I loaded up last week on two top Bitcoin mining stocks here.

Why? Bitcoin is trading today at $27,600 USD at the time of writing. Its all-time high is $64,000.

The price today is 43% of its all-time high.

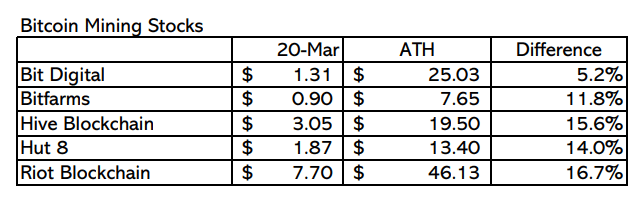

Have a look at the chart below of a general sample of the largest bitcoin mining company’ stocks:

There are NO Bitcoin or cryptocurrency mining stocks now trading anywhere near 40% of their all-time high.

Are there risks in investing in this sector? Oh absolutely.

The US financial regulators have established beyond a shadow of a doubt that they hate Bitcoin and will do close to anything to kick sand in the gears.

Even Joe Biden hates Bitcoin. He has announced he will be seeking a 30% energy tax on all Bitcoin mining operations just… because.

On the other hand, the Democrats looking to tax anything right now to plug the future massive federal deficit so perhaps we shouldn’t take that personally.

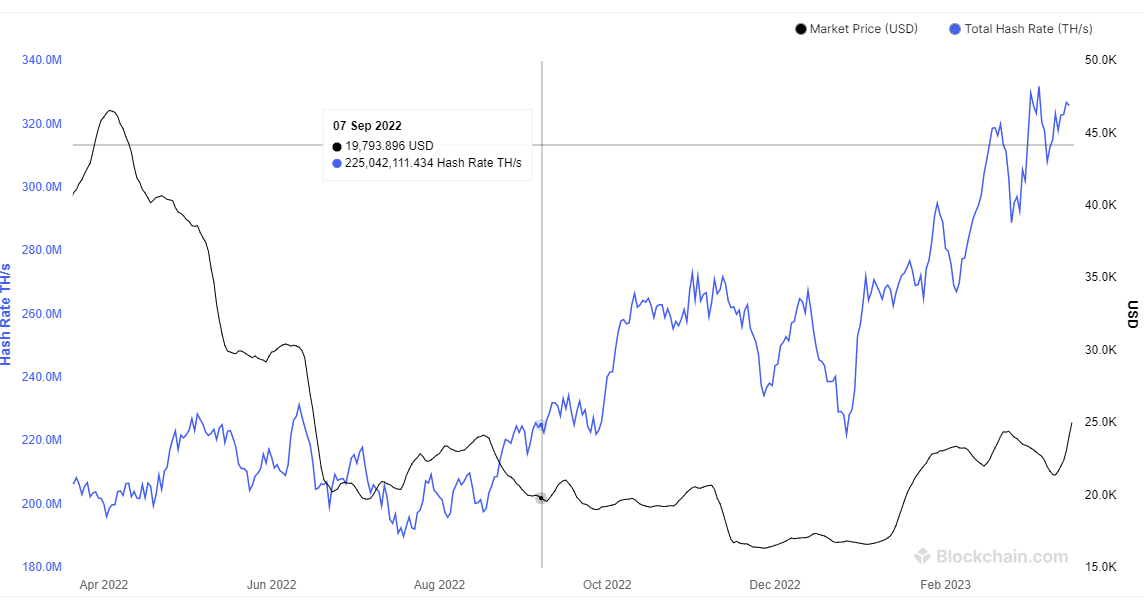

Another risk is the hash rate. That’s the amount of computing power dedicated to securing the Bitcoin network:

You want the black line to go up and the blue line to go down or at least stay flat. But the reverse is true, and that’s not good.

That, in a nutshell, is the bitcoin mining industry and is why bitcoin mining stocks got completely hammered in the last year, much more so than the price of bitcoin.

However, that always happens with Bitcoin and crypto mining stocks. They exhibited the same behaviour from 2017-2020: Stupid-high stock price at the peak, the stupid-low price at the bottom.

Bitcoin mining stocks have always had torque to the upside and the downside.

HIgh-risk but high reward.

How it is looking right now?

Well, if you are not taking a real hard at these stocks right now, I don’t know why you are reading this blog, because now is the time to think about seriously loading up.

