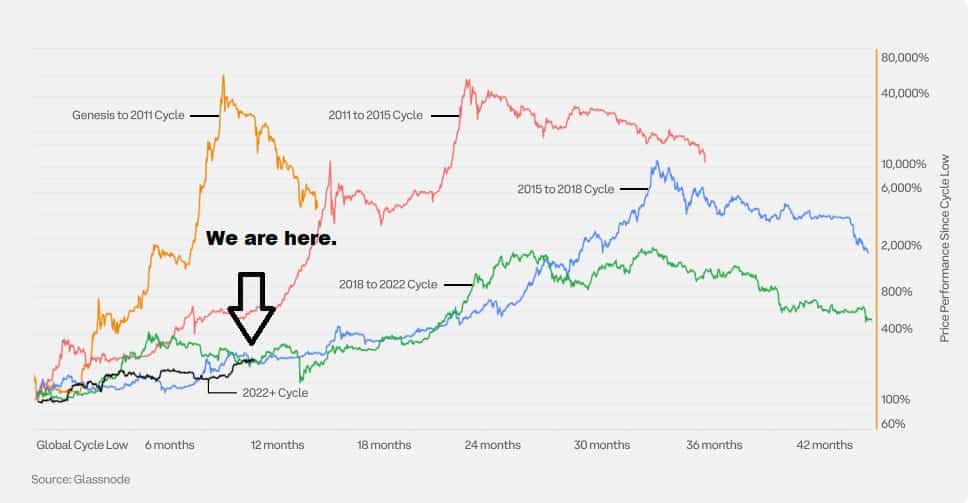

Since Bitcoin was created in January of 2009, there have been four “supercycles.” We are now less than one-quarter of the way through the fifth:

During every supercycle, Bitcoin has appreciated by AT LEAST a factor of 10.

