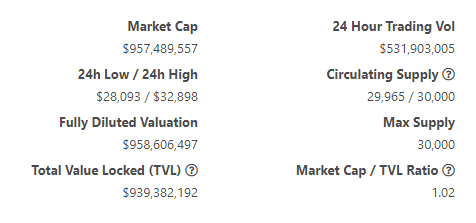

| Yesterday, the yearn.finance (YFI) token was worth a little less than THIRTY-TWO THOUSAND US DOLLARS. Here is a screen snapshot from coingecko.com if you don’t believe me: |

It’s beyond the scope of this article to explain exactly what the yearn.finance token is…. Or what it represents. The developers of the token don’t even have their own website but they were nice enough to put an article on Medium.

Let’s call YFI a derivative of Ethereum liquidity pools and leave it at that for now.

By the way, YFI has a market cap of nearly one billion dollars and traded more than half-a-billion in USD last Wednesday.

If you had bought YFI thirty days ago, you would be looking at a return of more than 700%. If you had bought just a week ago, you would have made 100%.

But not everybody who is “investing” in Ethereum tokens is making a killing. Surprise, surprise, some tokens are crashing hard. Look at the chart of Ethereum token HOTDOG:

It launched on Wednesday, September 2nd, and reached a high of nearly $7200 USD. Then it started going down. And down. Now it is worth ONE-THIRD OF A PENNY.

Who are the buyers in this bubble?

Why One of the Richest Men in Crypto is Buying Ethereum Tokens

If you don’t know who Arthur Hayes is, you haven’t been paying much attention to crypto.

Arthur Hayes is the CEO of Bitmex. I have written frequently about Bitmex in the past, but since US (and most Canadian) traders are banned from trading on Bitmex (the largest crypto future exchange in the world), he is not as well-known as he should be in North America.

But we can assume he is worth a lot of money, as Bitmex is a cash-generating machine.

In a post from Crypto-Trader Digest, Hayes confesses to as why he is buying tokens on Uniswap:

“I, like many other punters, am enjoying yield farming meme tokens. To put this degenerate behaviour into context:

I fully expect to lose most of all of the money I “invest” into any of these projects. In my head I like to believe I can read market sentiment and get out at the top of the bull market. But in reality, like most other traders, I will buy high, hold, hold, hold, and sell well after the top.

I view the destruction of my capital as the only way to learn what the next wave of products and services should be built in this space by 100x (bolded by ed). You can never find a truffle if you aren’t willing to wallow in the dirt.

The size of my positions are tiny. My core investments of gold and silver miners, physical gold, and my interest in 100x dwarf any investment in YAM, YFI, DOT, or any other piece of shit token I decide to buy.

There are no nightclubs. I am replacing bubbly water spend, with shitcoins. At least I’m learning something.”

Still don’t get it?

Let’s look at three different trading organizations and see if you can spot which ones have the greatest potential:

In the last 24 hours, trading volume on Bitmex was about $ 4 billion USD. As discussed in my post last year, Bitmex collects a trading fee of 0.075% on that $ 4 billion, which works out to gross revenue of $3 million a day or $1.1 billion a year.

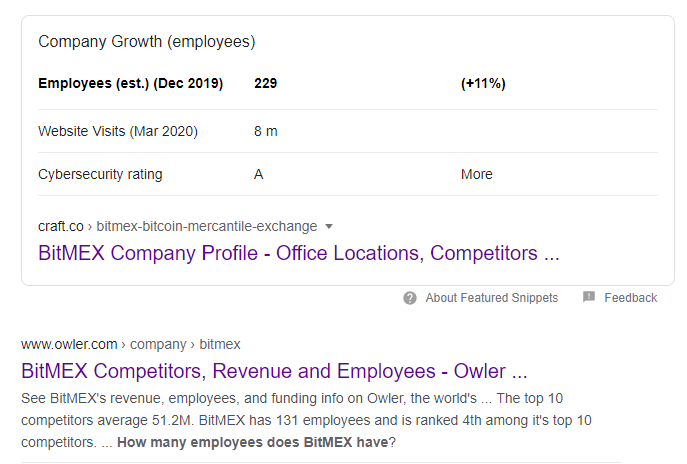

Bitmex has anywhere from 100 to 230 employees, depending on who you believe:

Let’s take the highest number – 230 – and divide it into gross revenue – $1.1 billion USD.

Gross revenue per employee is a cool $4.76 million USD.

And remember Bitmex has lots of room to grow. If they ever get regulatory approval to sell their services to US citizens, lookout.

Meanwhile the stock exchange NASDAQ employs more than 4,000 employees. Gross revenue for 12 months ending June 30th, 2020 was $4.91 billion.

Gross revenue per employee was $1.2 million USD. And how much more can NASDAQ grow their revenue?

Third example: The hottest Ethereum token exchange this summer is Uniswap. It has 10 employees.

The trading volume on Uniswap over the last 24 hours (September 2nd) was $835 million USD.

What is the gross revenue generated by Uniswap? We know that 0.3% of each trade goes to the relevant “liquidity pool.”

Daily, that’s a cool $25 million in trading fees. Did all that money accrue to whoever owns Uniswap? No, it went to the investors are funding the “liquidity pools.”

But you would be quite naïve to think that the Uniswap management team doesn’t have an inside track on which pools are providing the juiciest return: They literally built the casino.

Conclusion

Am I keen to buy these crazy Ethereum tokens with an expected future value of zero? No. But like Arthur Hayes says, it’s the cost of an education.

The smartest guys in the room are looking at these decentralized exchanges and thinking “yup, this is the future.” They understand that they have to play in the casino (and lose) before building their own casino (and winning big).

It’s tomorrow, or next year, or even three years from now, when the payoff will come. Because the smart guys will understand the new “game” in town.

And the lazy investors, the bandwagon-jumpers, will not.

DJ