The case for why the Vancouver real estate will crash is simple:

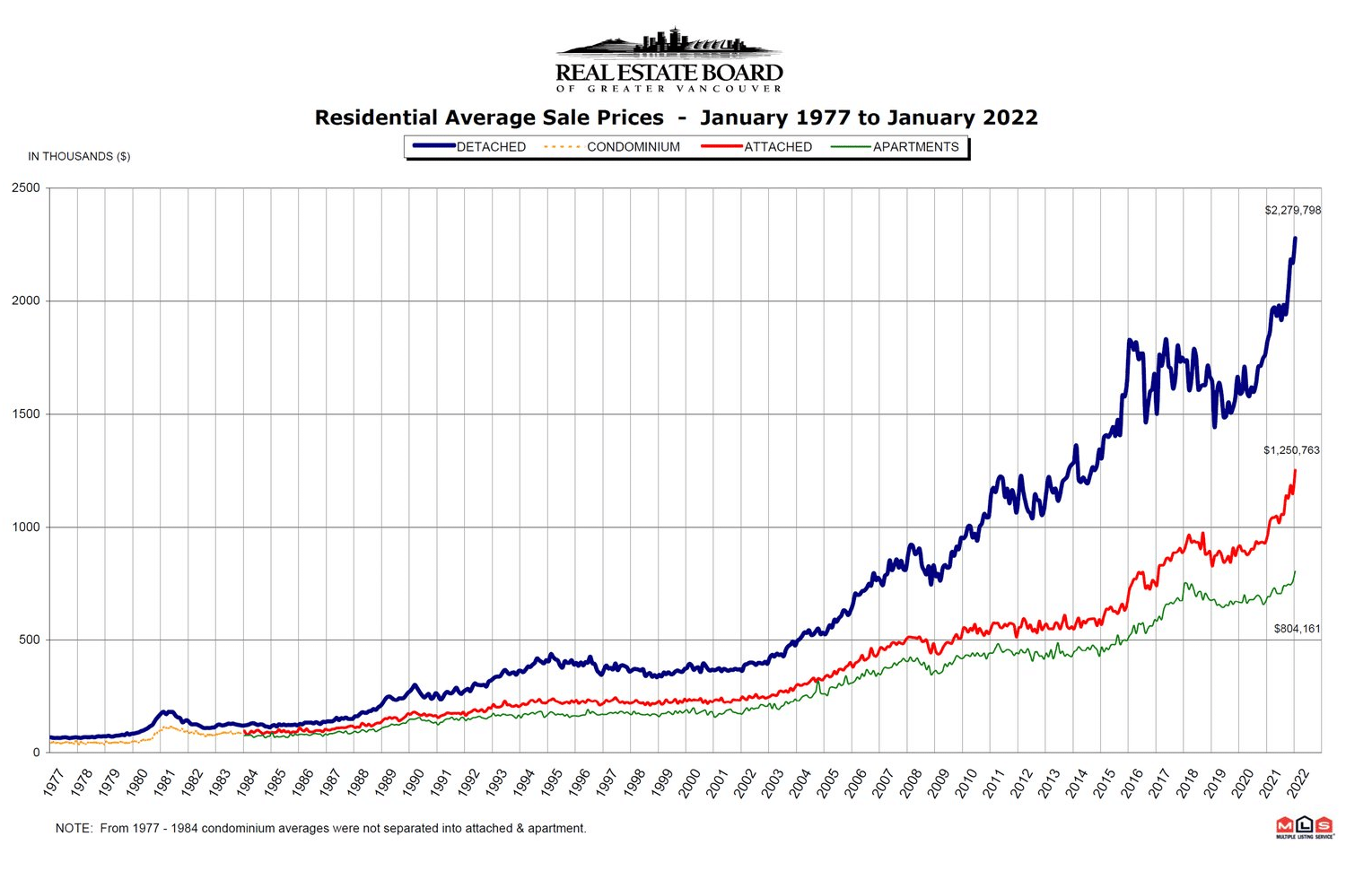

1. Vancouver housing prices have soared the last twenty years.

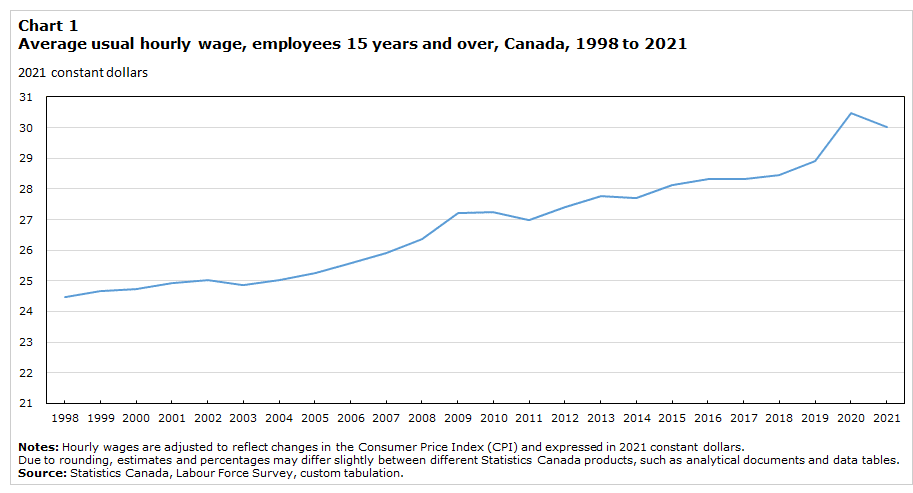

2. The average Canadian wages have not kept up.

3. Mortgage rates have spiked up this year.

Add up all these factors and it’s obvious that prices should not go down this, but they should crash.

But this conclusion is wrong. Let me explain why.

It is true that demand is dropping like a stone, but the market is already reacting to that by removing supply, as I wrote in last week’s article.

It’s true that Vancouver real estate prices have exceeded the rate of inflation by a wide margin:

This chart is only used as clickbait for lazy writers who want to pound the narrative that Vancouver is due for a crash.

And that narrative has been wrong for twenty years, and for twenty years I’ve been listening to people at Vancouver house parties tell me why the value of my home is going to crash THIS and THAT year.

If I sound annoyed with the narrative I am. I wish writing this story will stop those people from trying to lecture me while I’m sipping my Scotch and trying to relax, but I doubt it.

Now, to find better data points, you have to dig a bit deeper than the average freelance writer who is lucky to get paid three cents a word for their click bait articles. Fortunately, that’s not hard.

