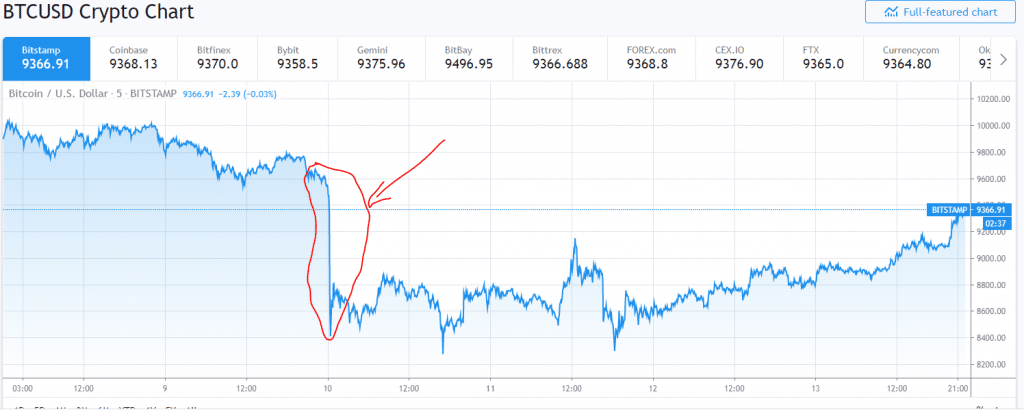

| On Tuesday, the bitcoin algorithm ordered the block reward to be cut in half, from 12.5 bitcoin every ten minutes to 6.25. And absolutely nothing else happened that day. The weekend before, of course, bitcoin dropped 16% in a matter of minutes. |

That happened NOT because a bunch of new money moved into bitcoin. It happened because a bunch of new money bought bitcoin futures.

And as usual, the new money went in too highly leveraged and got wiped out with a sudden correction.

As they say in Vegas, thanks for your contribution to the casino. Come back and visit your money anytime.

Putting aside the frequent corrections of bitcoin, we need to ask ourselves: How do we profit in the coming months?

Conventional and simple logic tells us that bitcoin mining stocks should suffer greatly because of the halving. Therefore, because nothing is as it seems in the world of crypto, we should look at buying them (again).

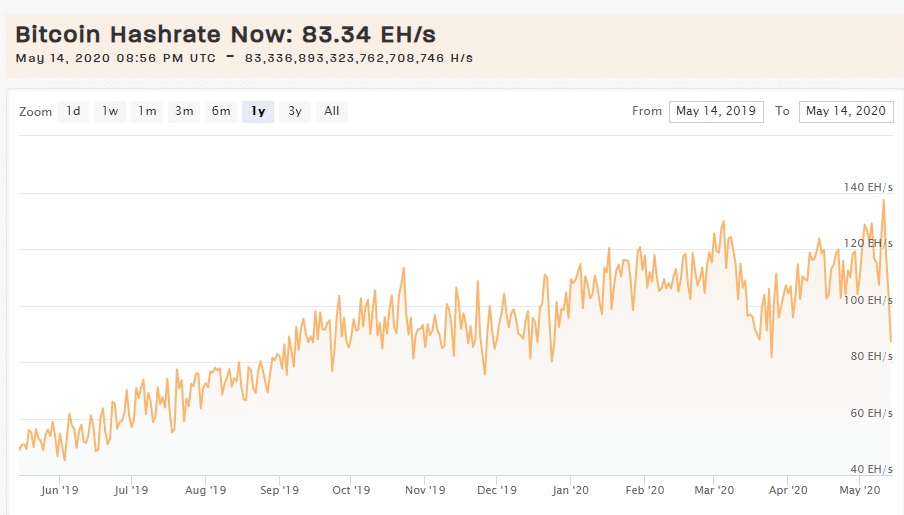

Conventional wisdom says that bitcoin network hashrate should see an immediate drop right after the halving, as miners with older mining rigs should drop off the network, as they became unprofitable overnight.

At this point in time, that’s looking like a reasonable bet.

Since October of 2019, the hashrate has surged as high at 140 EH/s but note how it always fall backs to its baseline of 80 EH/s.

Therefore, in theory, most miners are losing money.

Even with the very best mining rigs, the remainder are not making very much.

