In the last week of February I mentioned three junior gold mining stocks (that I bought) and two blockchain stocks (that I passed on).

About three weeks later, the apocalypse hit. Let’s see how those stocks weathered the storm.

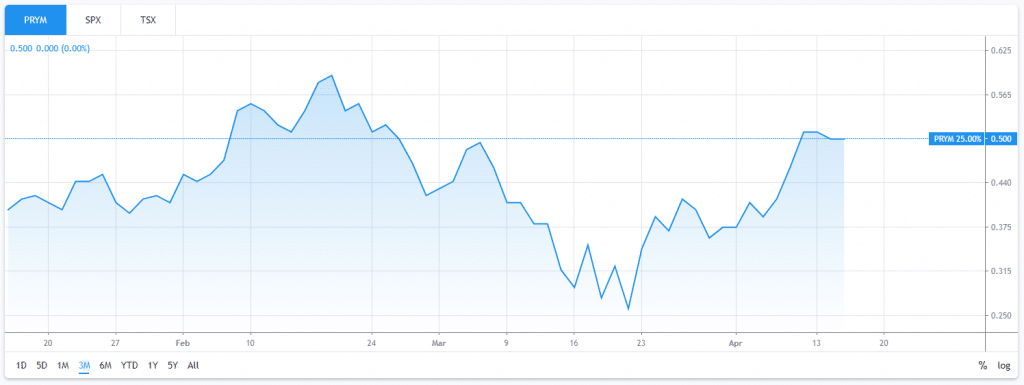

Prime Mining Corp (PRYM-TSXv, PRMNF-OTC)

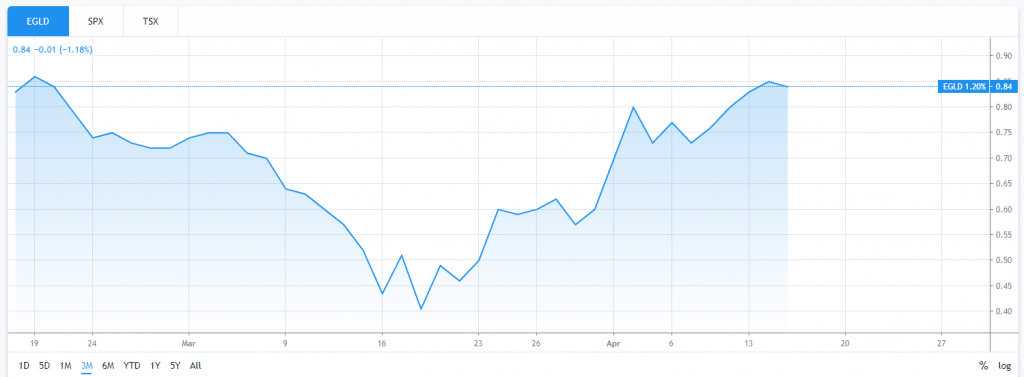

Eclipse Gold Mining (EGLD-TSXv)

K92 mining (KNT-TSXv)

A quick look at the chart shows they all got hammered in March but bounced back in April. And that suits me just fine.

Junior gold stocks on the TSX have a well-deserved reputation for being one of the riskiest stocks you can buy. With the senior markets seeing the quickest 20% drop in recorded history, you bet I’m happy that I’m flat the latest sixty days.

And what about the crypto stocks that I didn’t buy?

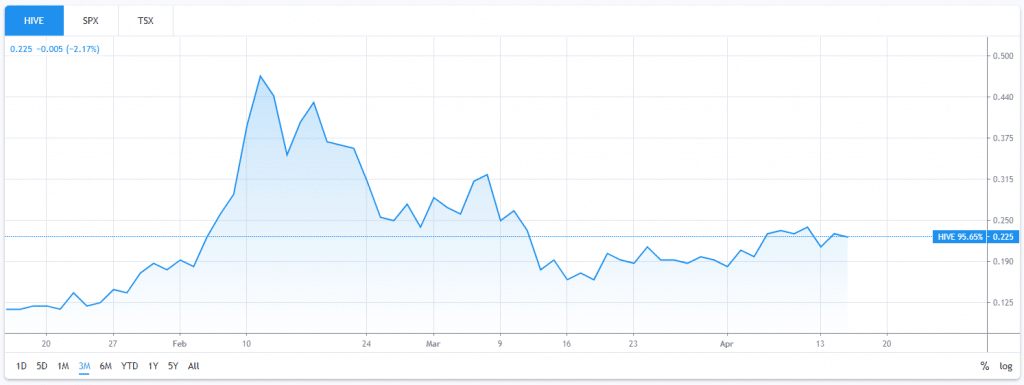

Here the chart on Hive Blockchain (HIVE-TSXv)

