Crypto investors in Defi (decentralized finance) are generating yields of 3 to 30 percent yield via staking rewards.

But a lot of crypto owners don’t do it because there is a bit of a learning curve.

And if you don’t know what you are doing, transaction and staking fees can eat up a lot of the profit, and you can even lose money.

But generating a passive income off your crypto, especially if you plan to hold for a few years, is too lucrative an opportunity to ignore.

In my opinion, the risks of crypto staking, once you know what you doing, are far less than buying dividend stocks (and I should know, I have buying dividend stocks for decades).

This guide will teach you how to stake crypto in the safest manner possible, and then when you gain more confidence in navigating the blockchain world, you can experiment with higher-yield smart contracts.

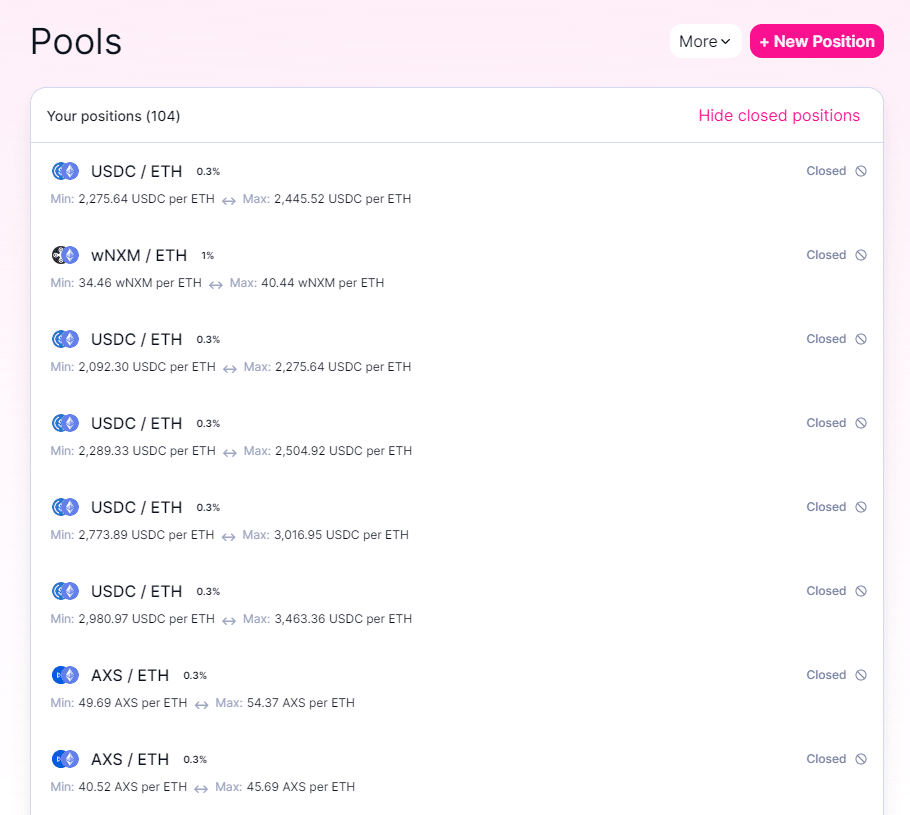

I have been yield-farming and staking crypto for more than a year now:

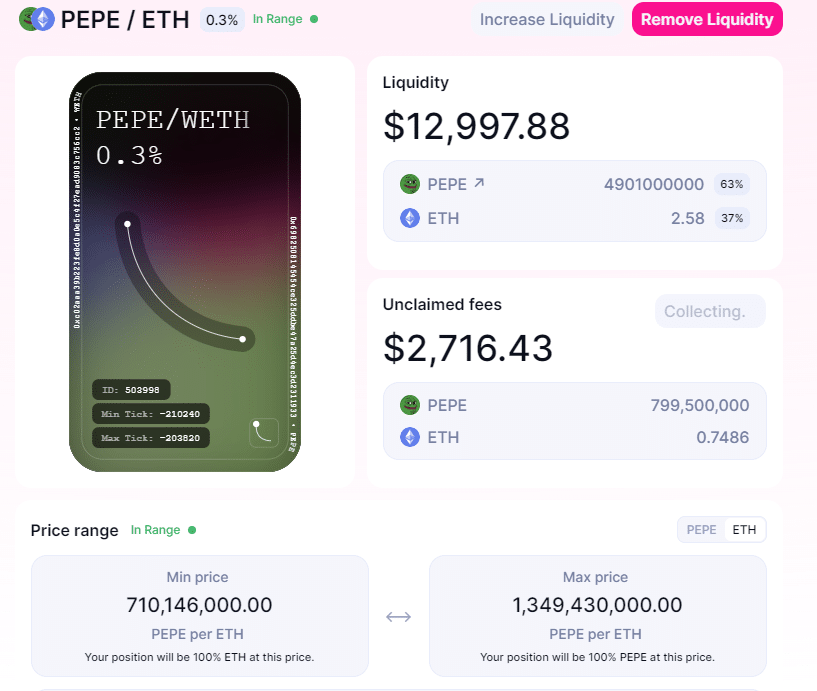

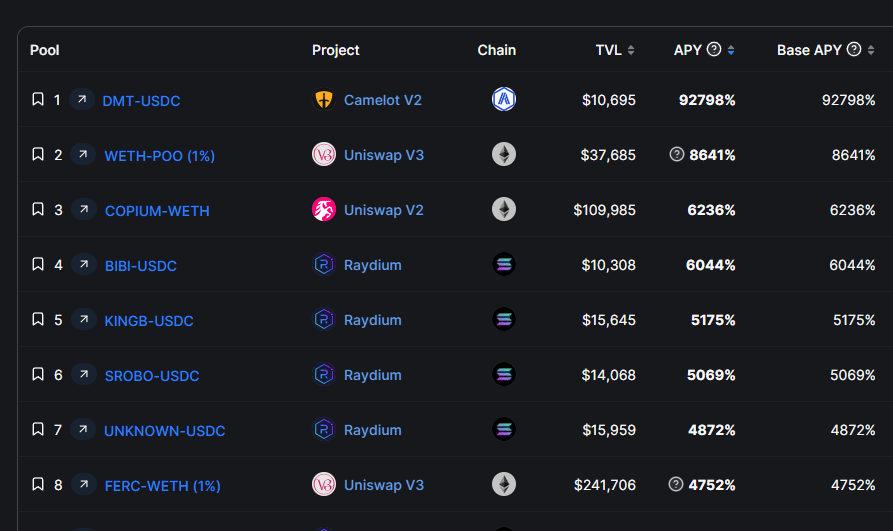

The high-risk cryptocurrency staking pools can give insane yields sometimes. When the Pepe meme coin was a craze, the Uniswap pool was yielding easily more than 1% a day when you staked Ethereum and Pepe:

But How Does Staking Crypto Generate Yield?

First, it’s very hard to generate yield off Bitcoin. Most staking is done through the Ethereum blockchain, via the Ethereum token, and other tokens generated through that blockchain.

There are other proof-of-stake blockchains, but for this article, we will focus on Ethereum and layer 2 blockchains such as Optimism, Arbitrum, and Polygon which are part of the Ethereum eco-system.

The layer 2 protocols are where you want to start, as the transaction fees are so much cheaper than on the Ethereum mainnet. More on that later.

Staking crypto offers the opportunity for investors to make money through a process called “proof-of-stake” (PoS) consensus mechanism. Unlike the traditional “proof-of-work” (PoW) aka crypto mining, mechanism used by cryptocurrencies like Bitcoin, PoS allows holders of a particular cryptocurrency to participate in the network’s consensus and earn rewards in return. Here’s how staking cryptocurrency generates revenue:

-

Network Security by Validating Transactions

By staking crypto, you contribute to the security and operation of the blockchain network. Validators are selected to create new blocks and validate transactions based on the number of coins they hold and are willing to lock up as a stake. This ensures that participants have a vested interest in maintaining the network’s integrity, as they have something to lose if they act maliciously.

-

Earning Staking Rewards

As a validator or staker, you can earn staking rewards for your contribution to the network. These rewards are typically paid out in the form of additional cryptocurrency tokens. The rewards can vary depending on factors such as the network’s inflation rate, the total amount of staked assets, and the duration of the stake.

