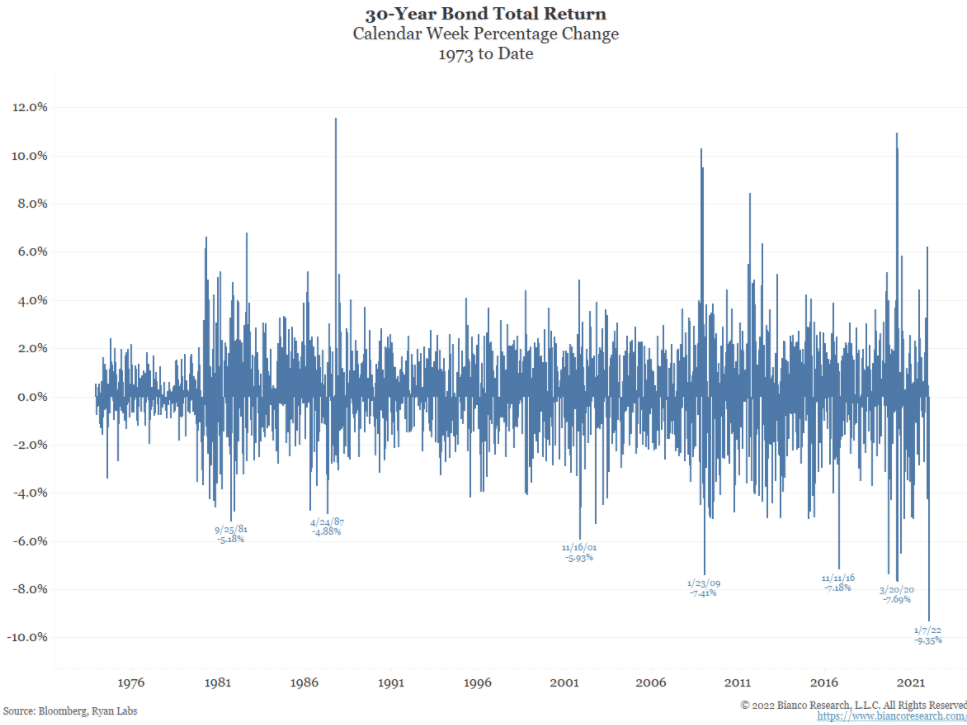

I have linked to an excellent summary below of what happened in the bond market last week:

- The bond market collapsed

- The stock market is the slow kid in the room, meaning, as the bond market goes, so goes the stock market afterward.

I have been investing seriously in crypto since 2017. I have been in the financial newsletter publishing business since 2009.

I have been investing with my own money since 1999.

That period of time covers the 2001 Nasdaq crash, 9/11, Deepwater Horizon debacle (was in oil stocks back then), the Greek financial crisis, the 2008 banking crisis, the 2014 oil crash (was in energy stocks again), the great crypto crash of 2018, and of course the COVID crash of 2020.

I have gone through periods of the market where week after week the news was just bad, all the time, every time.

But in this last month, I can’t remember another time when so many Smartest People in the Room (trademark pending) wrote convincing articles that this time we are really going to hell in a handbasket.

Here is another one, this time from Arthur Hayes of Crypto Trader Digest:

Let’s forget what non-crypto investors believe; my read on the sentiment of crypto investors is that they naively believe network and user growth fundamentals of the entire complex will allow crypto assets to continue their upward trajectory unabated.

To me, this presents the setup for a severe washout, -bold added as the pernicious effects of rising interest rates on future cash flows will likely prompt speculators and investors at the margin to dump or severely reduce their crypto holdings.”

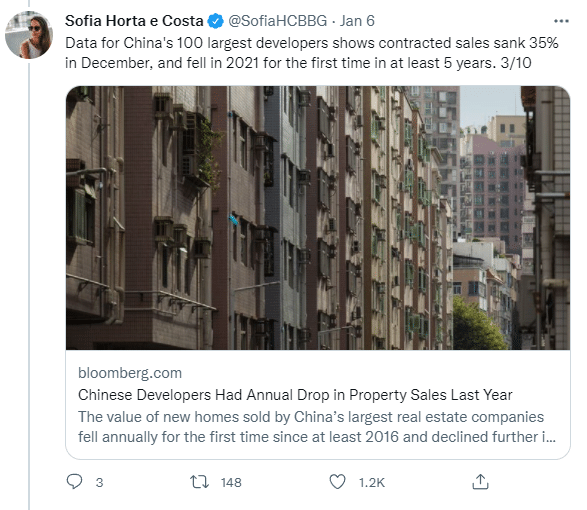

Now if the news from North America is depressing, the news from Asia is downright suicidal. Here is another gem about real estate in China:

Is bitcoin going to fall below $30k? Is Ethereum going to plunge below $2K. Oh, I don’t know.

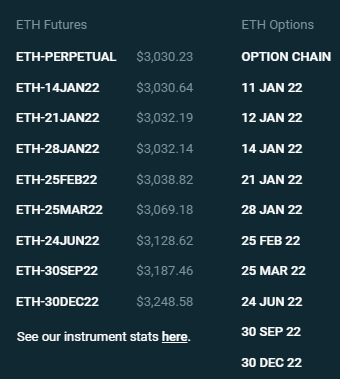

But what I do know for sure is that the chances of Ethereum pumping above $4000 look really, really remote right now.

The crypto-derivative market supports that opinion:

Liquidity is leaving the market. And that’s not good.

Here is how I think:

1. I am greedy.

2. I want to double my money. Preferably, very quickly.

3. Crypto allows me to do that.

4. Except in a bear market. I am not going to double my money in a bear market.

5. Therefore, why am I in crypto?

I am not saying the market is going to crash. I mean, come on, it’s crashed already.

But is bitcoin or Ethereum going to pump anytime soon? Like 100% pump in the next few months?

That just doesn’t look likely to me at all.

I think it’s time to look elsewhere.

DJ

P.S. Tomorrow is “turnaround Tuesday.” Crypto usually goes up on Tuesday after a lousy weekend and a dumpy Monday. But wait until Friday.