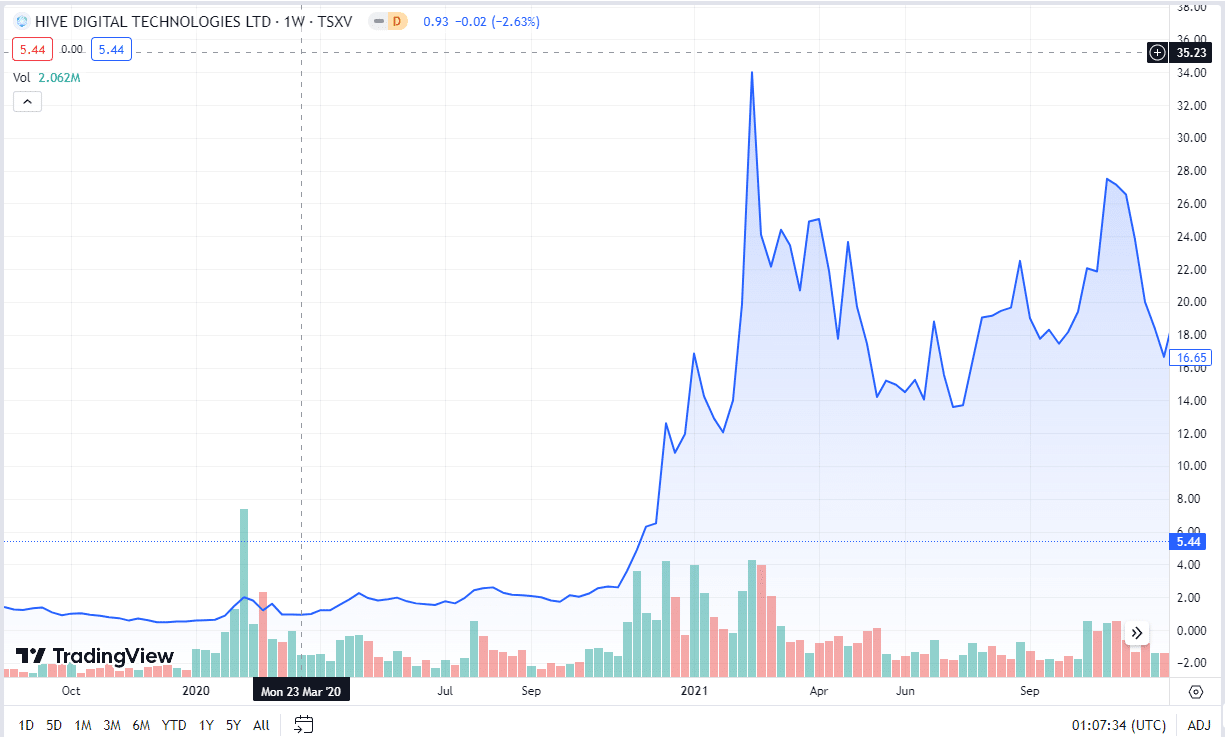

But it’s not just Bitcoin that goes up. Equities that have exposure to the blockchain sector go up as well, but even stronger and faster:

This is a chart of HIVE Blockchain (HIVE-NASDAQ). From September 2020 to February 2021, it went from one dollar to $34! That’s a 35-bagger in six months!

Even if you missed the top, one year later you could still sell it at $20, for a twenty-bagger.

At this point, you must be thinking, okay this is easy. Bitcoin goes up, crypto-stocks go up. I buy crypto-stocks and wait, and profit.

But it’s not.

Take this week. On Wednesday, multiple Bitcoin spot ETFs were approved by the Securities and Exchange Commission.

People were pumped! The price of Bitcoin was going to soar!

But it didn’t. Instead, it became a sell-the-news event. Public Bitcoin miners are selling off this week hard.

What happened?

As I said in my last bulletin to my subscribers last Thursday:

“Two reasons why Bitcoin miners are slumping this week

One, today was the day for traditional finance guys to sell the news. That’s what traditional finance guys do when they buy crypto. They look for an excuse to sell. Bitcoin miners have a had huge run-up over the last few months. Many investors have doubled their money in sixty days or less.

Today you saw a lot of Itching fingers hitting the sell button.

But the second reason is probably having a greater impact.

The stock price of Bitcoin miners tends to stagnate or even go down if the CEOs are trying to get private financings done. When that happens, the institutional buyers will stop buying on the open market and try to score a sweeter deal on the private deals.

We saw that with Riot last summer. That’s what happened with Bitfarms in the last week of November when institutions got a sweet deal for stock below market price and a warrant. Only then did the stock start to take off.

Is that what is happening now? I can’t prove it. But I would bet a lot of money on it. Actually, I AM betting a lot of money on it. I haven’t sold any of my Bitcoin miners this year.”

If you take a very close look at the HIVE Blockchain, you might be able to see that the stock did not stay one dollar before booming upward to $35. It bounced between one dollar and 50 cents for one year before the takeoff.

That’s what it is like holding crypto stocks. If they ain’t going up, they are going down.

But when they go up, they go up A LOT.

How Long Have I Trading Crypto?

I have been trading crypto full-time since 2021. More than 95% of my income is from trading. The other 5% is from subscriptions to my newsletter.

The New Currency Frontier newsletter published its first story in 2017.