-

Inflationary Rewards

Many blockchain networks have built-in inflation mechanisms that create new tokens as a way to incentivize participation and secure the network. Validators and stakers are rewarded with a portion of these newly minted tokens, allowing them to earn additional crypto holdings over time.

-

Transaction Fees

In addition to inflationary rewards, staked token holders may also receive a portion of every transaction fee generated on the network. These fees are paid by users when they send transactions and contribute to the overall revenue pool that is distributed among validators and stakers.

Remember the value of the staked coins and tokens may fluctuate due to market conditions. Therefore, it’s crucial to carefully research and evaluate the risks and rewards associated with staking before you start to stake coins.

If you are just starting out trading crypto, you will want to start with staking stablecoins like USDC or Tether, and Ethereum. Then you can look at the risks of staking more exotic coins that exist on the blockchain.

Crypto Wallet and Staking Platforms

-

Converting Fiat Money into Crypto:

- The first thing to do before you can trade crypto.

- Choose a reputable crypto exchange that supports fiat-to-crypto conversions. Some popular exchanges include Coinbase, Binance, Kraken, and Bitstamp.

- Create an account on the chosen exchange and complete the necessary verification process.

- Link your bank account or credit/debit card to the exchange.

- Deposit the desired amount of fiat currency into your exchange account.

- Use the exchange’s interface to buy the desired digital assets with your fiat funds. You are going to buy Ethereum to start.

Transferring Crypto to Metamask:

-

- Install the Metamask wallet extension on your web browser (Chrome or Firefox). Get it here: https://metamask.io/

- Set up a new Metamask wallet by following the on-screen instructions. Make sure to securely store your seed phrase.

- Once your Metamask wallet is set up, copy your wallet address from the extension’s interface.

- Go to your cryptocurrency exchange account and navigate to the withdrawal or send section.

- Enter your Metamask wallet address as the recipient and specify the amount of cryptocurrency you want to transfer.

- Confirm the transaction and wait for it to be processed. The transferred crypto should now appear in your Metamask wallet.

-

Understanding Metamask:

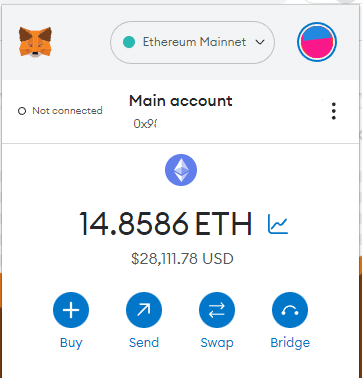

Metamask is a popular cryptocurrency wallet and browser extension that allows you to interact with decentralized applications (DApps) on the Ethereum blockchain.

It provides a secure way to manage your crypto assets, including staking, trading, and interacting with various DeFi protocols. It will be wallet for your staked funds.

Metamask also acts as a gateway to the many blockchains, including Ethereum. The Metamask wallet will enable you to access staking services, keep track of your staked crypto, and sign transactions without sharing your private keys.

While Metamask is automatically configured to use the Ethereum mainnet, we will want to start out staking on the cheaper L2 blockchains such as Arbitrum and Optimism. To learn how to get Metamask to switch between blockchains, check out this Youtube video: https://www.youtube.com/watch?v=84XQAmOZqOY