At least for me.

How to Value Bitcoin Mining Stocks?

Gauging cash flow from a potential Bitcoin mining deal is easier than you think. It’s WAY easier and less risky than trying to gauge cash flow from a gold mine that is 3-5 years away from producing a single ounce.

Key Metrics

To calculate cash flow you need to know the following:

- Price of Bitcoin

- Hash Difficulty rate for Bitcoin

- Kilowatt per hour that the miner is paying for electricity.

- Hash rate of the Bitcoin miner/data centre.

- Wattage of the Bitcoin miner

- Cost of equipment.

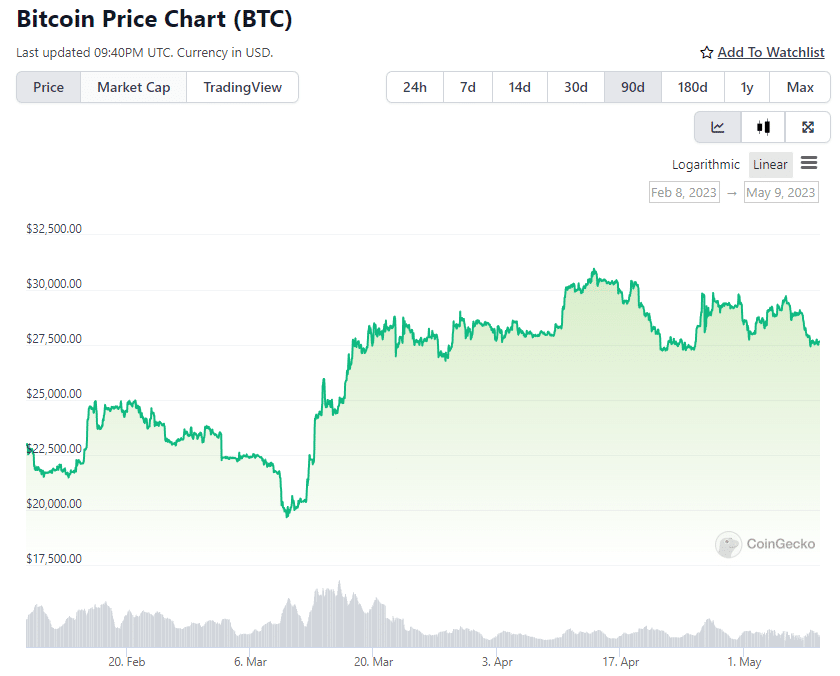

Let’s look at each of these items in turn. The first, the (1) price of Bitcoin, is easy to find. Today the price of Bitcoin is about $27,500 USD:

Chart from CoinGecko.com

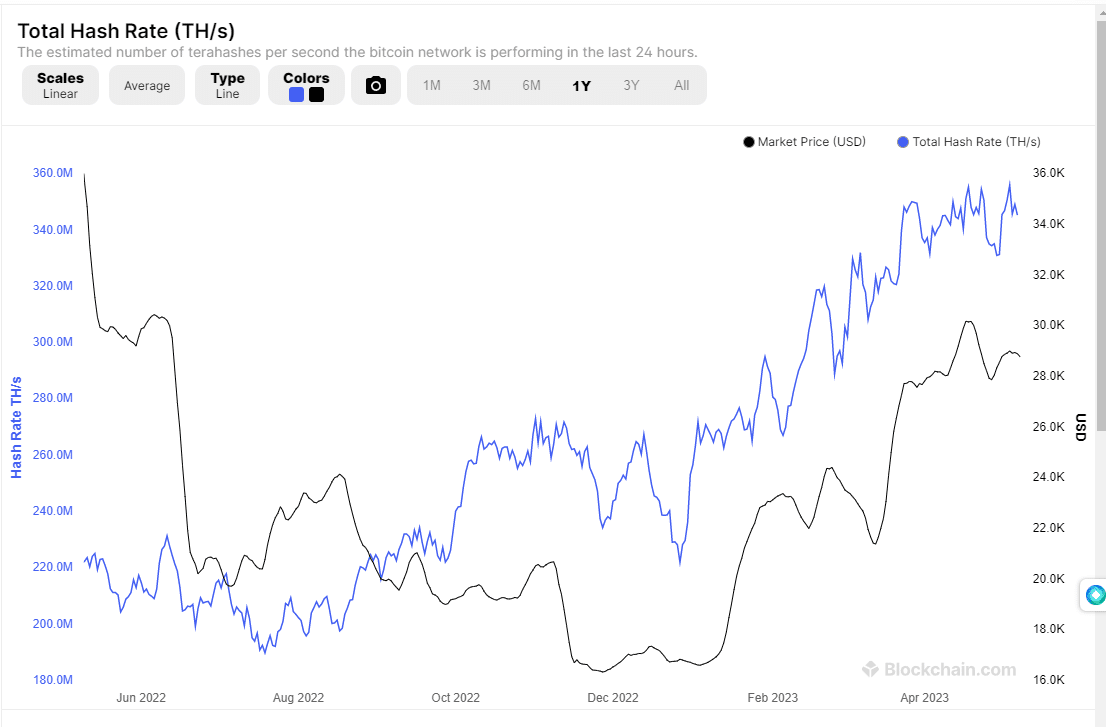

(2) Hash difficulty rate is also easy to find, as blockexplorer.info tracks that information. The hash rate today is 340 million TH/s.

If you don’t know what hash rate means, it’s essentially the sum of all computing power on the Bitcoin network:

chart of bitcoin hash rate

The third data point we need to find is (3) Kilowatt per hour that the miner is paying for electricity. This is very important so it has to be somewhere in the prospectus. If the company has landed a sweet deal for electricity and doesn’t want to make it public, then at the very least the prospectus should provide guidance such as “lower than 10 cents a kilowatt hour” or around 8 cents etc.

No guidance on electricity rates is a red flag. But it’s common to see even in quarterly reports from big public Bitcoin miners.

The fourth thing we need to discover is the (4) Hash rate of the Bitcoin miner/data centre. The total hash power will tell you how much Bitcoin the data centre is capable of mining on a monthly, weekly or even daily basis.

Virtually all public Bitcoin mining companies will tell you the amount of total hash power they are running.

If you are lucky, the company will provide the all-in cost it takes to mine one bitcoin.

If not, you have to dig deeper.

Somewhere, somehow, you need to find the number of mining facilities and rigs that are up and running and what model of the mining rig.

New mining rigs are much more cost-efficient than previous-generation machines and mining operations are so much more profitable.

On the other hand, older mining rigs will be fully amortized (you would hope) so a crypto mining company with a lot of newer rigs also might have a heavy debt load.

In case, it’s really important to know what model rigs the company has in operation.

The company most times won’t tell you how much they pay for the rigs, so again you have to do a bit of detective work.

The current workhorse of the Bitcoin mining community is the AntMiner S19. It’s the favourite mining rig for the data centres and crypto mining industry as it has the best operating efficiency at 21v watts per Terahertz (the lower the wattage the better).

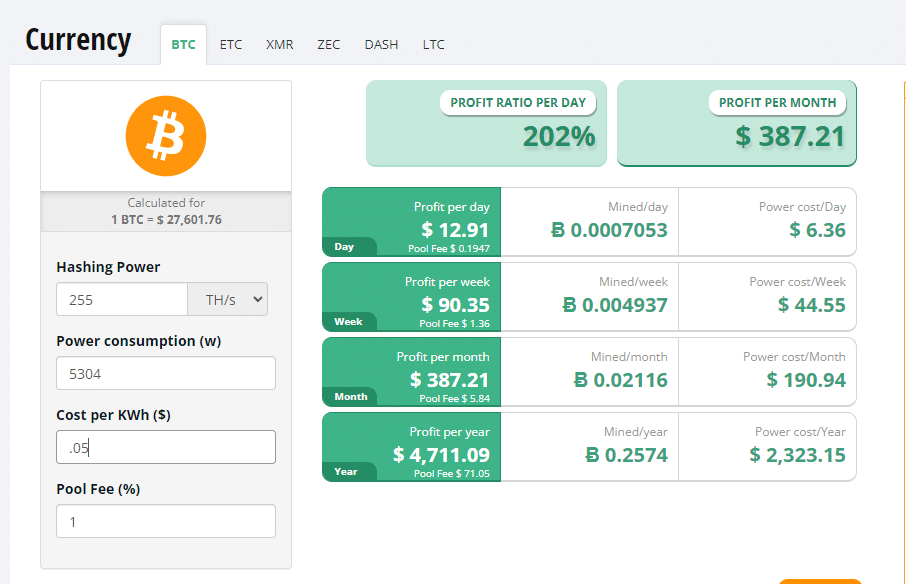

The (4) hash rate of the Bitmain Antminer S19 XP Hyd (255Th)is 255 TH/s and it consumes (5) 5304 watts.

