Carnage today on the junior markets as the bears growl “rising bond yields.”

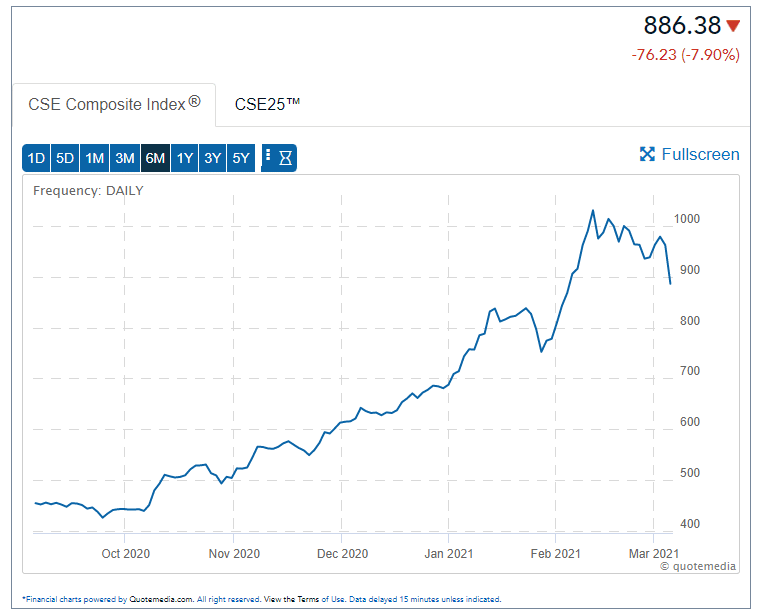

The Canada Stock Exchange (CSE) index fell from 962 to 866, a fall of 7.9%

The TSX Exchange (TSXv), Canada’s other junior stock exchange, fell 65 points or 6.6%.

These two exchanges make up the bulk of publicly-listed crypto/blockchain companies.

A sad day today, but the last six months have been glorious.

Since the first week of December, the Dow Jones Industrial Index is only up 11% and the Nasdaq is up 14%.

But until today, the Canadian Stock Exchange or the CSE was up 116%. It’s still more than doubled.

Despite the title, the CSE is not Canada’s biggest stock exchange . That would be the Toronto Stock Exchange, or the TSE (which is up 12% in the last six months as of yesterday). Daily trade volume yesterday of the TSE was just under $1.5 billion CAD.

(The TSX has a “little brother” the TSX Venture Exchange headquartered in Calgary, Alberta.

Companies list on the TSXv when they don’t meet the regulatory requirements of the TSX. The TSXv is up 33% in the last six months. Daily trade volume was $174 million CAD.)

Daily trade volume of the CSE was $330 million CAD. It’s headquartered in Toronto with a branch office in Vancouver.

How Did the CSE Become the Sexiest Exchange in North America?

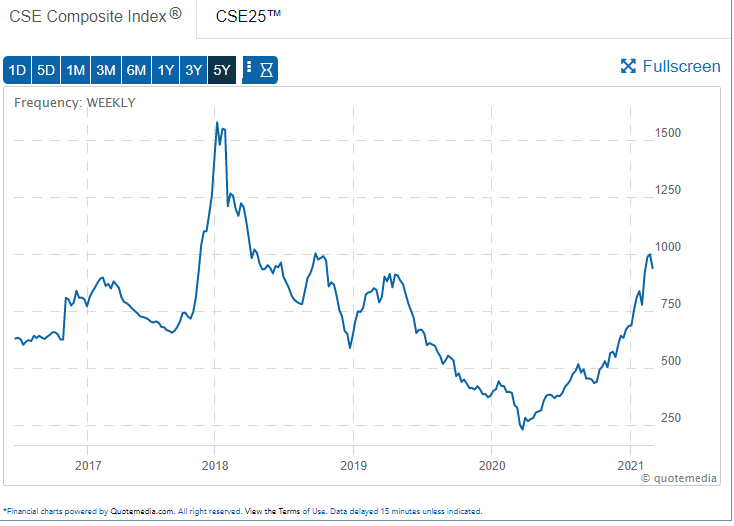

It’s no surprise that the CSE and the TSXv crashed today. These junior exchanges have a history of super-volatility.

The big surprise is why didn’t these junior markets tank sooner? Or even how did they go up so high in the first place?

The junior stock exchanges in Western Canada have traditionally been focused on resources, specifically mineral exploration/extraction and oil drill punts.

Basically, oil, natural gas, gold, silver, and copper, zinc, uranium, etc.

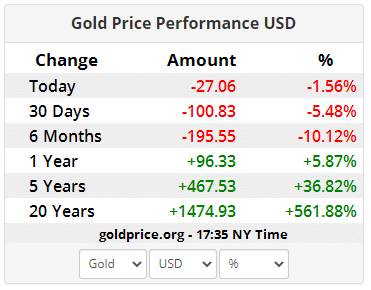

In the last six months, excluding minerals involved in the renewable energy sector like lithium, the resource sector has NOT been a good place to put your money.

Gold, especially, in the last six months, has been a HUGE disappointment.

Junior gold mining stocks went flat in the 4th quarter of 2020 and have been trending downward for all of 2021.

What has been driving up the index of the CSE?

Cannabis and crypto.

Sometime in the mid-2010s, the capital markets of Western Canada stopped running on natural gas and crude oil and switched to pot.

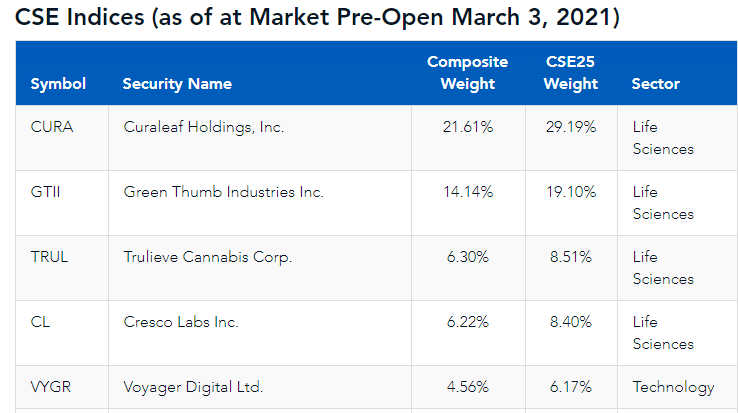

Four of the top five companies with the biggest markets caps on the CSE are in the cannabis sector:

The fifth-ranked company is Voyager Digital, a crypto-exchange company with a market cap of$ 2.5 billion CAD.

While cannabis dominates the CSE rankings, crypto is shooting up fast. Six months ago, the stock price of Voyager was under a dollar, or a market of just around $100 million CAD.

Recently it hit a high of $26.90. It has since corrected to $17.79. It’s still up 1800%.

Another crypto company, BIGG Digital Assets, is ranked at #33, with a market cap of $314 million and a share price of $1.61.

Guess the share price of BIGG almost one year ago.

FOUR CENTS.

This Where Investors Need To Be…At the Starting Line, Not At the Finish

North American crypto companies start their public life here. Even before getting an OTC (over-the-counter, or pink sheet) listing, they list on the CSE.

Then they climb up the golden staircase:

1. CSE

2. OTC or PINK sheet.

3. TSXv (maybe)

4. TSE

5. And if they hit the jackpot, it’s NASDAQ, the nirvana for most public technology companies.

In conclusion, do you want first crack at public listings of crypto companies before they hit $1 billion market cap? The CSE is the place to be.

More on that later.

DJ