Bitcoin had a nasty 25% drop last week on news that US regulators want to subpoena Bitfinex over the issuing of Tether, a digital coin that is (supposed to be) backed by the US dollar.

After a bounce back Friday, Bitcoin tanked again on the weekend. Yesterday, it continued to drop before bouncing back on “Turnaround Tuesday.”

What’s the cause? Many are blaming Tether:

“One key reason [the Bitcoin crash] is related to another cryptocurrency called tether and allegations that the people behind it are using tether to prop up the bitcoin market.

Fears are rife that any collapse in tether could have huge ramifications for the bitcoin market.”

There is also an interesting website called Tether Report that uses statistical analysis to conclude that the issuance of Tether is propping up the price of Bitcoin.

But I don’t believe it, and I’ll explain why. I think the issuance of Tether is symptom of why Bitcoin is falling. That is to say, the Asian markets are using Tether for dumping Bitcoin, not pumping Bitcoin.

But first, some background on Bitfinex and Tether.

Bitfinex is one of the largest and oldest Bitcoin exchanges, and has been the target of numerous investigations and sanctions by US authorities, from disallowing banks to authorize wires to the exchange, to various allegations of market manipulation.

In short, they have been in hot water with US authorities for years. However, that doesn’t mean they are going to get put out of business anytime soon.

They are based in Hong Kong and they have a strict KYC policy that forbids US citizens from signing up to their platform (I am Canadian and have had an account there since 2014).

That’s one problem for the US regulatory authorities right there. The SEC or FTC or IRS can pretty well show up in any European or North American country and expect cooperation from the local authorities but Hong Kong? I don’t think China is onboard with that idea.

It is unclear to me how US authorities could “sanction” Bitfinex anymore than it does now (but I am course prepared to be surprised – the US does seem to have a very long arm with regard to managing the financial affairs of the world).

But onto Tether. Even though Tether is set up as independent foundation, it is widely believed to be controlled by the same people behind Bitfinex.

The market cap, or issuance of Tether has grown by quite a bit in the last few months.

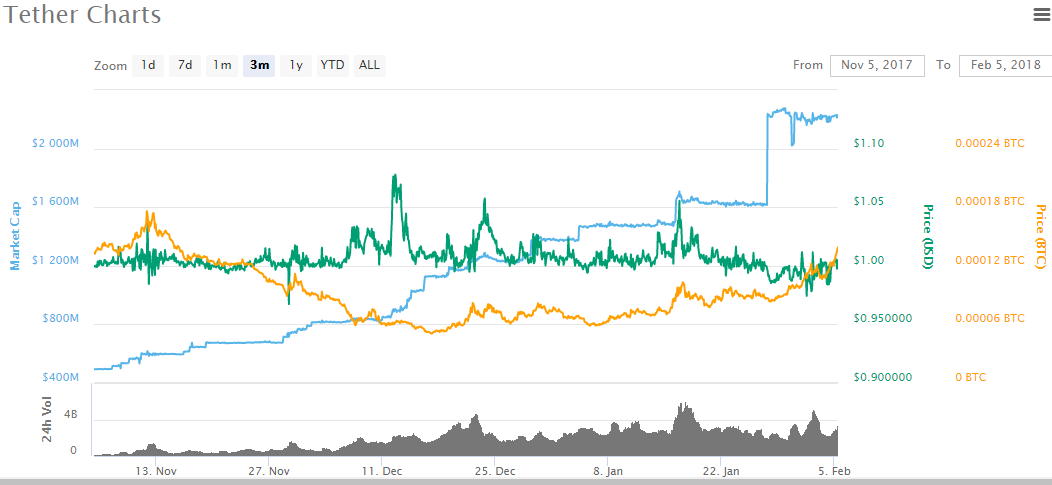

(Blue is market cap of Tether. Green is the price in USD dollar. Gold is the price in Bitcoin)

As you can see from the chart, the amount of Tether that has been issued (the blue line) has grown from just under US $500 million to US $2.2 billion.

And therein lies the first problem with the conspiracy theory that Tether is manipulating/propping up the price of Bitcoin.

About $1.7 billion of Tether has entered the markets in the last three months. That sounds like a big number until you realize that in November, Bitcoin had a market cap of $120 billion, then reached a high of $300 billion in December, before crashing down to $120 billion again in early February.

That’s an awfully small tail wagging an awfully big dog.