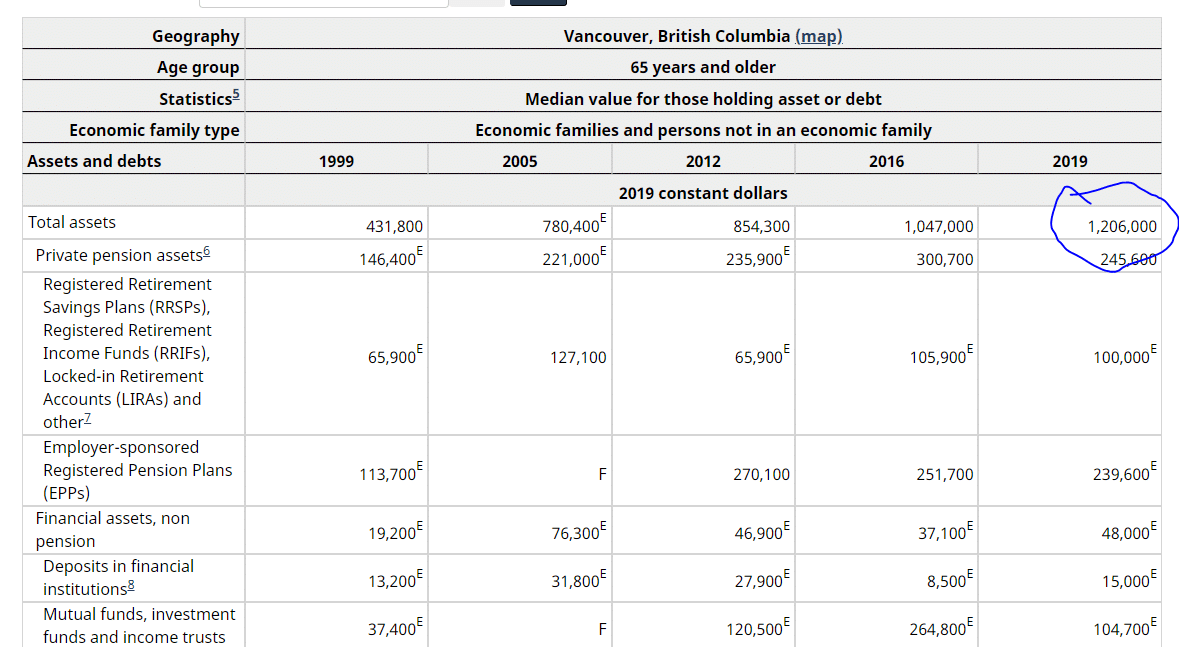

Let’s take, for instance, the average amount of assets owned by a Canadian living in Vancouver, over the age of 65:

For the average Vancouverite aged 55-64, their net worth was $1.025 million on assets of $1.381 million.

For those aged 45-54, they owned assets of $993,000 but their net worth is $757,000.

Age 35-44, assets: $584,000, net worth: $297,000.

And now we get to the juicy part: Under the age of 35, the average Vancouverite is worth $78,000.

Right away this data tells us two things.

Vancouver real estate is overpriced – for young people. The real shocker in today’s society (I’m talking Canadian society) is not the overpriced real estate in Toronto, Vancouver, and other Canadian cities, but the huge wealth disparity between young and old.

But back to the story.

For older people, especially those close to retirement age, Vancouver real estate looks very affordable

Because the average Vancouver resident over the age of 55 is a millionaire! In 2019!

Now, you may say, those people are millionaires only because the price of real estate is inflated, and you may be correct.

But that’s irrelevant because the debt load of the average Vancouverite over the age of 55 is very low compared to the assets they own.

Meaning any spike in mortgage rates will have a minimal effect on whether they can afford to keep their house or not.

Over the age of 65, the mortgage debt load is so low (or the data is so unreliable) that Stats Canada doesn’t even publish the data.

From age 55-64, mortgage debt is $290,000.

Against a principal residence worth a little more than $1 million.

These stats are to be used with caution, and they are from 2019.

However, the numbers would have to be off by a considerable amount to contradict my thesis. And again, the data is six years old.

If anything, the average Vancouverite over the age of 55 is probably worth considerably more than one million dollars.

If you are a young person, yes, you are out of luck, like my children who are no longer children but are becoming young adults. And that’s a big problem.

But alas for the young, I don’t see a crash coming out of the blue, allowing them to buy a house or even a condo a few blocks from the family home.

Conclusion:

Why, in a financial newsletter, are we discussing this?

Because if you ask 20 Canadians whether Vancouver real estate is too expensive, at least 19 would say yes.

Very few would say the correct answer: it’s too expensive for young people because all the old people in Vancouver are millionaires.

I don’t know how many articles you have read over the last two decades about Vancouver real estate, but I have read a lot (too many).

And NONE of them come to this conclusion: Vancouver real estate is expensive because Vancouver residents, on average, are considerably wealthier than the average Canadian.

And their debt, compared to their assets, is quite low. So spiking mortgage rates aren’t going to have the effect that a lot of pundits think they should have.

Perhaps the real story here is not about the myths surrounding Vancouver real estate, it’s that the free financial press in Canada is so bad that in twenty years, nobody made the point that in a city, where the average resident is a millionaire, the real estate is going to be expensive.

And what else does the mainstream press miss? Well, pretty much everything about crypto. But that’s another story.

DJ