I like to sell off only half of an investment.

Over the last year, since I started my newsletter service, I have written dozens of bulletins where I buy and sell, buy and sell. But I hardly ever sell it all. Most of the time, I sell half.

I’m sure it’s irritating to some of my subscribers at least. It looks weak and indecisive. A newsletter writer should be able to pick an asset, build a strong narrative, and invest with conviction.

But I’m not really a newsletter writer. I’m a trader with a newsletter business on the side, and that changes everything.

My trading churn is what allows me to profit in crypto, even in a flat market.

Because if you trade in crypto, I think the worst investment advice to follow is “Cut your losses and hold on to your gains.”

In a volatile sector like crypto, which in the long run goes up but in the short run has very sharp reversals, that doesn’t work.

Instead, I don’t sell my losses. I sell 50% of my gains whenever my investment doubles.

This is a better investment strategy, and the math agrees with me:

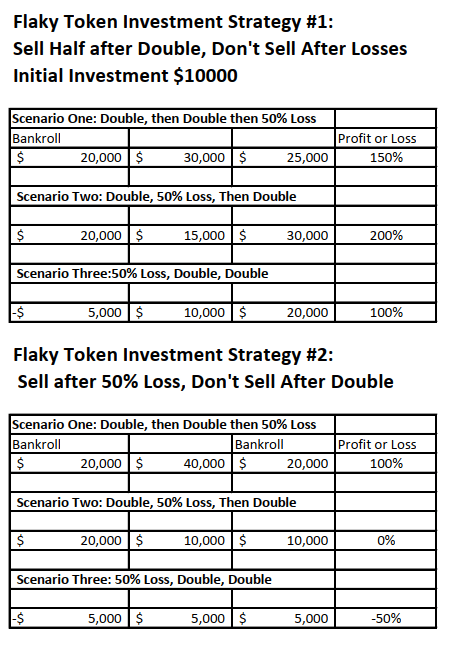

This simple spreadsheet takes into account three possible scenarios: You buy a token and it a) Doubles, then doubles again, then retraces 50%, b) Doubles, then retraces 50% c) Drops 50%, then doubles, then doubles again.

You can see investment strategy #1, which is to sell half after every double, is better almost every time.

As a matter of fact, the best-case outcome for strategy #2 is equal to the worst-case outcome using strategy #1.

Why does the sell-half strategy work? Because it reduces volatility. And techniques to reduce volatility in a highly volatile investment sector like crypto is always a good thing.

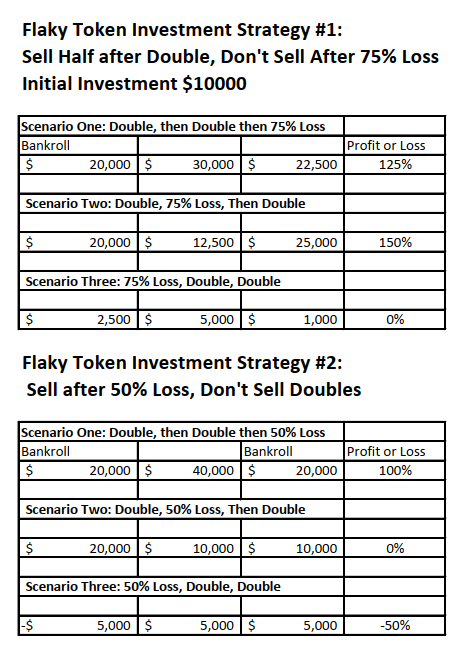

However, you may be thinking “But what if the asset doesn’t just drop 50%, what if it drops 75%?”

How do the trading strategies compare then?

Selling half after a double, and holding on after losses, still works better than cutting your losses in all cases except one.

And that one case occurs when the token drops 75% without ever making a double. After four years of trading in crypto, I’m getting pretty good at avoiding those types of assets, so I’m not worried.

There are some assumptions you do have to make about this trading strategy.

One: the asset you are buying, is really going to double at some point in time, if you are investing in crypto for the long term (and that means longer than one or two months),

I mean, I’ve seen absolutely garbage 10x (hello SHIB coin) in this sector. Unless you are buying an absolute scam coin, it’s going to double.

But of course, if you are holding crypto for the long term, there’s also an excellent chance you will see a significant retrace in the next three months, or even less. Hence sell half when double.

The key is not getting scared out of the trade. When you buy a coin, chances are that it’s not going to go up in a straight line. It will either go up then down or down then up.

Eventually up, but there will always be downs along the way.

Understanding that the trading strategy outlined really works (check the math yourself) will help you through those lousy troughs where your buy just went into the tank.

And of course, if you sold some before hitting a trough, it’s much easier to sleep at night.

In crypto, it’s a bad strategy to cut your losses and ride out the gains.

Take money off the table whenever you can, and don’t panic during a rout (and in any given year, count on at least two or three of them!).

DJ