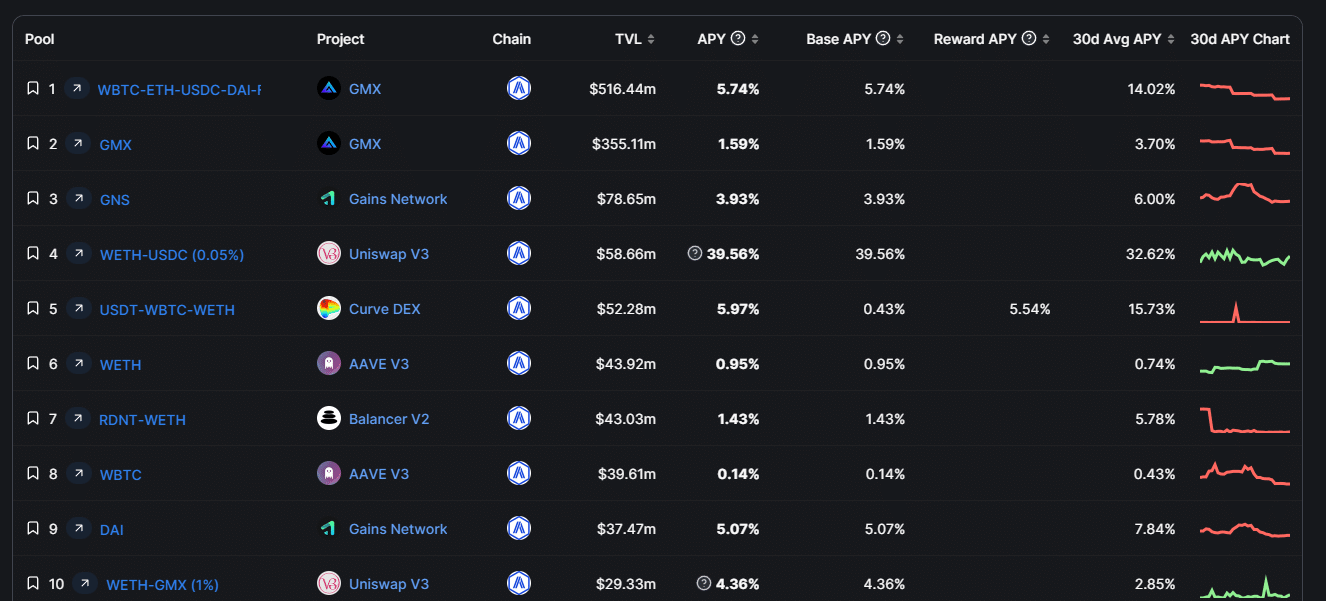

Where to Find Best Staking Yields

After you have set up your Metamask to accept Ethereum and Arbitrum, it’s time to do some research. Below is just a partial list of the websites that offer staking information on various blockchains. You will want to invest direct on the staking platform that is available on these blockchains.

The amount of info is simply overwhelming, but to start we can cut down and just look at the Level 2 protocols such as Optmism, Arbitrum, and Polygon. as transaction fees are quite low on these platforms..

- DeFi Pulse (https://defipulse.com/): Offers an overview of various DeFi protocols, including staking options, total value locked (TVL), and other relevant metrics.

- CoinGecko (https://www.coingecko.com/): Provides market data and information on different cryptocurrencies, including staking pool, token metrics, and community data.

- DefiLlama: https://defillama.com/: A comprehensive DeFi analytics platform that allows you to explore staking options, track your portfolio, and monitor performance.

- StakingRewards (https://www.stakingrewards.com/): Focuses specifically on staking, providing details on available staking coins, rewards, and estimated earnings.

- YieldWatch (https://www.yieldwatch.net/): A platform that specializes in tracking DeFi yield farming and staking opportunities, offering insights into APYs (Annual Percentage Yields) and more.

Getting Start in Crypto Staking

Okay, if you have browsed through any of the above websites, you are probably feeling a bit lost right now. There are so many websites, listing so many blockchain projects, that are asking you for your crypto to stake, that it’s overwhelming.

May I suggest that you start right here: https://defillama.com/yields?chain=Arbitrum

- Arbitrum is a level 2 blockchain that offers a high degree of security, very quick transactions, and most important of all, it’s cheap. You should spend no more than a dollar staking your crypto, and it should cost less than 25 cents to move your crypto around.

