Lawyers, Lawyers, Lawyers Everywhere

ETHDenver is supposed to be a conference for developers, but there were lawyers everywhere.

This does not sound good until you realize where there are lawyers, there is … money.

The number one topic at ETHDenver was the machinations of the head of the US Securities Exchange Commission SEC Gary “I will prosecute a ham sandwich” Gensler.

Mr. Gensler seems to be determined to take away the punch bowl at the crypto party.

Last week I learned what a “Wells notice” is: a letter that the U.S. Securities and Exchange Commission (SEC) sends to people or firms at the conclusion of an SEC investigation that states the SEC is planning to bring an enforcement action against them.

The morning I flew back to Vancouver, I read on my Twitter feed a rumour that a Wells notice was being issued against a token in which I had a rather large position.

So, I sold it.

Of course, the rumour now looks to be unsubstantiated if not outright false, but that didn’t stop the token from dropping 15% over the weekend.

Everybody is complaining about the SEC arbitrary enforcement without explaining or giving guidance. But it’s been that way for years.

However, there are signs that things maybe be changing. Later this year, the US may finally launch new crypto legislation which means that crypto enforcement may not rely on legislation written almost one hundred years ago.

And crypto companies are starting to lawyer up, in a big way.

This is one story that I will be writing more about.

Frontrunning the $1 Trillion Money Train

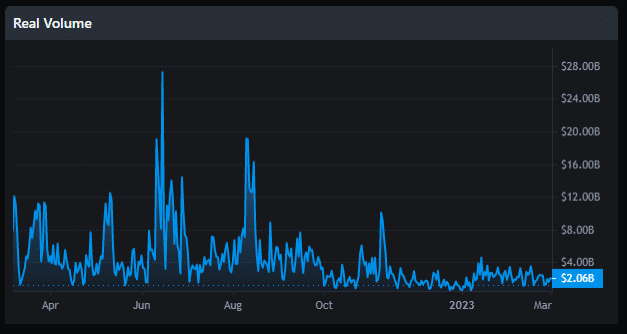

Yesterday there was about $2 billion worth of transactions through the Ethereum blockchain, but it’s usually more, sometimes a lot more:

https://messari.io/asset/

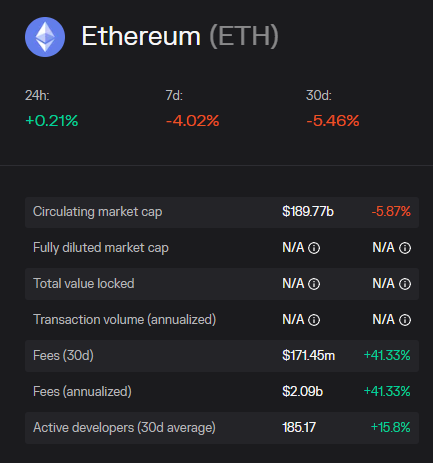

There are fees associated with moving all those tokens around, called “gas fees.”

It’s no surprise that there MANY companies (all private*) at the conference whose sole purpose is to participate in the building of transaction blocks on Ethereum to get some of those fees.

It’s a lucrative business, especially if you can figure out how to “front-run” other block builders.

If you have ever read the seminal book on front-running in equities (Flashboys by Michael Lewis), you will understand that we are still pretty much in the Wild West stage on Ethereum.

In the world of Ethereum, the business of block production is called “maximum extractable value” or MEV, if you are interested in doing more research on the matter.

But, nobody is willing up to give their secrets willingly. The whole MEV debate is so controversial that Ethereum itself has been called “A Walk into the Dark Forest.”

Decentralization: For the Party to Continue, We Need More People (Stakers)

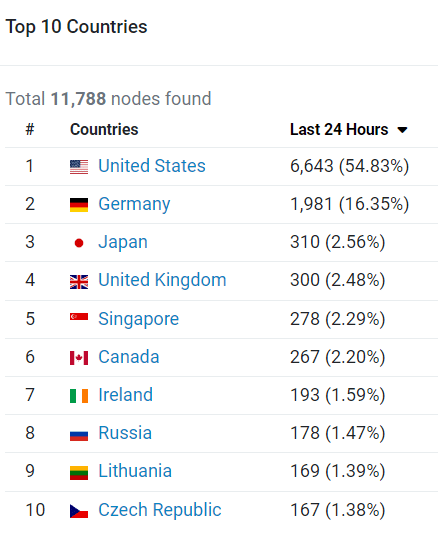

It’s not looking good:

https://etherscan.io/

Ethereum nodes are the computer servers that control the Ethereum network via the proof-of-stake (POS) consensus mechanism.

Note that more than half of Ethereum nodes are based in the United States. That’s not being decentralized.

Mr. Gensler has also noted this fact, and the SEC is putting forward the argument that Ethereum should fall under American securities legislation because of the heavy US concentration.

Companies and organizations that are exploring ways to boost the number of Ethereum nodes (especially outside the USA) were popular at the conference, especially liquid staking providers (LSD) like Lido and Rocketpool.

At present, you need to “stake” 32 Ethereum to create one node, or more than $50k US. Liquid stakers allow you to contribute to a node using less than 32 Ethereum.

Conclusion

The big stories at the conference, for me anyways, were: the legal problem, the frontrunning problem, and the decentralization problem.

For Ethereum to achieve global dominance in electronic financial transactions, solutions to all three problems must be found or created.

It will take years at least, perhaps a decade.

But it will happen.

DJ

*If there any public companies that specialize in building Ethereum transactions blocks, you can be sure I will tell you about them. Right after I load up on the stock to my eyeballs. The money and margin these companies are making is eye-watering, just from the public presentations that I saw.

Not that I’m holding my breath on these companies selling a piece of the action. They don’t need to raise funds