Now before I start taking a piece out of Munger, let me first praise him, in a ceremonial fashion, to show courtesy and good manners.

Charlies Munger along with Warren Buffett are considered two of the greatest investors of the last 100 years, if not the greatest.

Their holding company Berkshire Hathaway is worth $678 billion. Charlie Munger himself is worth $2.3 billion, and he would be worth a lot more if he wasn’t giving away so much of his fortune.

Mr. Munger is also a very good writer and eminently quotable. I highly recommend reading his top 100 quotes

To be diplomatic, It has been mediocre. Not bad, but not great either.

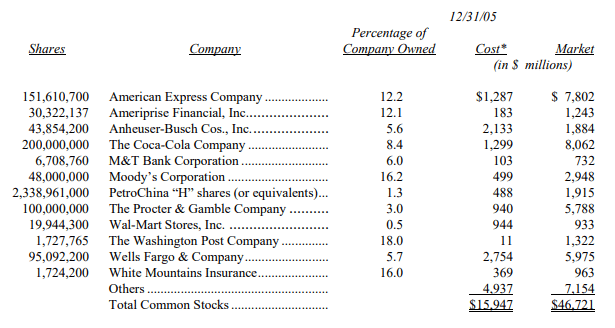

Let me show you. This is a snapshot of Berkshire Hathaway’s major holdings in 2005 (page 14):

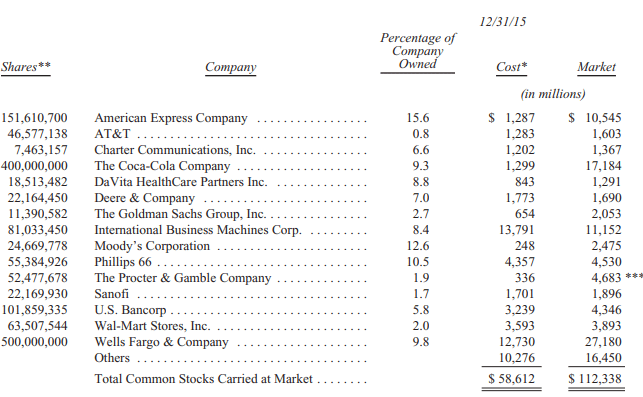

And this is Berkshire Hathaway’s portfolio in 2015:

Let’s not talk about the stocks that are ON the list, but the stocks that AREN’T ON the list.

From 2005-2015, Berkshire Hathaway did NOT buy shares in:

1. Apple (from $1.60 to $29.20 adjusting for splits, up 1725%)

2. Amazon (from $1.76 to $15.17, up 761%)

3. Google/Alphabet (from $4.68 to $26.25, up 460%)

4. Microsoft (from $26.67 to $47.19, up 76%)

5. Facebook (from $34 in 2012 to $78, up 129%)

I could also bring up companies like Tesla and Netflix but I think you get what I am saying.

For the first 15 years of the 21st century, Berkshire Hathaway took a hard pass on the best-performing stocks in North America.

Instead of buying Amazon, they bought and held Walmart (up 66% from 2005-2015).

They held on to IBM (up 65% from 2005-2015) instead of buying Apple or Google.

Their largest holding, American Express, was up 91% (and that did beat Microsoft, I wil give them that).

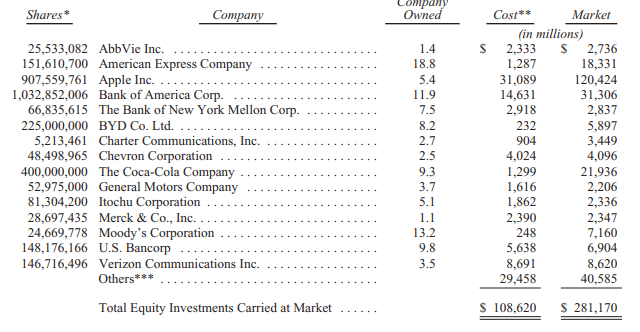

Okay, now let’s look at 2020:

To their credit, they finally added Apple. But that’s it.

