I have been investing since 1999.

I would say for about 15 years, my return on my investments was at best okay in good years, and terrible in the bad years.

Then in 2018, after the crypto crash, I slowly started to turn it around.

How did I do it?

Avoiding sectors that suck.

You can’t look at a stock and decide whether it’s a good investment just on the merits of the company behind the stock.

You must look at the industry. You must look at the sector.

From 2010 to 2014, most of my investments were in the energy sector, specifically oil and gas. I did okay, and in some years I did well.

Then in 2014, everything changed. The Saudis decided to get into a price war with American shale producers and flooded the market with crude.

The overhang, despite what you may have read elsewhere, continues to this day.

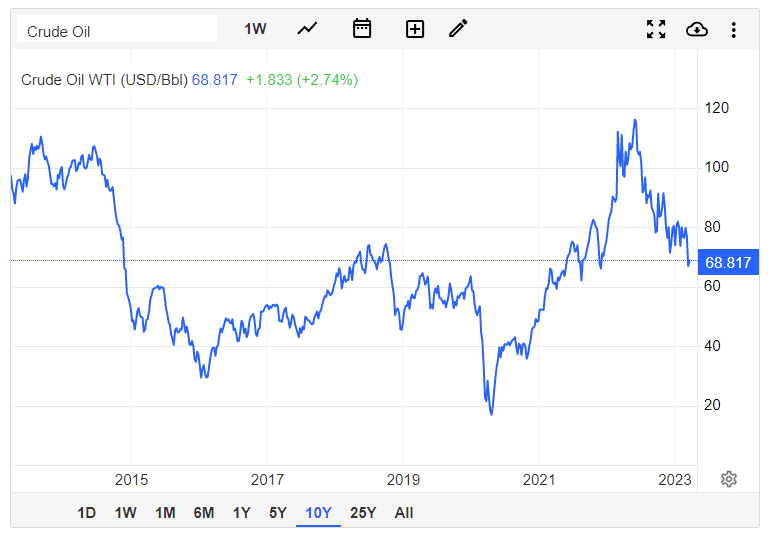

Look at the price action of crude oil over the last ten years:

https://tradingeconomics.com/

I’m also Canadian and so, I invested in Canadian energy stocks.

But in the early 2010s, the ESG movement started to gather steam, harassing institutional investors who wanted to invest in energy, and more importantly, shutting down Canadian oil pipelines.

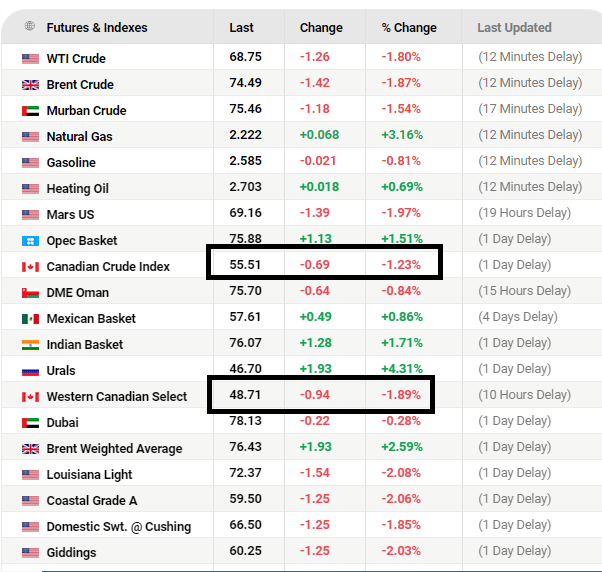

As a result, Canadian crude is the cheapest in the world (excluding oil from Russia):

https://oilprice.com/oil-

Now, did I quit investing in oil and gas in 2014? No, I kept investing in that sector for years afterward.

But from 2014 onward I didn’t make any money in that sector.

Around 2013, I started investing in small caps and micro caps and did quite well, mostly because I worked with two newsletter writers who really did their homework and picked quite a number of five and 10 baggers for the next seven years.

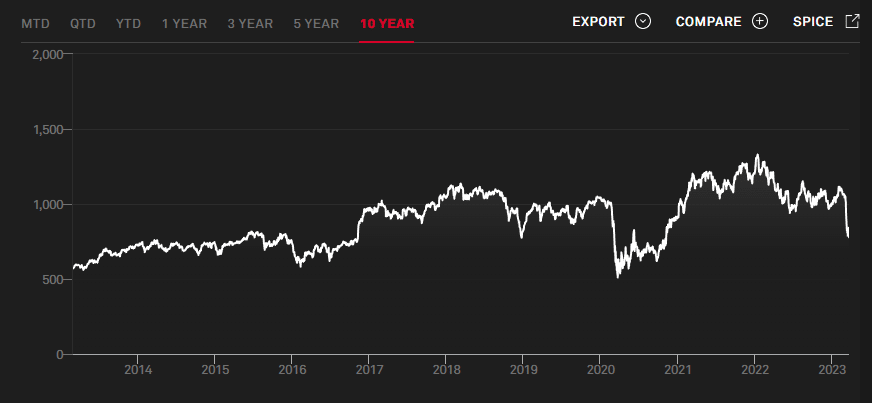

I was very, very lucky to work with them because the small-cap market in general over the last ten years has been decidedly mediocre:

Again, I’m Canadian so that’s a chart of Canada’s leading small-cap stock exchange, the TSX Venture.

In 2013, I bought my first bitcoin. I lost interest in crypto in 2014 with the first big crypto crash. I started investing again in the last half of 2017 and so caught the big wave.

Note that while I have been seriously trading in the crypto, there have been TWO 80% retracements and at least one additional 50% retracement in the last five years.

I must admit that trading crypto is not for the faint of heart.

Where Will I Put My Money for the Next Ten Years?

Crypto if necessary, but not necessarily crypto.

That’s the point of this whole essay. It’s more important to figure out in which sector you will NOT put your money and go from there.

I like crypto for the next few years but that’s about as far as I will go.

The ESG movement has killed the energy sector for me, forever.

The Canadian small-cap sector looks dead to me for at least a couple more years (but I reserve my right to change my mind on that, at any time).

And finally, for me, the big AVOID sector is bank stocks. I don’t mean to avoid it just this year.

I think the banking sector is dead for a decade (again)! Look at the ten-year chart of the S&P Banks Select Industry Index:

ttps://www.spglobal.com/spdji/en/indices/equity/sp-banks-select-industry-index/#overview

The ten-year return on this index is 2.76% over the last ten years (not annual).

The issue is not if somebody can profit in this sector. I’m sure somebody can. But not me. And I don’t think the average retail investor will profit over the long term as well.

You can lose money investing in crypto. You can lose a lot of money in crypto.

But if you have invested in crypto for five or more years, you probably have done very, very well.

There are surprisingly few sectors out there where you can say the same thing.

DJ

*Is it surprising that Canadian oil goes for the same price as Russian oil, even though, unlike Russia, we are not invading any countries? Not really to me. But perhaps the average Canadian should be mildly surprised that nobody in the Canadian media, ever, mentions this interesting tidbit.