Newsletter writers HATE to put out copy when terrible afflictions grip the world, as they so often do:

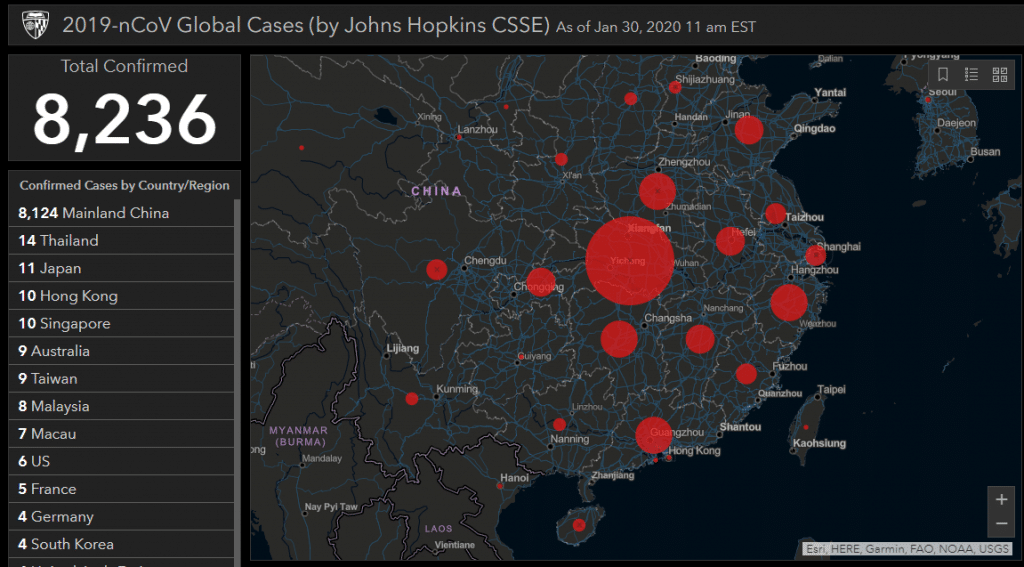

https://gisanddata.maps.arcgis.com/

In the world of financial publishing, nobody wants to be labelled a vulture (“Buy this stock because of THIS natural tragedy”).

But people want to hear (and read) what other people think about the great issues of our day (or this month).

Like the Coronavirus.

And thus we wade into the swamp, to Render An Opinion.

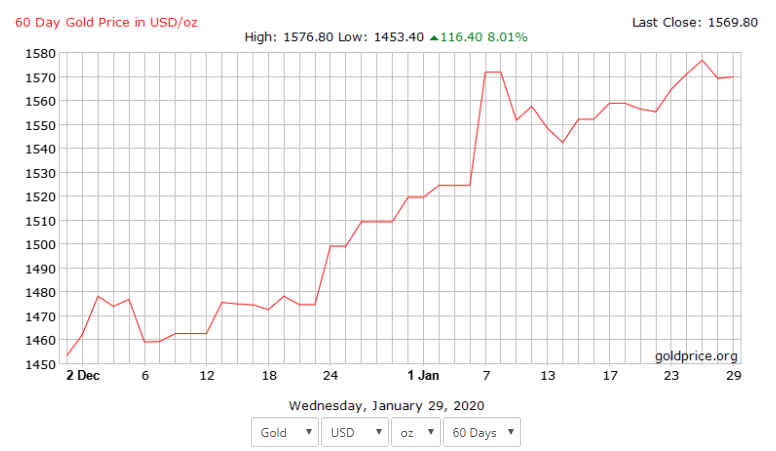

My three obsessions heading into 2020, in no particular order, were oil (energy stocks), gold and bitcoin.