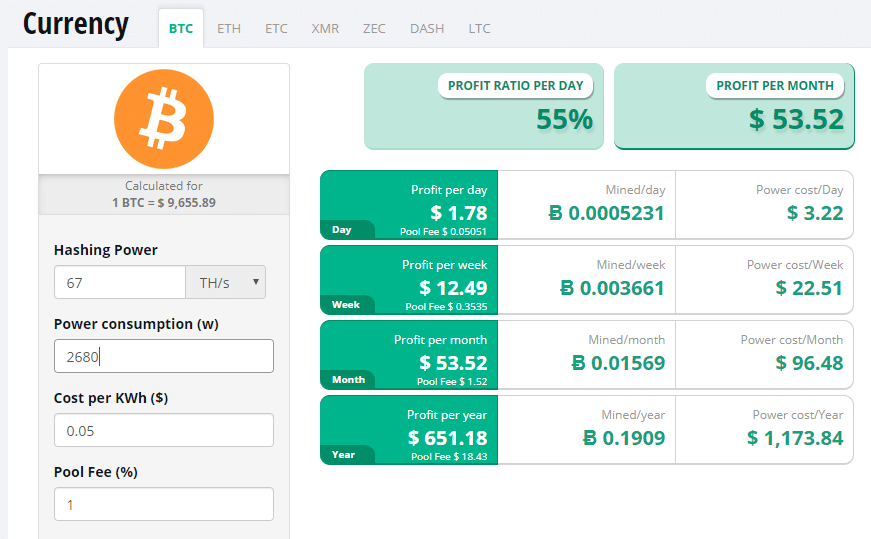

If we take the specs of the most profitable bitcoin mining rig, the Antminer S17plus, we see this:

With a street price of $2000, (if you can even get it), in theory it would take three to four years to pay off the cost of the Antminer rig.

Other mining rigs are even less efficient, meaning they generate less than a dollar a day of revenue after paying for electricity.

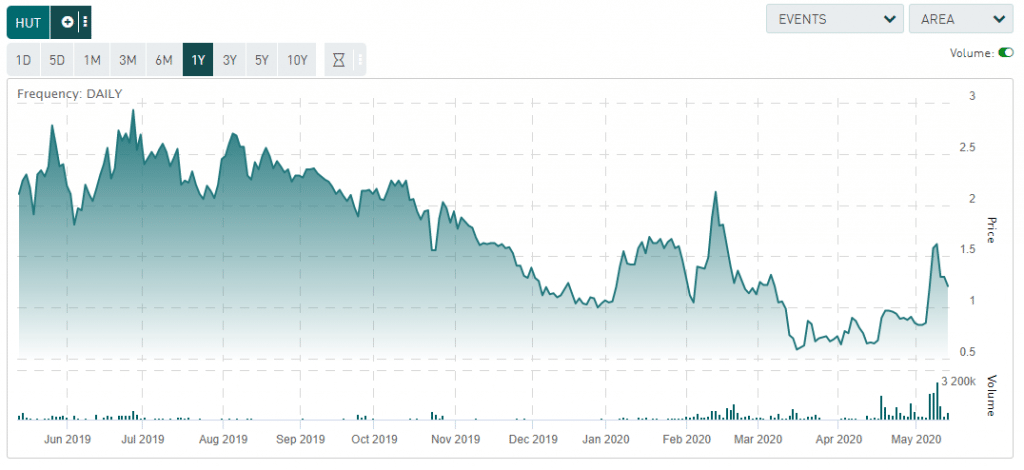

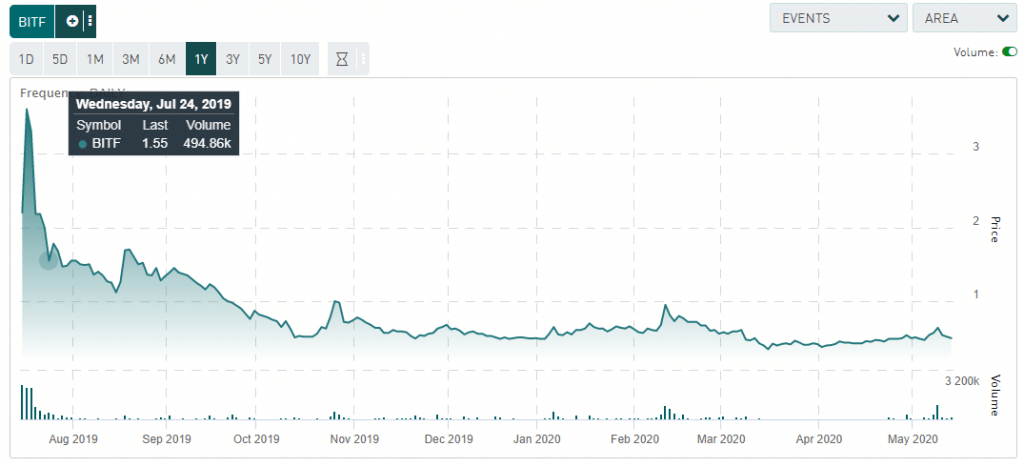

Bitcoin mining stocks have had a rough 2020 so far, as shown by the one-year charts of Canada’s biggest public bitcoin miners:

Bitfarms

These charts are not… good. However, let’s look at the price of bitcoin in the last year:

Bitcoin has been flat. Meanwhile, year over year, the network hashrate has surged as high at 140 EH/s, wreaking havoc on the profitability of miners.

In short, can the bitcoin miners do any worse in the next twelve months then in the last twelve months?

I doubt it.

Conclusion: If the market sector hasn’t hit rock-bottom, it’s close enough for me.

Therefore, I’m going to buy some stock in the next or so. It’s just a question of which company.

DJ