If you have been paying any attention at all to crypto, you will know that the Defi (Decentralized Finance) sector has been red hot.

People trading DeFi tokens have made 1000% return on their investments in ONE DAY.

But let’s not focus on the negative. I assume you are not reading this newsletter because you are interested in buying Treasury bonds.

Here is how to gain access to Uniswap, or the Devil’s Playground which it what I called it in last week’s bulletin.

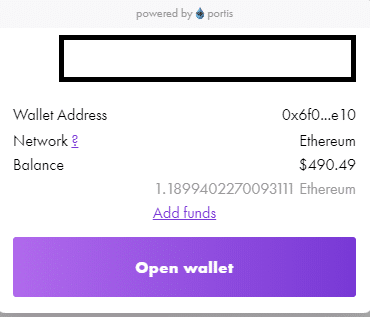

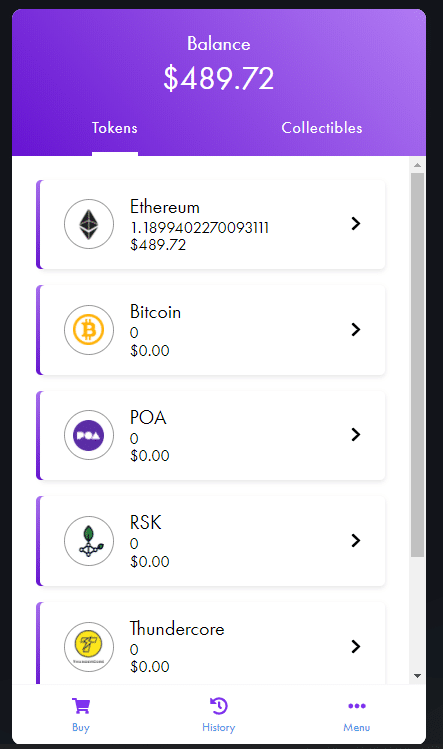

Instead, the tokens and ether are always stored in your own wallet, in this case, my Portis wallet:

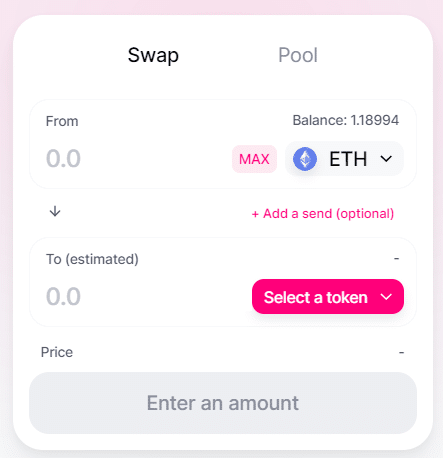

First thing to learn about the Uniswap dashboard: It’s not very informative.

