Before we agonize over what to do next, let’s take a moment to appreciate what happened in the month of April.

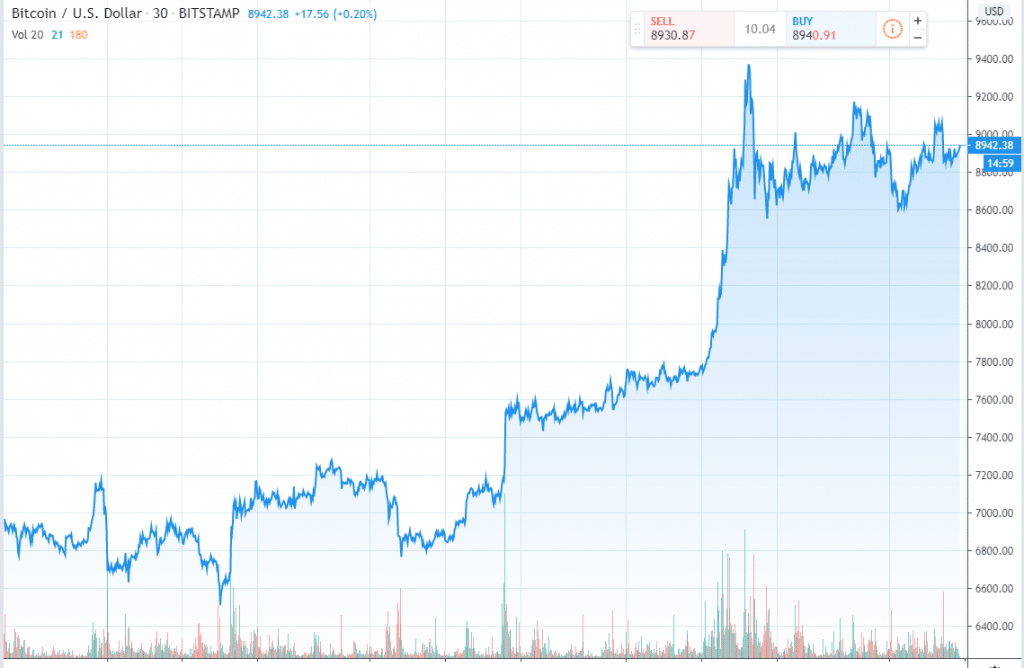

Bitcoin is up nearly $9000 from $7000 in 30 days, a bump of 29%. I would say that is the result of halving hype. If it breaks $10k anytime soon, that’s a nice bonus.

Most likely it will bump around for a few months until eventually starting to creep up, if it follows the historical record of previous halvings.

But I don’t expect much excitement. Bitcoin has become one of the most boring (and yet with hedging, the most profitable) investments in my portfolio.

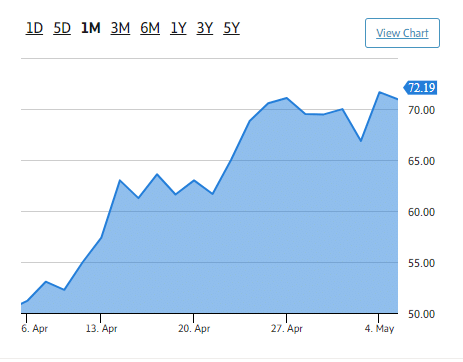

My junior gold exploration and mining stocks had a very nice April as well.

Actually, EVERYBODY’s junior gold stocks did very well, and they all rose with the tide including, Prime Mining Corp (PRYM-TSXv, PRMNF-OTC), Eclipse Gold Mining (EGLD-TSXv), and Fosterville South (TSXv-FSX)

Below is a chart of the BMO Junior Gold Index:

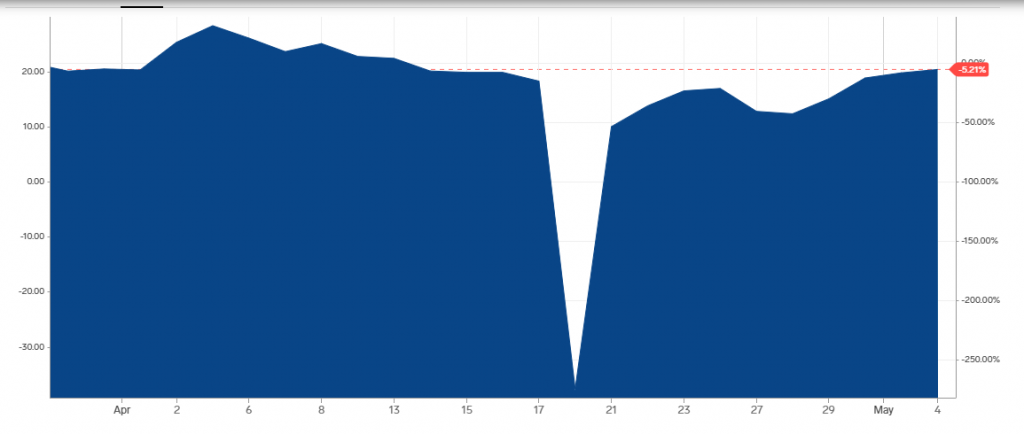

Lastly, even oil is staging a comeback of Biblical proportions, as it comes back from the dead like Lazarus:

Do We Continue to Ride this Rally or Cash Out and Head for the Hills?

Let’s start with the easy one: Bitcoin.

Since I’m hedging bitcoin (and the basics of hedging I explain here), I’m holding onto it, as always. If it goes down to $4K or $3K, so be it. I’ve been there before. I can do it again.

What to do with gold stocks?

Since I have to file my taxes at the end of this month (in Canada, this year, the filing deadline is June 1st) I do need some cash.

Sell some but hold on to most of it. Is there a chance of a pullback in the summer? Sure.

That is why you have some cash in the bank. So, when your super-risky stocks do a ten or twenty percent pullback, you don’t panic (and these penny stocks never go up in a straight line).

And finally, there’s oil. Oil this year, is just… goofy.

Two weeks ago, the smart guys in the room said WTI went to zero there was literally no place to store the stuff.

Since then, somebody must have found a few empty swimming pools. Now the smart guys are saying it could go to $35 over the summer.

That tells me one thing: Nobody knows anything for sure. And that means volatility.

Therefore I have bought puts on two oil ETFs: United States Oil fund (USO-NYSE) and ProShares UltraShort Bloomberg Crude Oil (SCO:NYSE.)

Obviously, if the price of oil goes down, down goes USO. If the price of oil goes up, then SCO should go down (because it’s an ETF that is shorting the oil price).

Why did I not buy calls? Because both ETFs are a basket of futures contracts that will get hammered on the contango, if the price of oil continues to be volatile.

I have a sneaking suspicion that oil futures are being manipulated so pro traders can take advantage of retail traders buying these ETFs thinking they are a pure play in the price of oil.

They are not. They are a play on the price of monthly oil futures. That’s a subtle but important difference which many novice investors are going to discover, in the future, the hard way.

The oil hedge should play itself out in one or two months, perhaps even by the middle of this month.

DJ