At close of trading today, the Dow Jones was down 4.4% for the day and down 11% since Monday.

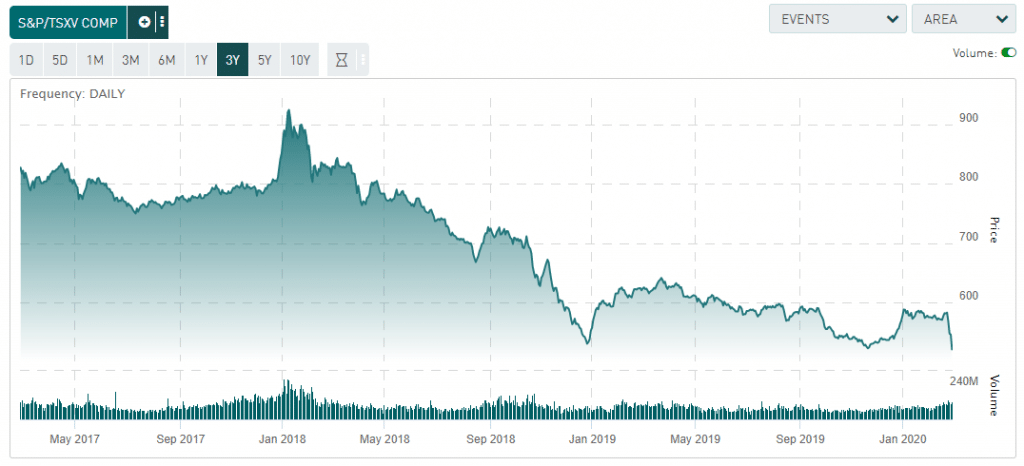

For the TSX Venture, (the Canadian small cap exchange home to many penny stocks), it was slightly worse. It was down 4.5% for the day and down 12% for the year.

It’s approaching all-time lows (again):

https://web.tmxmoney.com/quote.php?qm_symbol=%5EJX

Meanwhile, in the cryptocurrency universe, it’s business as usual.

Oh sure, Bitcoin is down 12% since Monday and down 5% since February 1st.

But for the year, it’s still up 23%.

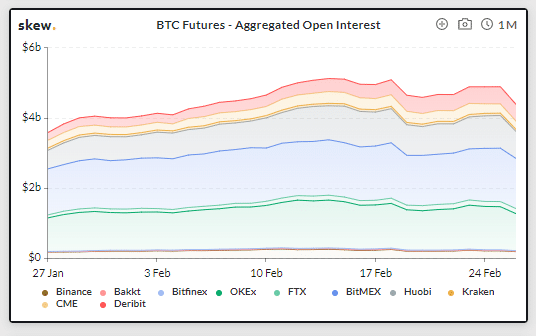

It’s an easy argument to make that crypto prices were due for a correction, especially since earlier in the month, open interest on bitcoin had reached a ridiculous $5 billion.

https://www.skew.com/dashboard/bitcoin-futures

Open interest has now dropped 20% to about $4 billion but an argument can be made that bitcoin is still slightly overvalued… or not.

It’s very common for bitcoin to correct one week to 10 days before the settlement of monthly futures contracts which occur on the fourth Friday of the month.

It’s so common that I wrote about the phenomena last November:

“Bitcoin has been declining steadily in the last week of every month since April. And the traders selling call options on bitcoin have been making a killing.“

Did I put my money where my mouth is and buy some bitcoin futures contracts? Yes. And I’m already in the money.

Let’s see where the price of bitcoin goes in the next week or so.

But What About the Coronavirus?

–

One of the benefits of belonging to a financial publishing group is getting access to high quality (translation: paid) reports on information pertaining to the financial markets.

A report by one of the best in business hit my inbox this morning (not telling who, but he is one of the smartest guys in the room and we pay a lot for his reports.).

This is what he has to say about the Coronavirus:

1. COVID0-19 is probably spreading unchecked among the general population in California.

2. President’s Trump weird press conference about the Coronavirus did not help at all in calming fears.

3. As of February 26th, there have been 445 people in the US tested with 14 confirmed cases. Expect that number to go up, dramatically.

That’s the bad news.

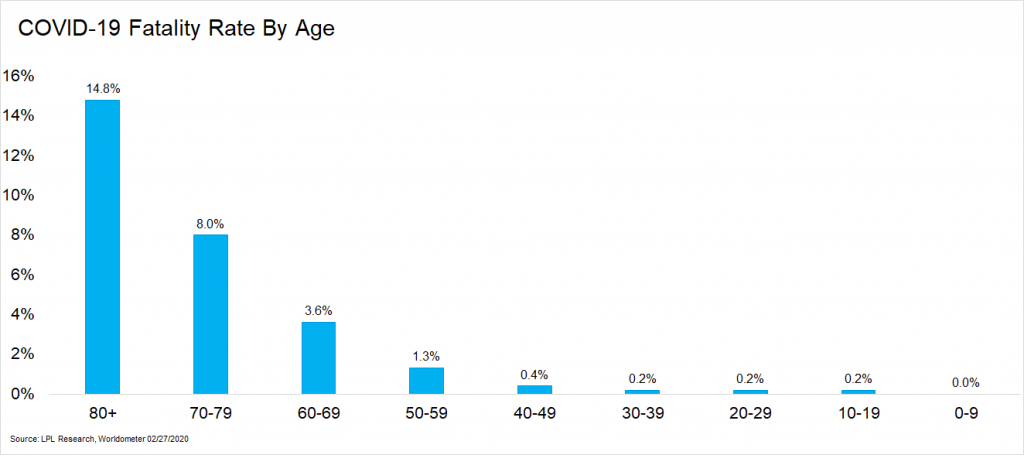

The good news is that the fatality rate looks to be seriously overestimated. At present, the number being bandied about is about 2% of people who catch the virus die.

But age is a very significant factor in determining whether the virus is fatal or even a nuisance:

I’m starting to see lots of commentary from people who are Smarter Than Me pointing to evidence that Coronavirus is no more lethal than the common flu, especially outside the city of Wuhan, which has borne an extraordinary number of fatalities.

Out of 2744 fatalities, 2641 have occurred in the province of Hubei, where the city of Wuhan is located.

To summarize, in Wuhan, Coronavirus is very bad, kills lots of people. Outside Wuhan, it’s hard to distinguish from normal influenza (hence why it may impossible to contain).

Nobody knows why that is (yet).

But Back to the Bad News:

Perceptions matter. Go on Twitter and it’s not hard to find some nut claiming a fatality rate of 3% and that tens of thousands of people have perished in Wuhan, etc, etc.

The markets are spooked and will probably stay spooked for Friday and through to Monday at least.

Will be there be good deals available Monday afternoon just before turnaround Tuesday? I suspect so but I don’t have to make up my mind up until then whether I will buy anything.

DJ