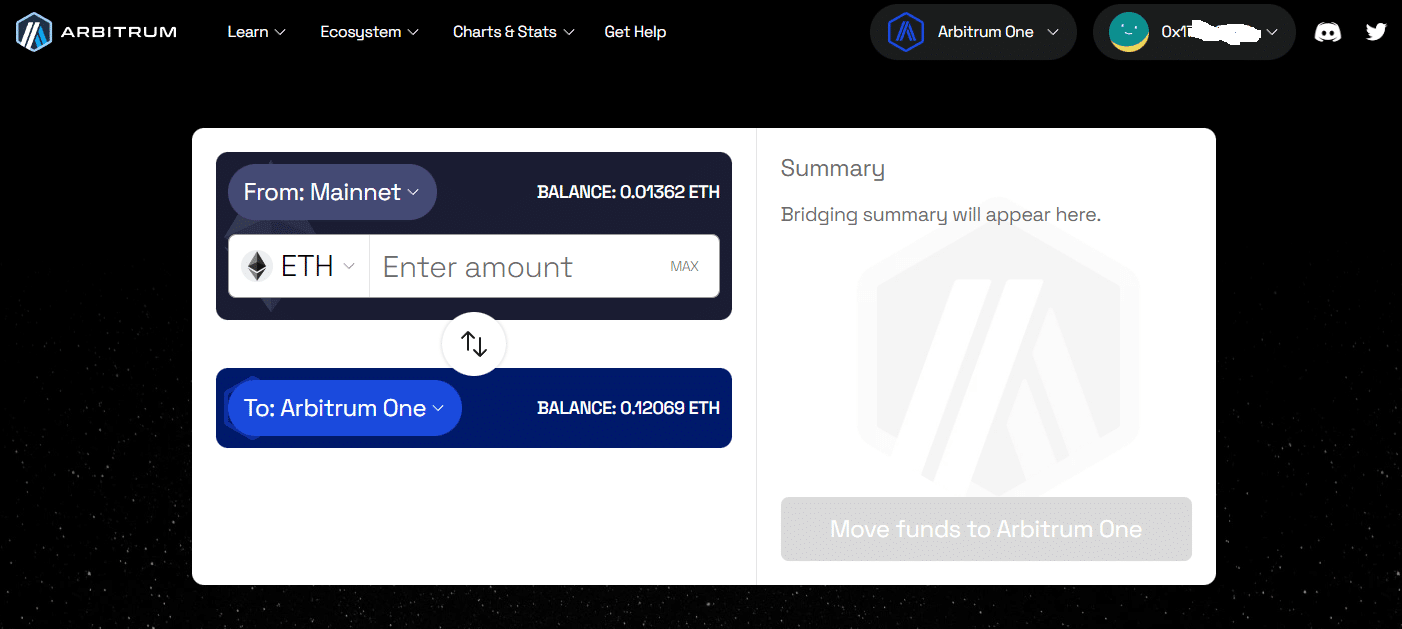

However, by now you have probably noticed, when you switch your Metamask wallet to the Arbitrum blockchain from Ethereum, the Ethereum you have is not available.

How to get the Ethereum over to Arbitrum?

You need to “bridge” the Ethereum between the two blockchains. And you can do this by going here: https://bridge.arbitrum.io/

- It can take up to a half-hour to transfer your Ethereum to the Arbitrum network, but oftentimes it’s less than 10 minutes.

Woo-hoo, now you are ready to start staking crypto and earn passive income!

The example I will give now is only relevant in the month of May, 2023. Things change awfully fast in the world of Defi, so the yields offered below will probably have changed if you are reading this article a few months down the road.