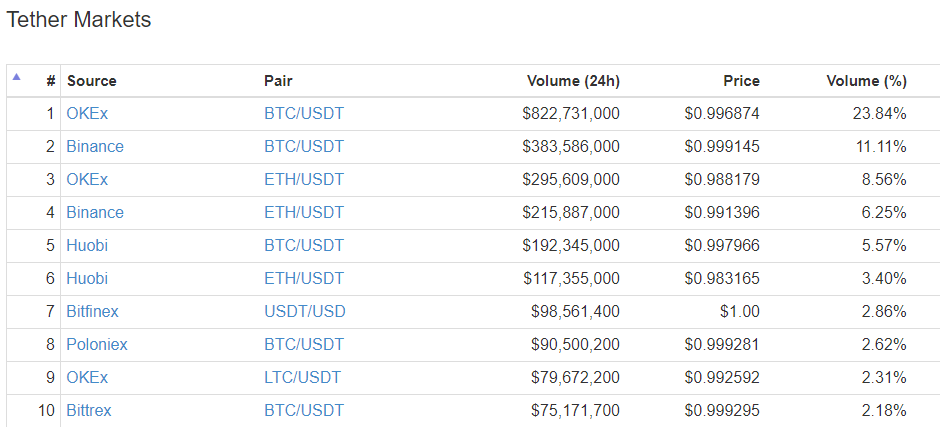

The second problem facing the conspiracy theorists is: Who are the actual users of Tether?

As you can see from the chart, only four exchanges (OKEx, Binance, Huobi and Bitfinex) account for 60% of Tether trading. All those exchanges are based in Hong Kong, which means that a great deal of their users come from mainland China (where trading in Bitcoin is banned).

So why the heavy trading activity in Tether from the mainland Chinese?

That’s easy to answer. We know absolutely there is one group of Chinese bitcoin investors who need to sell Bitcoin on a continual basis: The Bitcoin miners still in China:

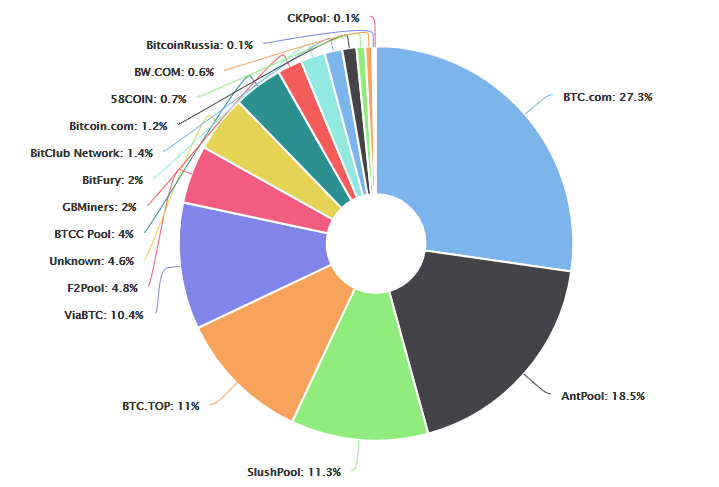

Source: https://blockchain.info/pools

Four of the top five mining pools are based in China (Slushpool is the only exception). Together they control 67% of the hashrate for Bitcoin.

Or put it another: Every day 1800 Bitcoins are mined, and 1200 Bitcoin are still mined in China.

Therefore, every month, there are 36,000 Bitcoins that need to be exported from China because you can’t sell them there.

With Bitcoin at $20000, that’s $720 million a month. At $10,000, that’s $360 million. Over the last three months, about $1.5 billion of Bitcoin has probably just been exported from China due to mining activities alone.

And that number is suspiciously close the amount of new Tether that has been issued ($1.7 billion) in the same time period.

But Why Did Bitcoin Continue to Crash?

Bitcoin price stabilized last Friday above $8000 and then even rose to almost $10,000 but started to tank on the weekend.

Then Monday the hammer dropped:

It has been announced today that China is really, this time for sure, is going to completely stamp out cryptocurrency trading.

Even though China announced a ban on cryptocurrency trading last November, it became obvious there were massive holes in the Great Wall–holes that are now being closed.

Anonymous trading in South Korean is now banned by the government; probably with some heavy nudging by Chinese authorities. That was one huge loophole for Chinese cryptocurrency investors.

The Great Firewall of China has been updated to block all overseas cryptocurrency exchanges. Ads for cryptocurrencies have been banned in China.

China is getting out of Bitcoin for real this time. If you live in mainland China, the only way you will be able to keep your Bitcoin is to save the private key to a USB stick and bury it in the backyard.

The last great bit of uncertainty left is the fate of the crypto-exchanges in the Hong Kong. Will China pressure the Hong Kong governing authority to shut them down?

If so, expect more chaos and blood in the streets. But that would the last nuke that China can drop on Bitcoin.

If the Bitcoin exchanges in Hong Kong are still trading Bitcoin by the end of the week, then we have hit the bottom, as the mainland China dump should be finished by then. But right now all we can do is watch and wait.

But it wasn’t Tether that caused Bitcoin to collapse. Tether was the canary in the coalmine. This Bitcoin crash was made in China.

Ross