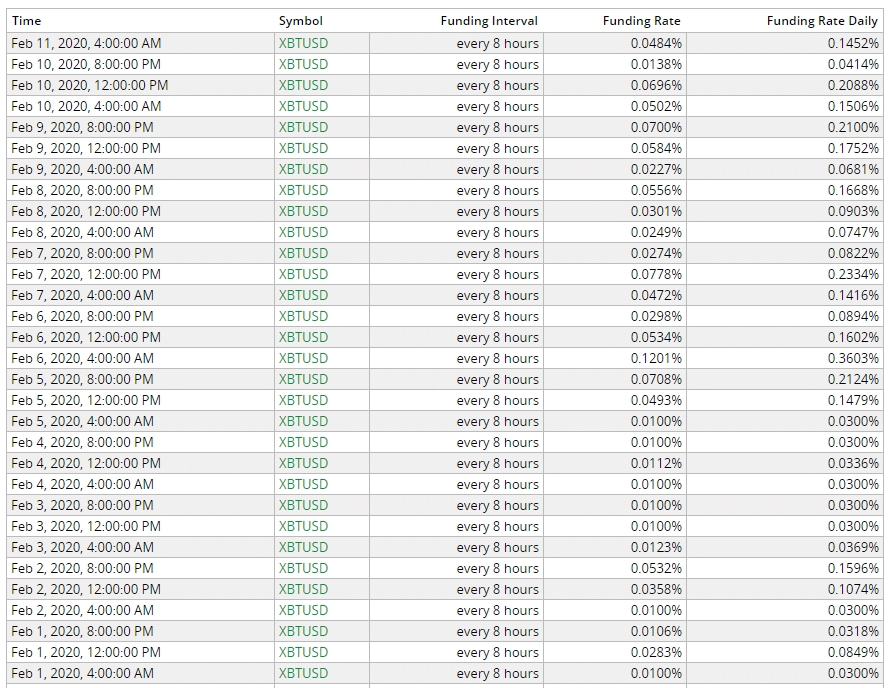

Volatility has returned to the crypto-markets, as indicated by the funding rate of bitcoin perpetual futures.

It has been a while since my last article on crypto-hedging, so let’s take it from the top:

The chart you are looking at is the funding rate for the most liquid bitcoin futures contract on the planet, the Bitmex XBTUSD perpetual contract.

The daily volume of the XBTUSD contracts is about $4 billion.

An impressive number made even more remarkable because US citizens and even residents of the US are banned from trading on Bitmex.

The numbers on the chart are the funding rate for going long (or short) on the XBTUSD contract. The funding rate is literally the interest rate. If the funding rate is positive, then longs pay shorts. If negative, shorts pay long.

But one VERY important note to consider. That funding/interest rate is not per annum. The funding rate is paid out every eight hours.

So what is the per annum payout if you are shorting the contract?

Take the funding rate and multiply by three to get 24 hours and then multiply it by 365 to get the per annum interest rate.

If we take the funding payouts from the last ten days, the per annum rate payout has been 41%.

How Does a Perpetual Futures Contract Work?

The simplest futures contract is a contract to buy some commodity at a future date. The contract expires on a specific date and the option to buy the commodity is then executed or declined.

But a perpetual contract has no expiry date. Instead, the contract “settles” or resets at some point in the future by paying out the longs or shorts depending if the contract price is higher or lower than the spot price of the underlying asset.

If more traders are wanting to buy the futures contract than sellers, then the price of the futures contracts moves higher than the spot (or market) price.

If more traders want to sell the futures contract then there are buyers, the price of the contract moves below the spot price.

The funding payout is a mechanism that resets the price of the futures contract closer to the spot price. If there are more traders wanting to go long than to go short, then the long traders have to pay for the privilege. And vice-versa

To summarize, the funding payout is an incentive for traders to take a contrarian position in the marketplace.

How Do You Not Lose Money?

Unleveraged, you make 41% a year. But you are not covered.

To cover your short, you have to buy an equal amount of bitcoin.

Let’s say you buy 10K worth of XBTUSD contracts. You are short $10K. So you need to buy $10k worth of bitcoin to have a market neutral position.

Doesn’t matter if the price of bitcoin goes up or down, at the end of the year, you have the same amount of bitcoin you had before, plus all those funding rate payouts.

But of course, if you cover your position, your return on investment is cut in half to 20.5%.

However, if you start to employ some leverage, it starts to get interesting.

Short XBTUSD futures at 3 to 1, buy bitcoin on margin at 3 to 1 and then your annual return zooms to 61.5%, minus carrying charges, which should average around ten percent.

That’s a 50% return on your bitcoin which is hedged with no risk of negative losses (in bitcoin).

Last April I built an educational program on how to hedge bitcoin and Ethereum futures. It’s has been working out very well for me, even during the bear market of the latter part of 2019.

It works even better in a bull market. You can read more about it here.

Note: As I said earlier in this story, American citizens, and residents of the US are not allowed to trade bitcoin futures on Bitmex and other overseas exchanges.

DJ