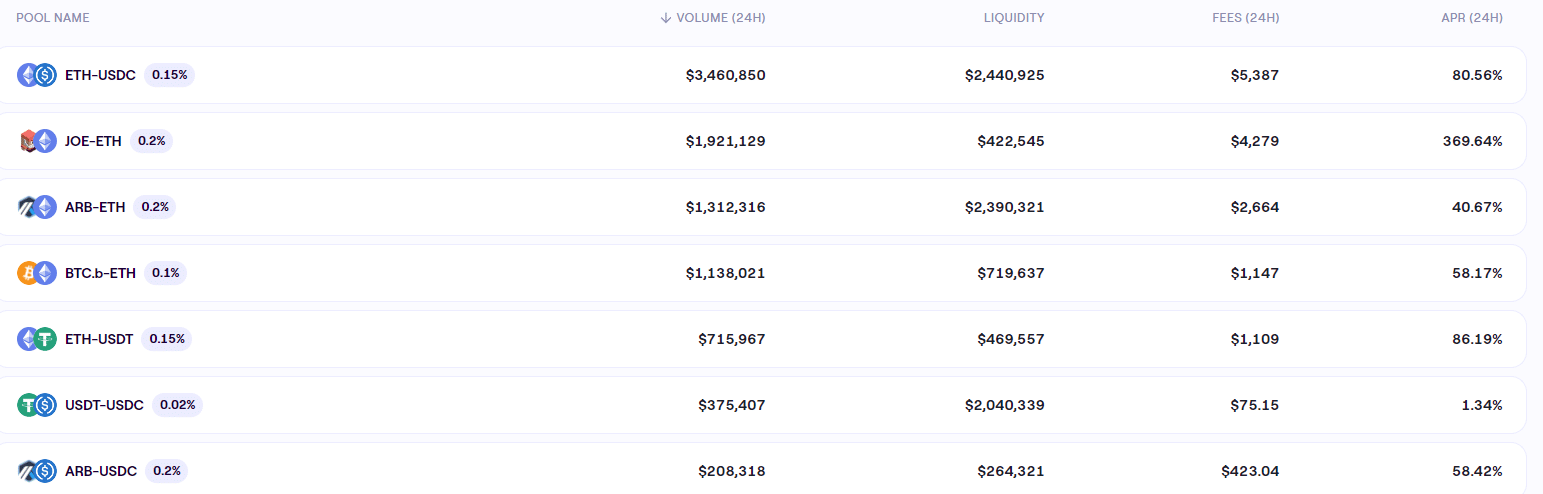

Let’s look at Trader Joe, one of the most popular decentralized exchanges on the Arbitrum network: https://traderjoexyz.com/arbitrum/pool.

Yes, those staking rewards are unbelievable, aren’t they? What’s the catch?

What you are looking at is liquidity pools, which involve staking not one but two coins, as opposed to single-side staking.

It’s inherently more risky because if one coin falls in value compared to the other coin, the pool may fall out of your trading range and you may no longer earn staking rewards.

Having said that, I exclusively yield farm using liquidity pools, as the returns are so much higher.

How Much Passive Income Can You Make From Staking?

