That is roughly maximum transactions per second that can be executed by the bitcoin and Ethereum network, respectively.

Those numbers have not changed for years.

In December of 2017, at the height of the cryptocurrency mania, the slow transaction times of bitcoin and Ethereum led to chaos.

It took hours, sometimes days to process a transaction. Network fees went as high as $75 a transaction.

It is not a coincidence that both the price of bitcoin and Ethereum crashed soon afterwards, and have been in holding pattern for about three years.

In comparison, the VISA credit card network can handle up to 1700 transactions a second. It’s literally a thousand times faster.

In the winter of 2018, developers from both projects said help was on the way.

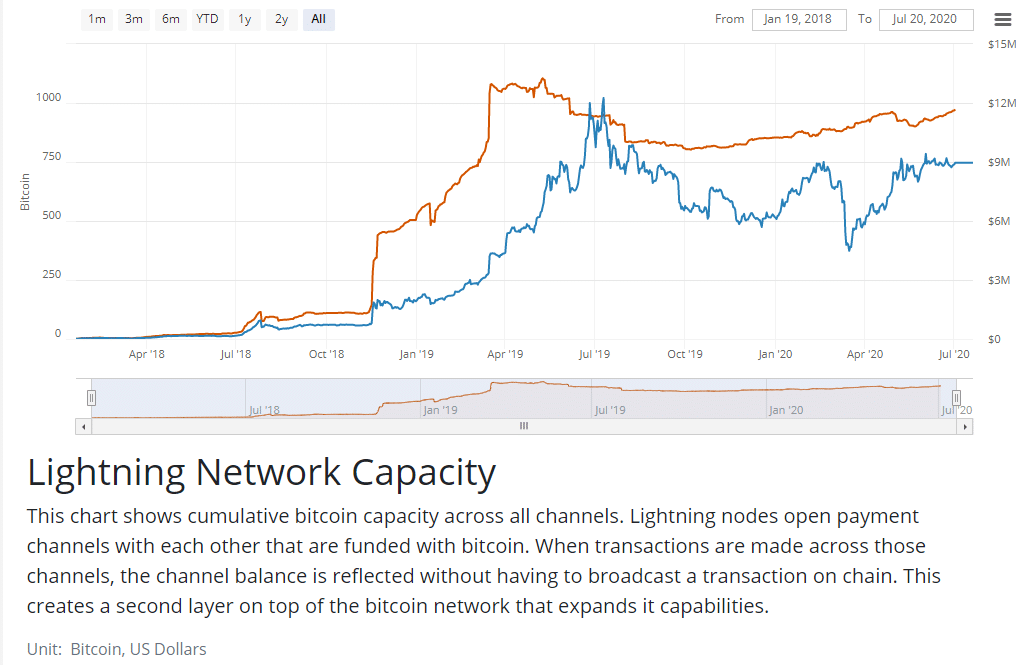

For bitcoin, the answer to the transaction problem is the Lightning Network.

The lightning network is a communication protocol designed to work with bitcoin to provide an additional layer of connections.

By establishing “channels” between multiple users, it enables Bitcoin to handle millions of transactions per second with almost zero fees.

That is the plan, anyway. Adoption has been slow, but steady:

An argument can be made that bitcoin users don’t really value the speed of transactions, but are more interested in the security of the network (and that is unchallenged).

But that means bitcoin will always be unsuitable for micro-transactions, such as buying groceries on Amazon.

The lightning network must gain widespread adoption, or bitcoin will forever only be used for transfers of significant value, as in thousands of dollars.

Ethereum

Whereas it would be nice to bitcoin handle more transactions per second, it’s absolutely essential that Ethereum sees a quantum leap in transactional speed for it to realize it’s potential.

Ethereum 2 or Eth2 is supposed to fix the transactional problem. It’s supposed to fix everything. It has been in development since 2017.

Obviously, it has been delayed a few times.

The latest proposed release date is now November of 2020.

How big a deal is Ethereum 2.0?

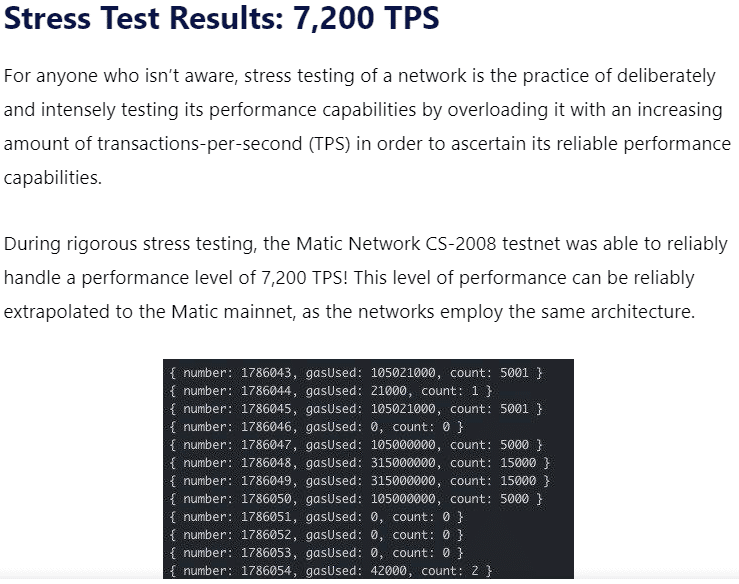

Many development teams are claiming processing speeds as high as 7200 per second using the new technology. That is about four times the speed of the VISA network:

Such a performance increase is vastly overdue. Remember, Ethereum 2.0 has been in development for YEARS.