Looking at their holdings over the last two decades, I have to ask myself, what’s the big deal?

Well, everybody knows that Berkshire Hathaway has beaten the S & P 500 in return since like…forever.

I know this because every article I read about Warren Buffett mentions this.

Well, why don’t we just double-check that?

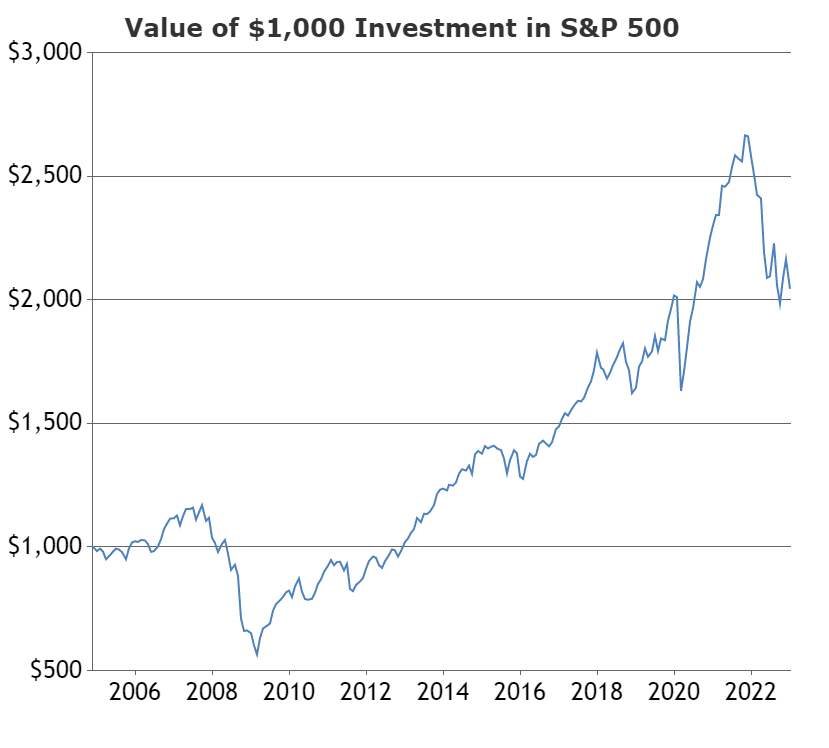

Well, at beginning of 2005, the stock price was $57. Now it’s $307. That’s a very nice return of 438%.

And it’s true, they easily beat the S & P 500:

But who cares? The S&P, in eighteen years, has only returned a cumulative average of 104.4% or an annualized return of 4.03%.

That’s not bad. That’s brutal.

That’s like me saying I’m a fantastic basketball because I can dunk on the kids at the elementary school a few blocks away (the school has eight-foot rims).

But let’s get back to Charlie Munger and crypto.

In 2013, Charlie Munger called bitcoin “rat poison”.

In 2013, Bitcoin reached a high of $938. It’s now more than $23,000, even after dropping more than 50% from its all-time high.

For those keeping score, that’s a return of 2352%.

Gimme some more of that rat poison.

Conclusion

From 2000 to 2020, only 22% of stocks outperformed the S & P 200. Berkshire Hathaway was one of those stocks.

Okay, I will admit that’s not mediocre. Being in the 22% percentile is pretty good (although I still can’t get over that annualized 4% return).

But it’s not great. It’s not fabulous.

I’m sure not hanging on Mr. Munger’s every last word hoping for some sweet stock tips that are going to double in six months or less, let alone take anything he says about crypto seriously.

But I guess Mr. Munger will always have an audience among those who missed out on the huge gains made by crypto investors over the last ten years.

Bitcoin can go to a million and people will still say it’s a scam.

DJ