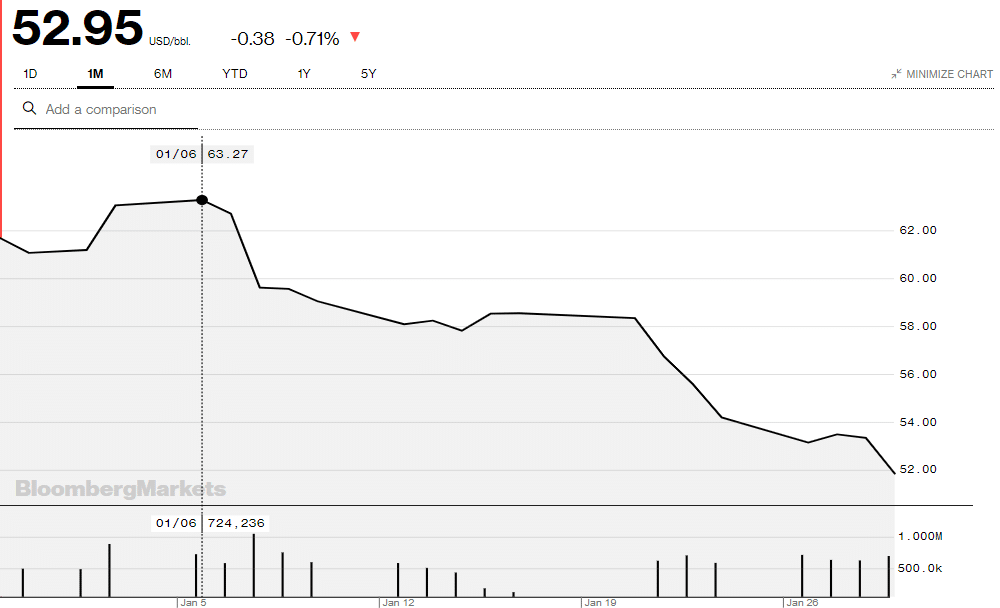

Let’s start with oil.

Oil futures look to be somewhat correlated with the spread of the coronavirus. That is to say, if the price of WTI and Brent head down, it’s a good chance there was bad news out of China.

And oil prices this month are not looking good.

| I think if WTI breaks below $40, that’s a sign the markets believe the virus can’t be contained. If rallies to $60 or higher, then the danger has passed. Meanwhile, gold, as the place investors go to when the smelly brown stuff hits the moving propellers, is holding up nicely and looking to break $1600. |

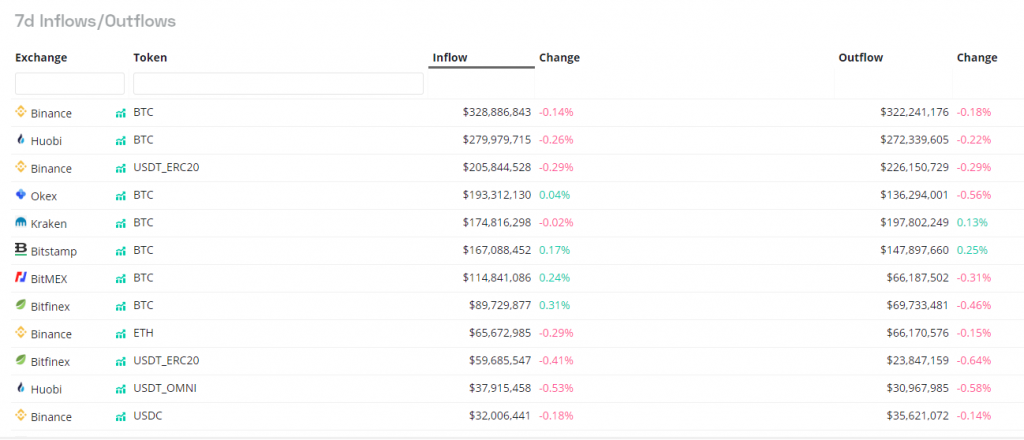

Bitcoin, as always, is the biggest surprise and the biggest mystery.

The biggest surprise because it’s on course to have one of the best Januarys ever, going to from $7500 to nearly $9500 at time of writing, a monthly increase of 25%.

The price spike is most mysterious as crypto-exchanges are not really showing any significant inflow of funds.

One of two things could be driving up the price of bitcoin:

One explanation is that there is money coming via “dark pools” i.e. not through exchanges whose wallets can be monitored through the blockchain.

A second reason could be a speculative frenzy, with evidence being a spike in the funding rate of the XBTSUD contract in Bitmex. Rates have been as high as 0.07% per 8-hour period (that’s 76% per annum, not compounded).

Expect huge price volatility on the weekend as the monthly options on Deribit will close out tomorrow (Friday).

By the way, “price volatility” means the price of bitcoin will go either UP or DOWN. Sorry I don’t know which way.

Finally, back to the plague. What do I really think of it?

To be honest, in the last week, instead of keeping up with what’s happening in the world of crypto, I have been researching plague containment strategies.

My amateurish conclusion? Keep on eye on reported cases in Hong Kong. Here is why:

Think of plague containment as a series of cordons. The hospitals in Wuhan have been cordoned off.

Wuhan itself has been cordoned off.

With all the talk of banning flights from China, there is the beginning of a cordon around China.

Within each cordon, you can expect different rates of infection.

At ground zero, within the hospitals of Wuhan, for all we know, the virus is still running amok.

As far as we know, the virus is still spreading in Wuhan. But maybe not.

We don’t know if the virus is spreading in the rest of China, because of the untrustworthiness of the state media.

However, outside China, in the final cordon, it’s a different story. We have very good access to information. And the reported cases in the last week have gone from 14 to 112.

In the last cordon, the one between China and rest-of-world, Hong Kong is the weak spot.

It has transit links with mainland China that would be extremely difficult, if not impossible, to shut down.

Hong Kong also has a relatively free open press and highly advanced medical system with previous experience in dealing with pandemics (think of SARS). So we can be very confident that official reports coming out of Hong Kong are accurate.

There are ten confirmed cases of the Coronavirus in Hong Kong, with no deaths reported so far.

I check that number every day.

DJ