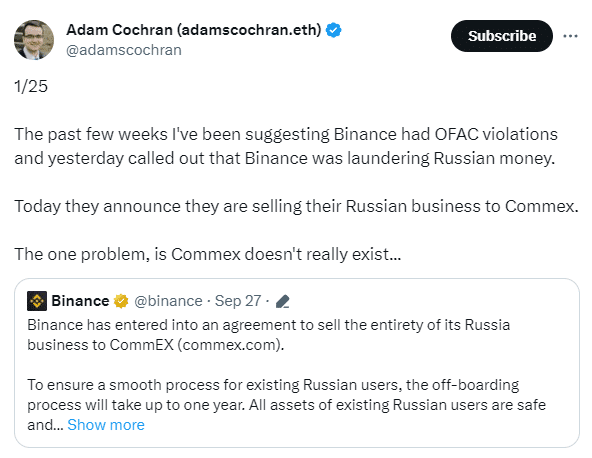

The second guy I watch closely is Adam Cochrane. He’s a crypto-guy, but unlike most crypto-pundits, he isn’t a nauseating manic-depressive cheerleader/suicide candidate but an earnest muckraker.

I have a special affection for him because he wrote on Twitter about rumours of FTX going bankrupt about four days before they halted withdrawals.

That allowed me enough time to close my account and pull out a significant bit of money. I still need to buy him a drink if I ever run into him at a conference.

Anyhow, he thinks Binance is toast:

Do I believe it? Honestly, after the last two years of crypto frauds, bankruptcies, and generally outrageously idiotic behavior by members of the crypto community, there’s very little that I wouldn’t believe.

But What About the Price of Bitcoin (and Ethereum)?

Bad actors leaving crypto generally cause a short-term dip followed by recovery. FTX was never really interested in promoting Bitcoin and Ethereum as new digital currencies, they just wanted to pump their own token.

Same thing with Binance and their BNB token. I don’t see how the company adds value to the community.

The shuttering of Binance may cause some short-term pain but in the long run, it would be a good thing.

And about those collapsing bond yields? I think it’s very bullish for Bitcoin.

This will be the third year in a row that institutional asset managers have gotten creamed holding bonds. I’m sure their clients are not happy.

Hello Bitcoin ETFs, the new sexy investment that will be a safe haven from shrinking US Treasuries.

The SEC can delay all they want, even until March 2024, but it’s going to happen.

Timing is everything, and maybe it’s too soon.

But October is usually the best month of the year for Bitcoin, and today isn’t bad at all (so far):

DJ