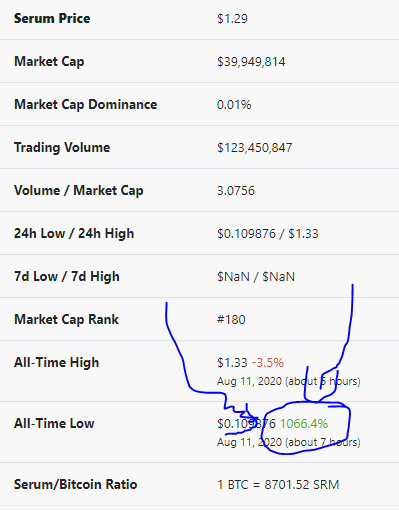

The Ethereum token Serum went up 1000% yesterday in its first day of trading:

https://www.coingecko.com/en/coins/serum

Today it’s up to $1.79, or 38%.

That’s not the only token that’s popping. The tendies token is up more than 400% since being listed July 30th.

https://www.coingecko.com/en/coins/tendies

But you can’t buy these magical tokens at your friendly neighbourhood discount brokerage.

Behold the new favourite exchange for North American cryptocurrency traders: Uniswap.

Over the last few months, Uniswap has exploded in popularity, with trading volume of $277 million USD in just the last 24 hours.

Uniswap just one of the many DAPPs (Distributed Applications) built on the Ethereum network.

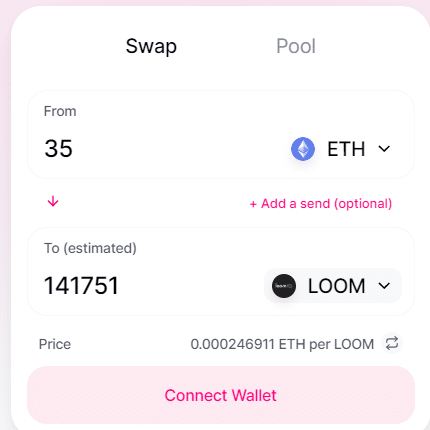

It’s a decentralized exchange allowing anybody to trade Ethereum for any ERC-20 token in the Ethereum eco-system.

What does “decentralized” mean? It means that with Uniswap, there’s no company involved, no KYC, and there is no human mediation during trades. Everything is automated.

With centralized exchanges, you need to deposit Ethereum in a wallet controlled by the exchanges.

But on Uniswap, when you execute a transaction, one kind of token is taken from your wallet and then the other token (the one you are trading for) is immediately placed back into your wallet.

There have been decentralized trading exchanges created on the Ethereum network before, but what makes Uniswap unique is the method for settling trades.

Uniswap doesn’t use order books, in the sense that there are no bids or asks for trading pairs.

Instead, by using smart contracts, Uniswap provides liquidity pools.

Uniswap incentivizes traders to provide liquidity by paying them trading fees. That is to say, the 0.30% trading fee charged by Uniswap is passed onto the traders who added liquidity to the trading-pair pool.

The concept and mechanism around Uniswap liquidity pools is somewhat complicated, so if you are interested in learning more,

here is a link.

Uniswap is exploding in popularity. Thirty days ago, daily trade volume was $33 million USD. Sixty days ago, trading volume was… zero.

Uniswap is the cryptocurrency darling of the summer of 2020.

But it’s also the Playground of the Devil.

Even though these tokens trade like securities, there are no listing requirements for Uniswap. No Securities Exchange Commisions regulations to follow. No regulatory oversight. Nothing.

It’s not the wild west out there. It’s outer space.

There is also no KYC (know-your-customer requirements)..

Therefore, it’s ridiculously easy to manufacture a pump-and-dump scheme on Uniswap and walk out with a lot of (real) cash in your pocket, without a chance of being traced.

That means a lot of people are going to LOSE a lot of money trading on Uniswap, in the long run.

.

Obviously 99% of all ERC-20 tokens are crap and will eventually go to zero. In the meantime, most traders are riding the mania train and hoping the greater fool will bail them out.

However, you can’t stop the future, and this is it.

I’ve been a penny stock trader for decades now, and bought my first bitcoin in 2014. Whenever I see a gold rush, my first thought is: Who is selling the picks and shovels?

And the answer is: With Uniswap, the users are providing the picks and shovels.

There is no central banker, no exchange CEO, no Goldman Sachs running things behind the scenes. The users are the operators

It’s revolutionary.

But it.’s also the Devil’s Playground, tempting, dangerous and most likely disastrous for most traders.

DJ

P.S.

1. None of what I write should be construed as advice on investing.

2. Yes,I have bought tokens on Uniswap. But I’m not planning to tell anybody which tokens.