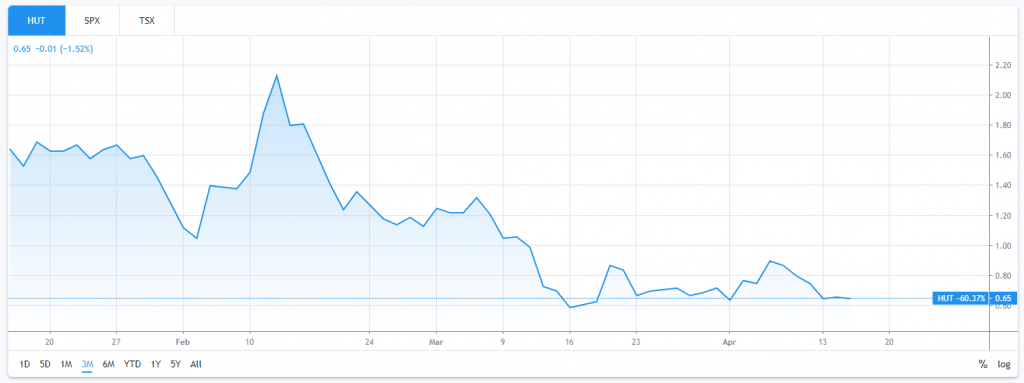

And here is the chart on HUT 8 (HUT-TSX) .

They got hammered in March and didn’t recover in April.

Are they ever going to pop back up?

Let’s wait and see on that one. With the bitcoin halving happening next month, their mining revenue is going to drop in half, unless one of two things happen:

1. The price of bitcoin goes up (a lot).

2. The network hash rate of the bitcoin network drops (a lot).

And that’s the problem. It’s going to take a lot of “something” for the needle to move on these stocks.

These stocks are asymmetrical in the sense that they won’t go up unless something “big” happens.

But the lower limit for these stocks is literally zero. If they run out of cash, there’s a real risk they will go bankrupt.

If the price of bitcoin doubles so what? That just means they are making decent money again and their stock bounces a bit.

But again, so what? I’ll pass. Better yet, if I really think the price of bitcoin is going to double in the next three months, I will just buy more bitcoin.

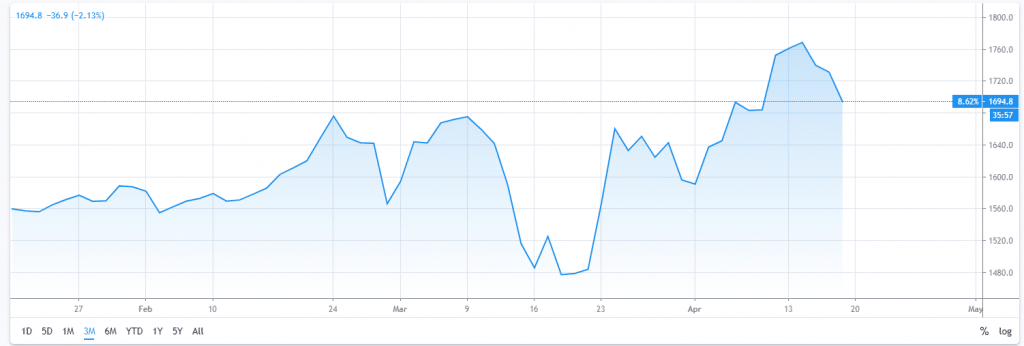

Meanwhile the junior gold stocks are showing high (but not perfect) correlation with the price of gold:

And here is where it gets interesting.

Note that gold really hasn’t taken off. It’s been bouncing around $1500 for the last six months but closed on Friday just short of $1700. However, its higher than it was three months ago while junior gold mining stock have stayed flat.

Will the junior stocks continue to lag behind the price of gold or as confidence returns to the market, will they show asymmetry and prove to be a better investment?

We shall see. Obviously, I’m betting on it.

Note; I am long Eclipse and K92, and other junior gold stocks that I have not mentioned in public.

DJ Follow me on Twitter