August, not so much. By September it will get crazy again.

I see Ethereum is bouncing around, hitting $2400 earlier this week, and now testing $2100. In the short-term nobody knows anything although lots of people pretend to.

But in the first week of August, expect big news to be announced in the mainstream media outlets about Ethereum.

The biggest upgrade of the year for Ethereum, the “London” fork, is set to go live on August 4th.

Most are not aware that the upgrade will be deflationary – in the sense that the ongoing supply of Ethereum will be cut back, perhaps significantly.

There are a little less than 120 million Ethereum tokens in existence. Miners receive 2 Ethereum per block mined, and roughly 6500 blocks are produced a day.

The London upgrade will cut the payout to the miners.

Transaction revenue – paid out in Ethereum to the miners – was $1 billion in the bear month of June, or about 500K Ether.

Depending on whether you are looking at the boom months of March to May, or the bear month of June, transaction revenue makes up one-third to one-half of all revenue to miners.

Predictions (nobody knows for sure) are as high as 70% of all transaction revenue will be burned or destroyed after the London upgrade, instead of being paid out to the miners.

Meaning (and trust me on the math on this), the production, or mining of new Ethereum will be reduced by one-quarter to one-third.

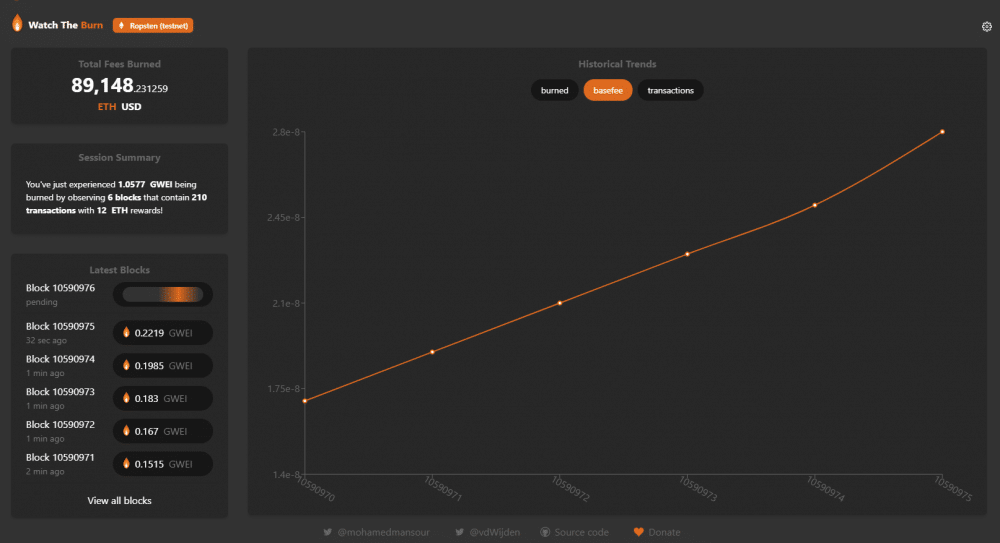

At present, you can watch the behaviour of a test Ethereum blockchain upgraded to the London version by clicking to this website: https://watchtheburn.com/ (note sometimes it takes a while for the site to come up).

Another development that has received even less attention is the continual migration of Ethereum applications to level two scaling solutions.

That’s a fancy way of saying it’s going to get a LOT cheaper to execute contracts on various trading platforms on Ethereum.

For example, on Uniswap, the leading trading platform on Ethereum, it costs as much as $45 USD in gas fees to add liquidity to a trading pool.

That means it’s not really worth your time to deal in transactions that are worth less than $1000 or even $3000 USD.

But level 2 scaling means the leading applications (or DAPPS, as they are called) on Ethereum can take in-house transactions off the main Ethereum blockchain.

Meaning, once you deposit a certain amount of Ethereum into the platform contract, executing contracts with that platform should cost under a dollar or even pennies.

In particular, I am keeping an eye on two Ethereum applications:

1. Uniswap V3. It’s supposed to migrate to the level 2 scaling solution called “Optimism” this month, although the rollout does keep getting pushed out.

2. Futureswap is scheduled to migrate to the level scaling solution called “Arbitrum” next month.

Uniswap, even with the super-high gas fees, has transaction volume in the billions of dollars.

Futureswap is looking to break into the $100 billion-a-day crypto-derivatives market. I have traded on that platform and it has everything it needs to be competitive with the big players like Bitmex and Deribit except that…the transaction fees are just too high.

While the London upgrade looks to be set to launch in early August, the level 2 scaling solutions could be delayed into September.

But they will come soon enough. And when it does, I think we leave the blue skies and calm waters of the eye of hurricane.

DJ