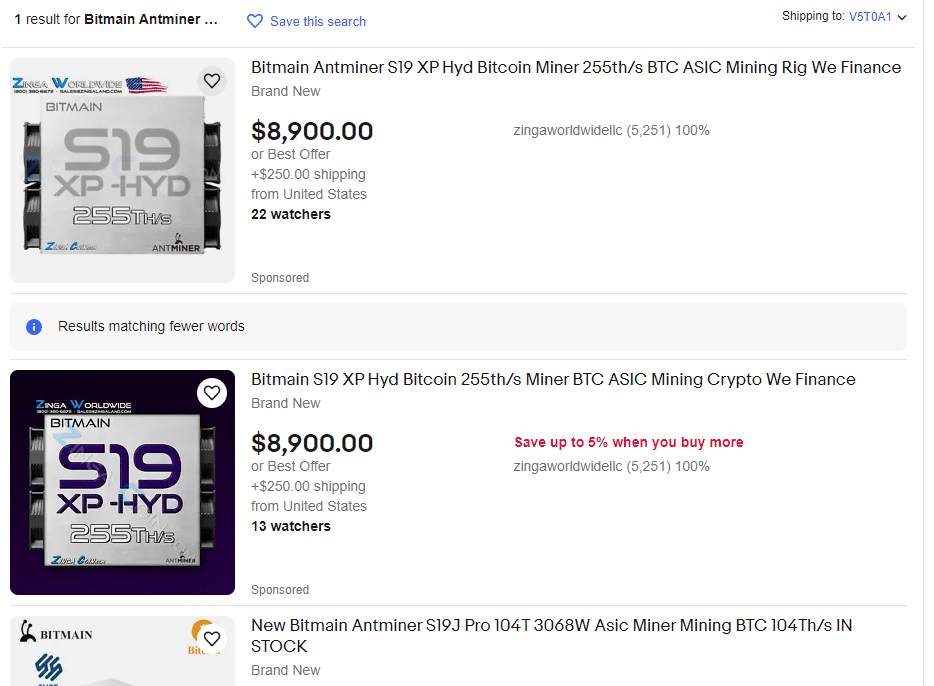

The list price of the above miner is $4150 USD. However, check the price on Ebay for the “real” street price.

the real street price of a bitcoin mining righ

So the street price of an Antminer S9 is $8900 and the wholesale price is $4150. Now the company management team won’t tell you what they paid (except to say they got a good price) so it’s time to stick a wet finger up in the air and guess that the cost of each miner was $6000.

Now you only need one more thing to complete your financial analysis and that’s a Bitcoin mining calculator. You can google that term, there’s are tons of them on the web.

I used Cryptcompare to make my calculations:

how to calculate profitibility of a mining righ

And there you go. Let’s say you are looking at a Bitcoin mining company that has one data centre with 1000 mining rigs. Each one makes $387 a month so the data centre will throw off a monthly cash flow of $387000 or $4.65 million USD a year. Cost of the rigs is $6 million.

But of course, you have to find the additional costs of the data centre, excluding the rigs. Fortunately, with a public company, you can pull that out of the balance sheet. With a private deal, you have to ask.

You Are Not Done Yet

Electricity costs are critical. If the data centre is paying 5 cents an hour instead of 8 cents then the profit per month is $387 instead of $272. That’s a difference in cash flow of 33 per cent!

Where is the price of Bitcoin going? If Bitcoin hits $50000 sometime in 2023, then obviously profit goes up. Where is the network hash rate going? Historically it has always gone up. If (and that is a big if) it continues at its historical rate, then you need to take that into account.

Conclusion

The year after a Bitcoin mining company makes a big purchase of mining rigs is usually toughest. After the equipment has been amortized, then the cash flow really starts to improve.

It has been five years (since 2018) that we have seen the rise of public Bitcoin miners in North America.

Despite some crazy up-and-downs in the price of Bitcoin during that period, the shares prices of every surviving Bitcoin and cryptocurrency mining company has done very, very, well.

DJ