n the years from 2010 to 2019, there was no worst place to put your money then the small-cap mineral exploration sector.

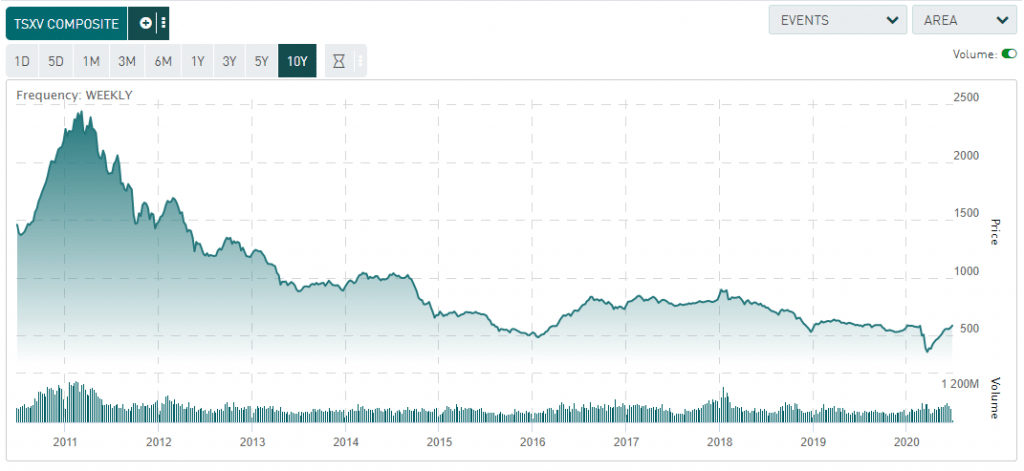

Below is a ten-year chart of the Toronto Stock Exchange (Venture), where most public mineral plays get their start:

This is chart of empty values and broken hearts.

But things have changed rather quickly in the last few months.

With gold breaking out from $1300 to nearly $1800, mining teams that have not been able to get financing for close to a decade, are now closing $3 to $10 million deals and can go exploring.

That doesn’t sound impressive?

There’s been no money available for exploration plays for almost ten years.

A few million dollars here and there, combined with good drilling results, has turbocharged many a penny stock.

Look at what has happened in the last two months:

Our sister publication Investing Whisperer, has been knee-deep in writing up these stocks and working with the management teams.

On April 29th, IW wrote a promotional piece on Fosterville Exploration (FSX-TSXv), and the stock finished the day trading at $1.62 CAD.

On May 22nd, another story was written news the company had staked out another high-grade gold play and the stock closed at $1.90.

At the time, Keith Schaefer, publisher of Investing Whisperer, wrote:

“Fosterville South has been a huge win for Investing Whisperer subscribers. Some were able to buy the 40 cent financing in the fall of 2019 before it went public—making the stock a 4-bagger in just six months.”

On June 25th, the stock closed above $4.04. Those subscribers who held onto the 40 cents financing found themselves owning a 10-bagger in less than a year.

Even non-subscribers had a chance for a double in a month just by reading the free stories.

Another great story has been Vizsla Resources (VZLA-TSXV/VIZSF-OTCQB). Investing Whisperer wrote a story on the company on May 14rd of this year, and he stock closed at 54 cents CAD.

It closed on Thursday of this week at 80 cents on news of drill results, with Investing Whisperer writing up the story here.

Not all of Investing Whisperer’s picks have gone up as quickly as those two.

A story on Roscan was published almost a year ago and the stock languished below 20 cents until May of this year.

But it’s now trading around 40 cents.

ALL these stories are free-to-read on the website.

Paid subscribers to his newsletter had access to the stories earlier and for accredited investors, they had a chance at the private financings.

How long will the party continue? Nobody knows. But right now, it’s the happiest sector in the investing world.

DJ