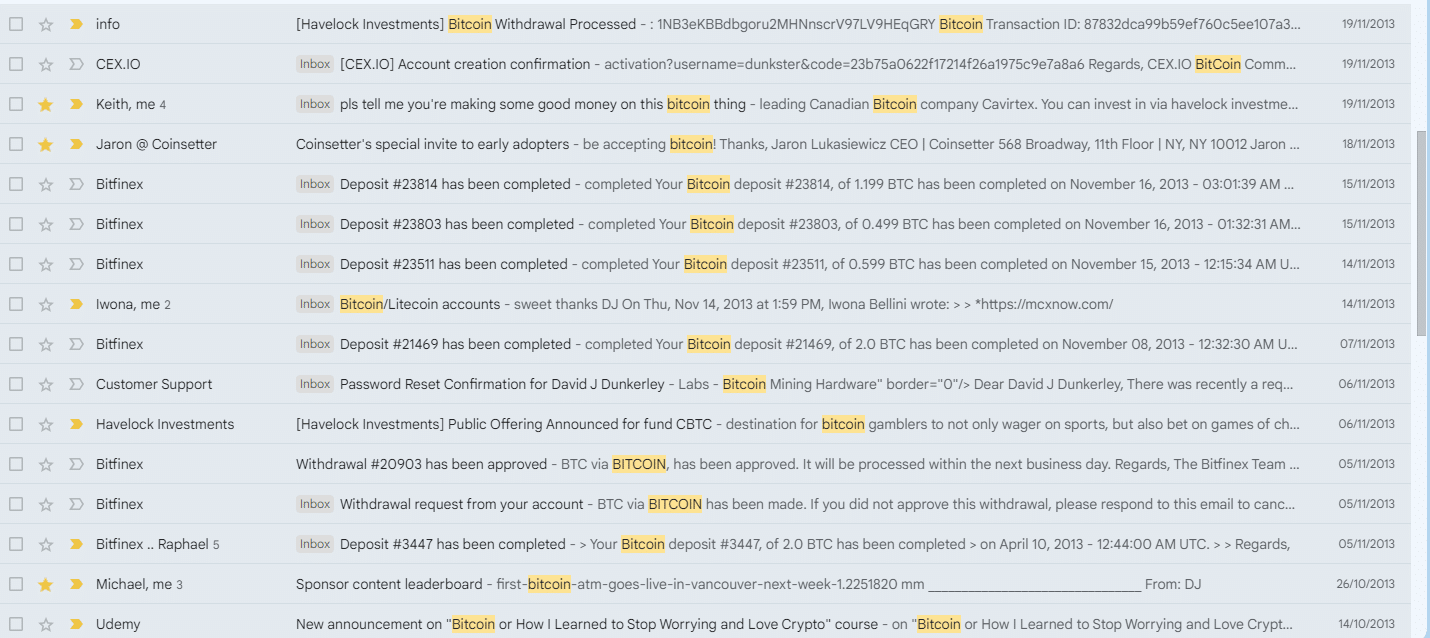

When did I buy my first Bitcoin? Back in 2013. Here is a screen snap of my inbox during that year:

Those were fun times. With Bitcoin worth only $100-$300 at that time, we threw Bitcoin around like it was a casino chip.

(If you had told me at that time, that Bitcoin would be worth $10,000 let alone $40,000 one day, I would have laughed in your face).

Anyhow, why am I telling you this?

Because right now, I don’t have a lot of competition. Trust me, there are very few financial newsletters writing about crypto right now.

But in a year at most, there are going to be a TON of newsletters writing about crypto. I guarantee it.

Most of them will be written by people who are very new to crypto, and have “pivoted” from other financial sectors.

Most of them won’t know what they are talking about.

But they will be getting subscribers. Because in a year’s time, the market will be saturated with investors buying into crypto.

However, by then most of the ten baggers (or 30 baggers!) will have boomed and investors will be piling in just hoping to double their money.

What I am Telling My Subscribers Today?

At present, I have more than a half-dozen stocks in the New Currency Frontier portfolio. All except two are in the green (my biggest loser is down 20%).

More than half have recorded triple-digit gains since September of 2023.

There are two stocks that I really like at this point in the cycle.

One stock I like, I bought on three separate occasions for my wife’s RRSP (the Canadian version of the IRA).

It’s a NASDAQ stock with a multi-billion market cap.

I think it will be the next Amazon or Tesla of the crypto sector. That is to say, it’s a stock to hold onto for the next five or ten years.

Another stock is highly speculative and trades on the junior markets. It’s already more than doubled from when I bought it.

But I think it still has potential to be a ten-bagger from today onwards, that’s why I still hold it.

You can know the ticker symbol of both these stocks, as well as all the other stocks in my portfolio by trying out my premium service for 30 days with no risk.

The price of my subscription service is $99 USD a month.

But for one week, you can buy my service for a low annual cost of $499 USD. That’s more than 50% off the regular price.

You will have 30 days to make up your mind, cancel anytime during this period, and get your money back, no questions asked.

Another supercycle has arrived. It’s time for my net asset value to go to the next level, again. I hope you can join me.

DJ Dunkerley, Publisher, New Currency Frontier