Both Europe and Japan are now solidly in negative interest rate territory.

The US is almost there. The Fed has lowered its reserve rate to 0%.

We will see if the US can hold the line. Don’t count on it.

Negative interest rates make for very weird economic behavior. For example, the quanto contract moves from being an esoteric financial instrument to becoming an essential part of any financial manager’s toolbox.

So of course, you ask, what is a quanto contract?

“A quanto is a type of derivative in which the underlying is denominated in one currency, but the instrument itself is settled in another currency at some rate. Such products are attractive for speculators and investors who wish to have exposure to a foreign asset, but without the corresponding exchange rate risk.” Investopedia

Let’s take an example because I know that even though I gave you the definition, it’s hard to wrap your brain around what that contract implies.

Suppose you have some Swiss francs. In that currency, you can’t find a positive interest rate. But Russian rouble currency holders can earn interest of 3% per annum.

You like that interest rate, but you don’t want exposure to the Russian rouble. So you buy a quanto contract that allows you to invest in Russian roubles with no exposure to that currency, as the contract is denominated in Swiss francs.

How does that work?

A quanto contract, in this instance, is denominated in Swiss francs but paid out in Russian roubles. If you are shorting the rouble, then you are protected from any currency devaluations.

Let’s say you bought a quanto contract for 100 roubles. Now let’s say the rouble depreciates 10% against the Swiss franc. You are shorting roubles so now the contract is worth 110 roubles.

But remember the contract is denominated in francs. Because the rouble depreciated 10% against the franc, the contract did not go up or down in value with regard to its value in Swiss the francs.

However, because you are shorting (ie selling or loaning roubles to people who want them) you are entitled to the three percent interest rate.

Voila, you get to stay in Swiss francs but collect an interest of three percent per annum.

By the way, this type of trading is called the “carry trade” and you can read more about it here.

Is there a “carry trade” in the world of crypto? You bet there is.

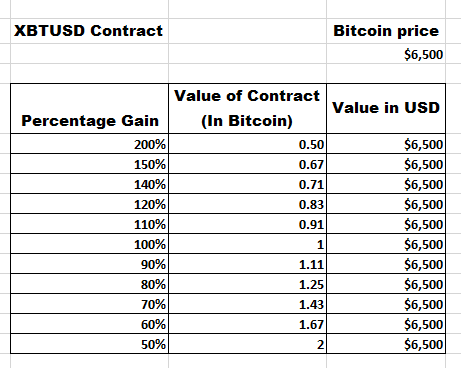

The Bitmex XBTUSD perpetual contract is a “quanto contract.” Therefore, if you short that contract (with no leverage) you have no exposure to the price of bitcoin.

But you still collect the funding rate (ie interest rate) three times a day. For most of the contract’s lifetime (4 years), the contract has had a positive funding rate anywhere from 7% to 30% per annum.

Very rarely has the funding rate of the Bitmex XBTUSD contract gone negative, although it went negative in March because of the financial crisis.

(However, note that you can build an inverse contract that limits exposure to the price of bitcoin but allows you to collect the negative interest rate. But the calculations are somewhat complicated and beyond the scope of this article).

Why This Is Important

Expect the use of quanto contracts to explode in popularity, both in and outside the world of crypto, now that negative interest rates are the “new” normal.

I don’t think the average investor has really thought through how negative interest rates are going to screw up the normal ways of doing business.

Do you have a million dollars sitting in a bank account that you need for a real estate transaction to close? At negative 1 percent per annum, every day of delay is costing you $27.40.

That’s annoying for you. But what about a multinational that has $1 billion in a cash float? That’s $27,400 a day the bank is charging to hold their money.

What about insurance companies that need to hold money to pay out settlements? Instead of making money on the “float,” they are now losing money.

That’s an earthshattering blow to just one industry.

As negative interest rates begin to bite, expect quanto contracts to go mainstream, as those with cash in currencies that offer only negative interest rates, seek out assets that carry a speculative premium.

DJ