In the meantime, more and more applications and products based on the Ethereum have been launched, putting ever more stress on the network.

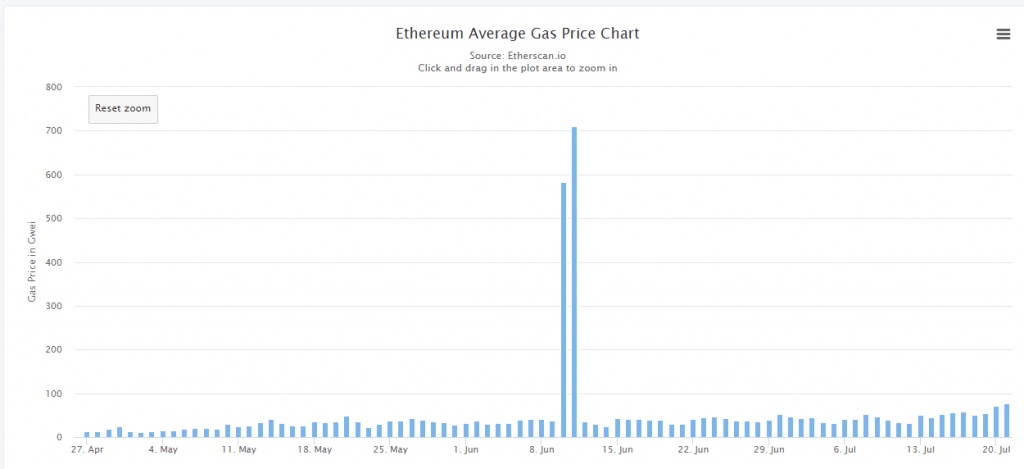

Remember, you must pay fees to do anything on the Ethereum network. These fees are paid in the currency known as “gas.”

And the price of those fees have been going up:

If you ignore the price spike during two days in June which skews the chart, you will see that the average gas price for a transaction in Ethereum has more than tripled in just four months.

That gas inflation cannot go on much longer, as it will make many transactions on Ethereum unprofitable or unattractive.

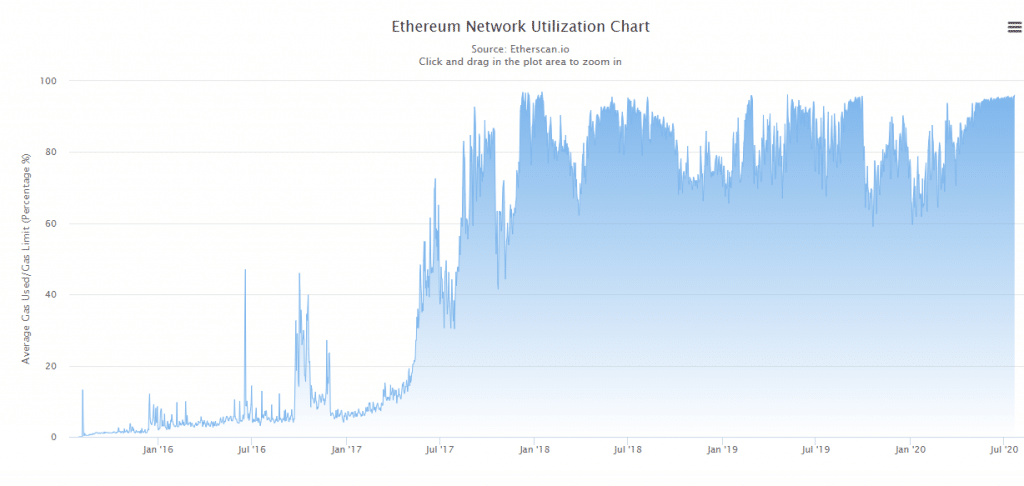

The next chart is even more damning. It shows utilization of Ethereum bumping up against the ceiling for the last three years:

Conclusion

If you have been wondering why crypto has been in a holding pattern this summer, now you know.

Year 2020 was supposed to have been the year of Ethereum 2.0, but as we all know, this year has been a tough one in many ways.

The good news? Ethereum 2.0 looks to be very real and there are several very successful projects that are running in testnet mode.

My opinion is that if Ethereum 2.0 slips again, it won’t be by very much, perhaps a matter of months.

Year 2021 will the year that Ethereum breaks out. I think it will be another 2017.

DJ