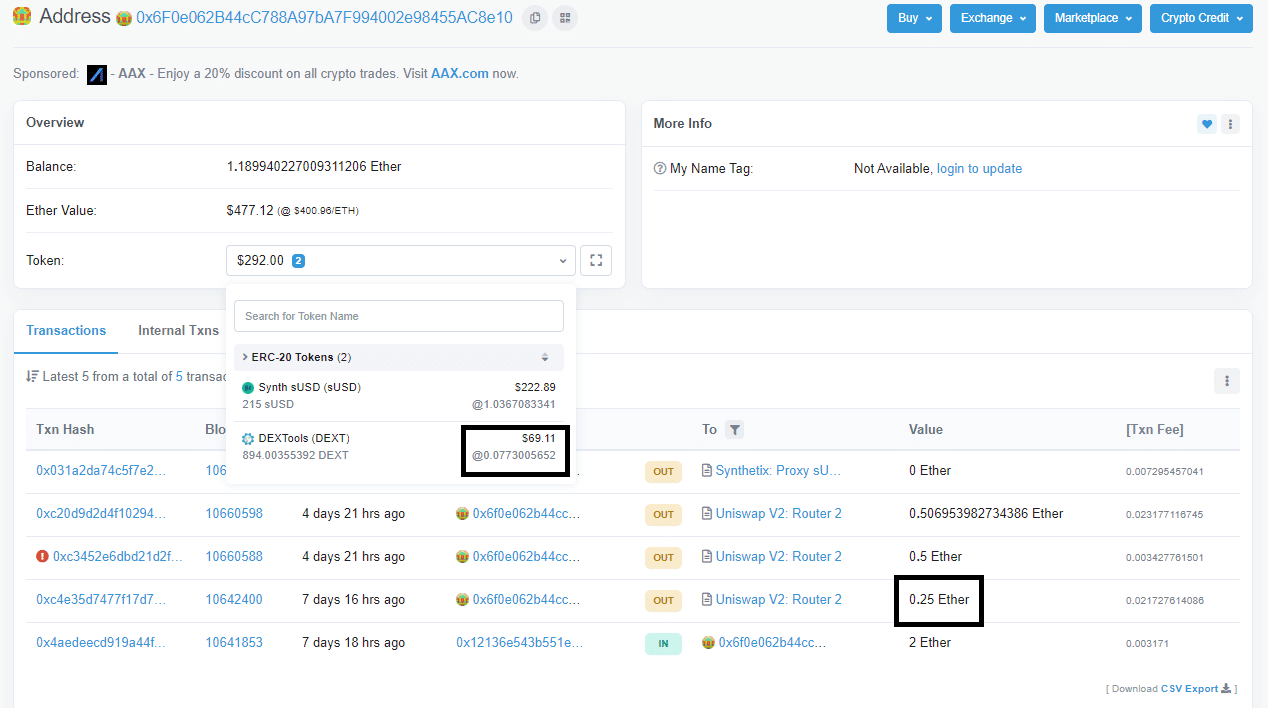

About a week ago I deposited two ether to my Portis wallet. Where did the rest of the ether go?

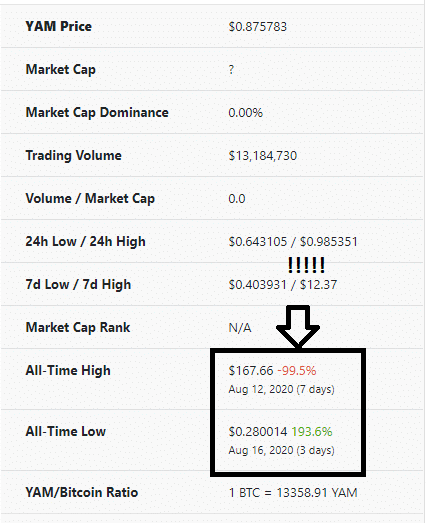

But Uniswap doesn’t try to put a price on those tokens. For that, you have to look elsewhere.

The next screen snapshot is one of my Portis wallet, where my ether and tokens are stored:

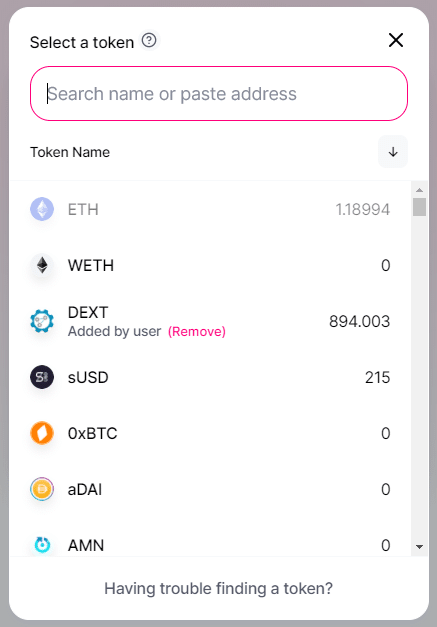

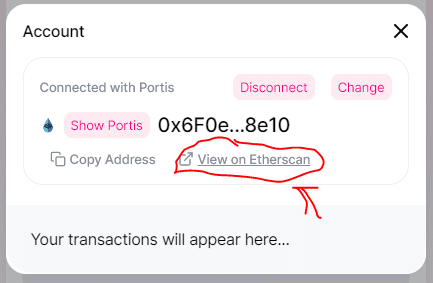

Even when you click on the balances, it is tough to find the tokens that you have in your account:

But fortunately, Etherscan saves the day. See the clickable link in the screen snapshot below, from the Uniswap dashboard.

Notice the boxes that I have highlighted. I spent 0.25 ether buying some DEXT tokens which are now worth about $69 (Yes I am down on the transaction).