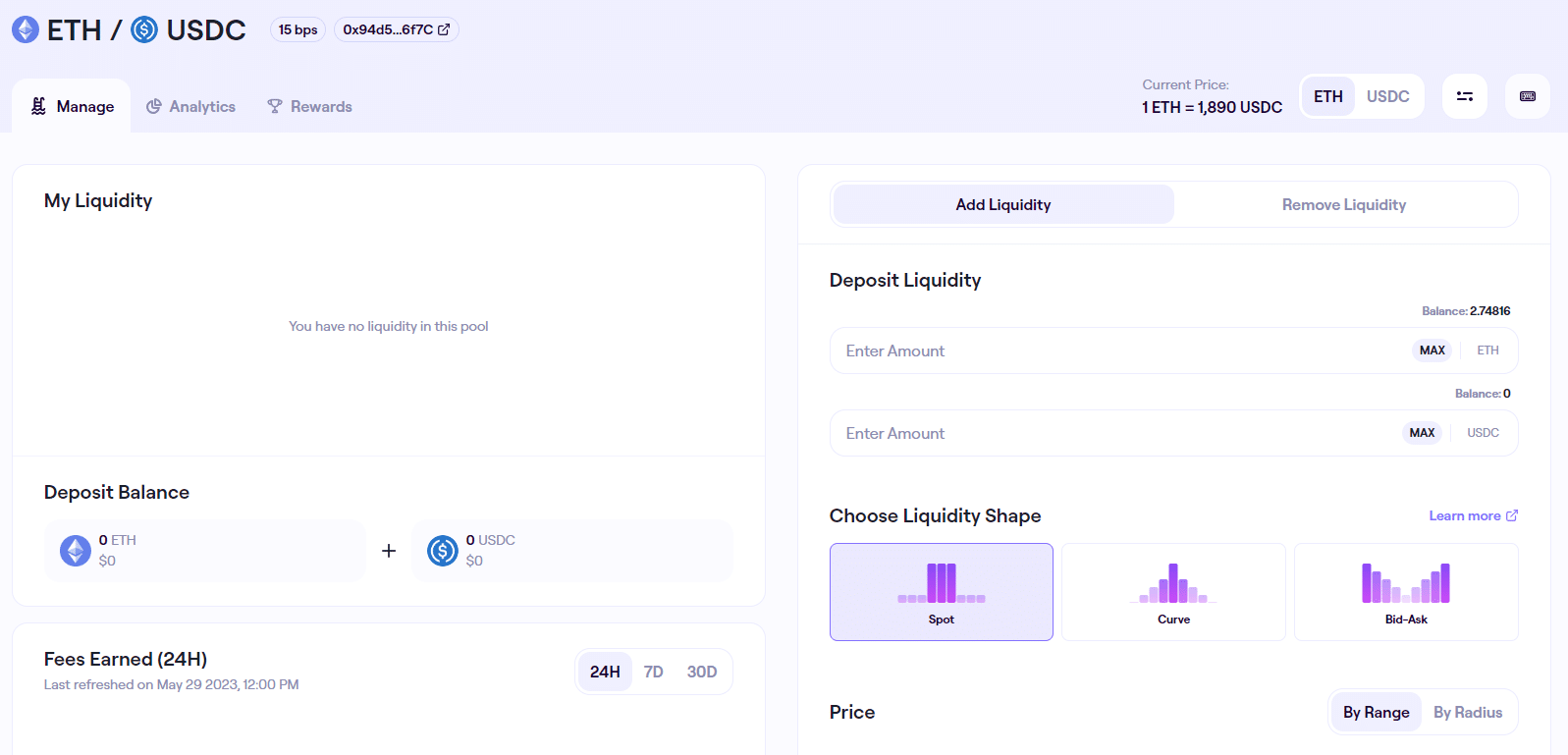

Note that the ETH-USDC trading pair is paying more than 80% per annum. If you want to stake some crypto in that trading pools go here: https://traderjoexyz.com/arbitrum/pool/v21/ETH/0xff970a61a04b1ca14834a43f5de4533ebddb5cc8/15

- Add some Ethereum, add some USDC, and then check every day for your crypto rewards.

Another advantage of liquidity pools is that there is no staking period. Some contracts require you to stake crypto for a set period of time before you earn interest. But with liquidity pools, you don’t have to do that.

Note staking in liquidity pools offers a much higher APR than single-sided staking, where you are only staking one coin or token.

For example, if you decide to just stake Ethereum it’s hard to get an annual yield that’s more than 5%. Same thing with a stablecoin like USDC or Tether.

Now there are some staking platforms that offer a high-yield for USDC like 10% or even 15%, but you should approach those type of platforms with caution. There’s a reason why the APR is so high (because it’s risky).

Is Staking Considered Income? Is it Taxable?

Yes and yes. If you live in America, you should report it as dividend income. In other parts of the world, you need to check with the various laws and regulations in your country. But most countries treat staking rewards as taxable.

Is There a Downside to Staking Crypto?

Like any other investment, staking crypto can be risky and there are numerous ways you can lose money

One risk is counterparty risk. That’s a fancy way of saying the smart contract that is offering the stake is exploited, or “rugged.” That happens a lot, which is why I stick to major staking platforms like Uniswap and Trader Joe.

Another risk is the lure of buying a coin that offers a very high APR when you stake it. But the coin drops in value to such an extent that the staking rewards don’t compensate for the loss in value in the coin. This happens a lot with certain blockchains, like Binance’s BNB network.

- One significant downside to staking crypto is that to get up and running, a traditional investor has to learn a lot of “new stuff.” You just can’t phone your broker and tell him/her to buy this and that stock.

You have to open an account with a centralized exchange, then fund it. That can take days or even weeks. Then you have to install Metamask and configure it for the blockchain you want to operate in.

Finally, you have to figure the ins and outs of whatever staking platform you want to use.

There’s a learning curve that can be quite steep for somebody who is not a techie.

Lastly, people literally lose access to their Metamask wallet, by forgetting to write down their password and seed phrase. Or they store the seed phrase on their desktop and it gets hacked.

Is staking crypto safe? No, absolutely not. But not many investments in the last few years turned to be “safe” either.

So Why Stake? There’s No Better Way to Generate Passive Income

I have been staking for years now. Generally speaking, five percent return on your investment is the absolute lowest you can expect. You can make a lot more.

Like I said earlier, on the Arbitrum blockchain, the Ethereum-USDC pair is paying out 80% per annum.

If you want to buy riskier coins and stake them, then you can easier get more than 100% APR.

In a bear market you can absolutely lose money but the flip side is you can make a killing in a bull market.

And in a flat market, the yield you collect every day can be a welcome addition to your savings account.