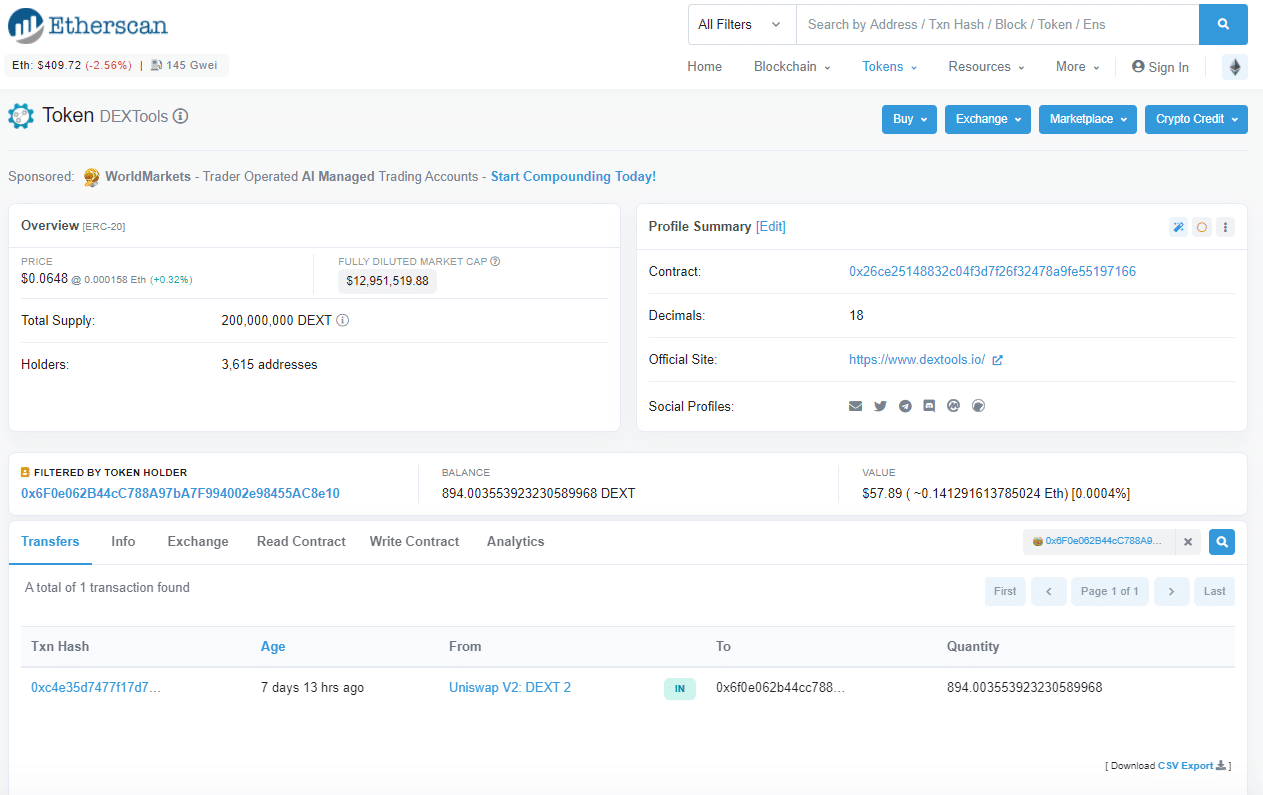

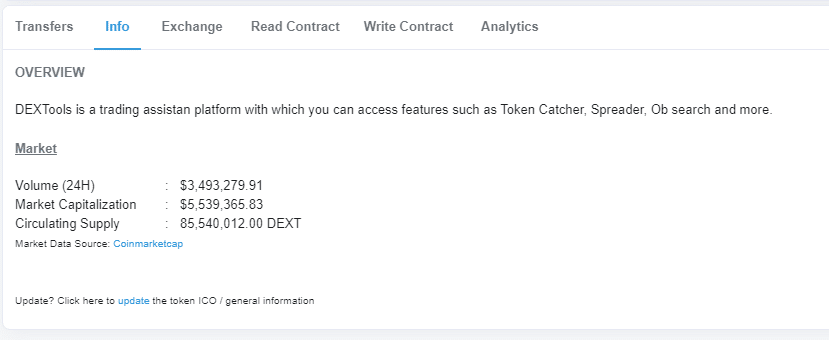

Etherscan is also a wonderful tool for showing information about the tokens on the Ethereum network.

Clicking on the info tab in Etherscan also gives us more information:

We can only hope that they don’t “dump” it.

Conclusion

It’s a good idea to learn to walk before running. Before doing any serious trading in Uniswap, you better know how to FIND your tokens after buying them.

I hope this guide helps.

In future articles, I will cover how to buy into liquidity pools and some token screening tools that may help you choose which tokens to buy.

Should you take this seriously? I honestly don’t know. I pointed out last week the problems with Uniswap.

But the last time there was a token craze, I made a killing. Check out this article I wrote almost three years ago and tell me if you get a sense of deja-vu.

DJ

Disclaimer: As always, what I write should not be taken as advice on investing.