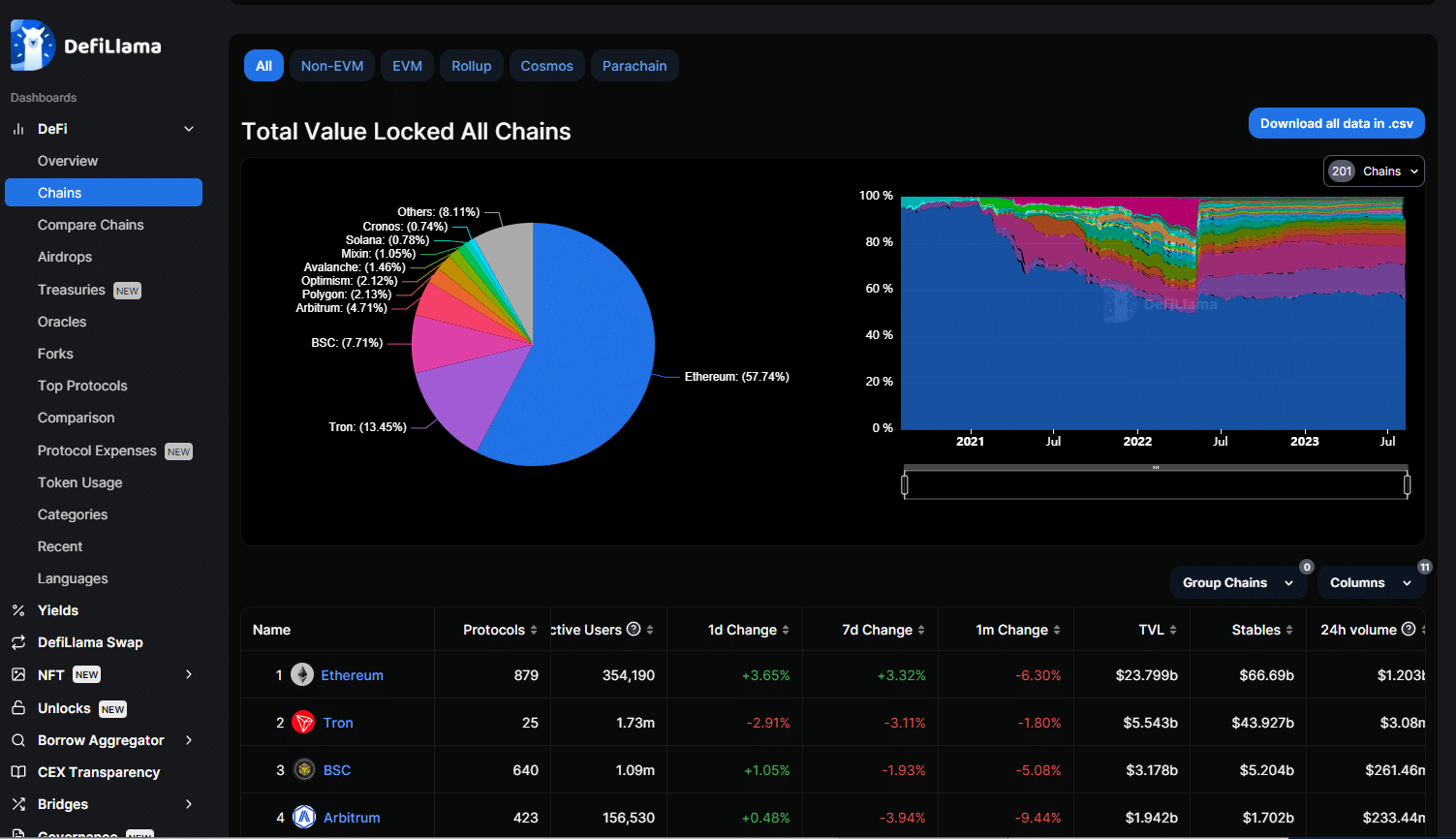

Here is a screen-snap of Defillama, one of the most popular websites for checking out the latest, hottest blockchains in the world of crypto:

Guess how blockchains are listed in Defillama? There are TWO HUNDRED AND ONE (as of August 9th, midday).

That’s not tokens, that’s blockchains. Each blockchain can contain dozens, if not hundreds of individual tokens.

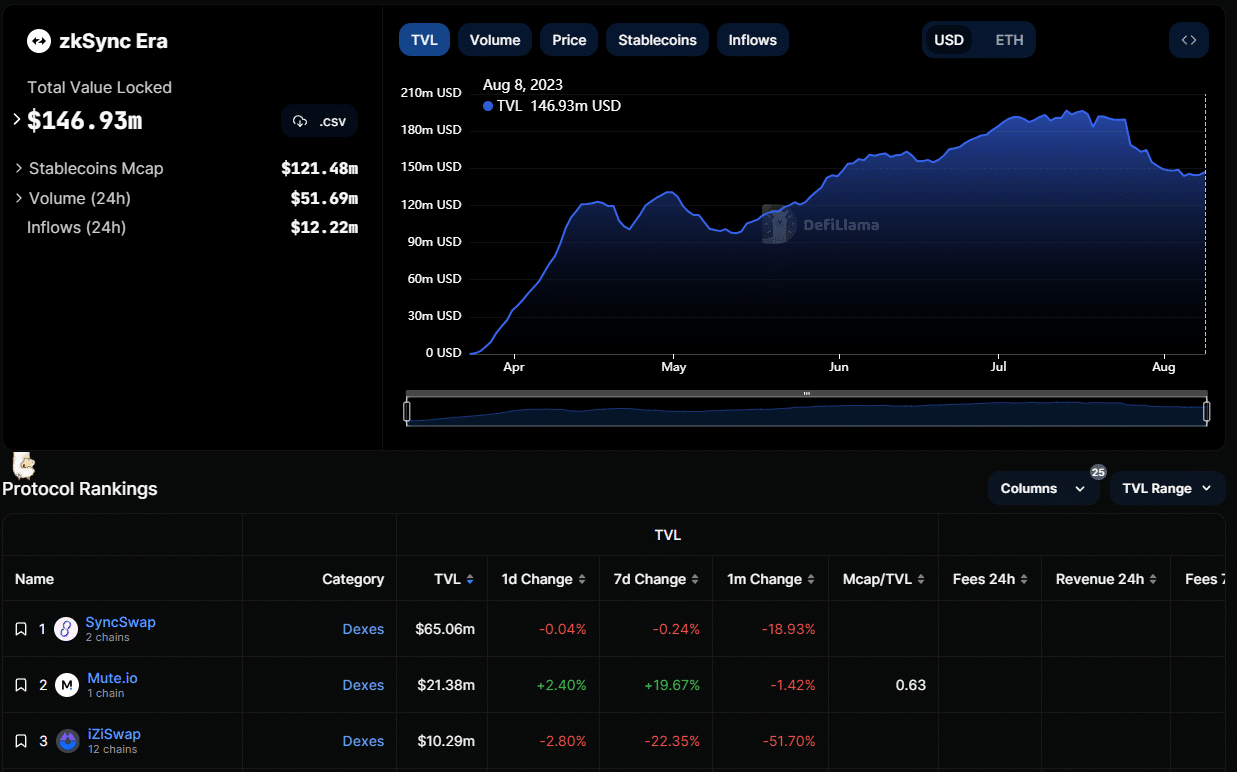

Let’s look at the zkSync Era blockchain. It’s #17 on the list:

On this blockchain, there are SEVENTY-FOUR protocols or applications (DAPPS = distributed applications) running on this blockchain.

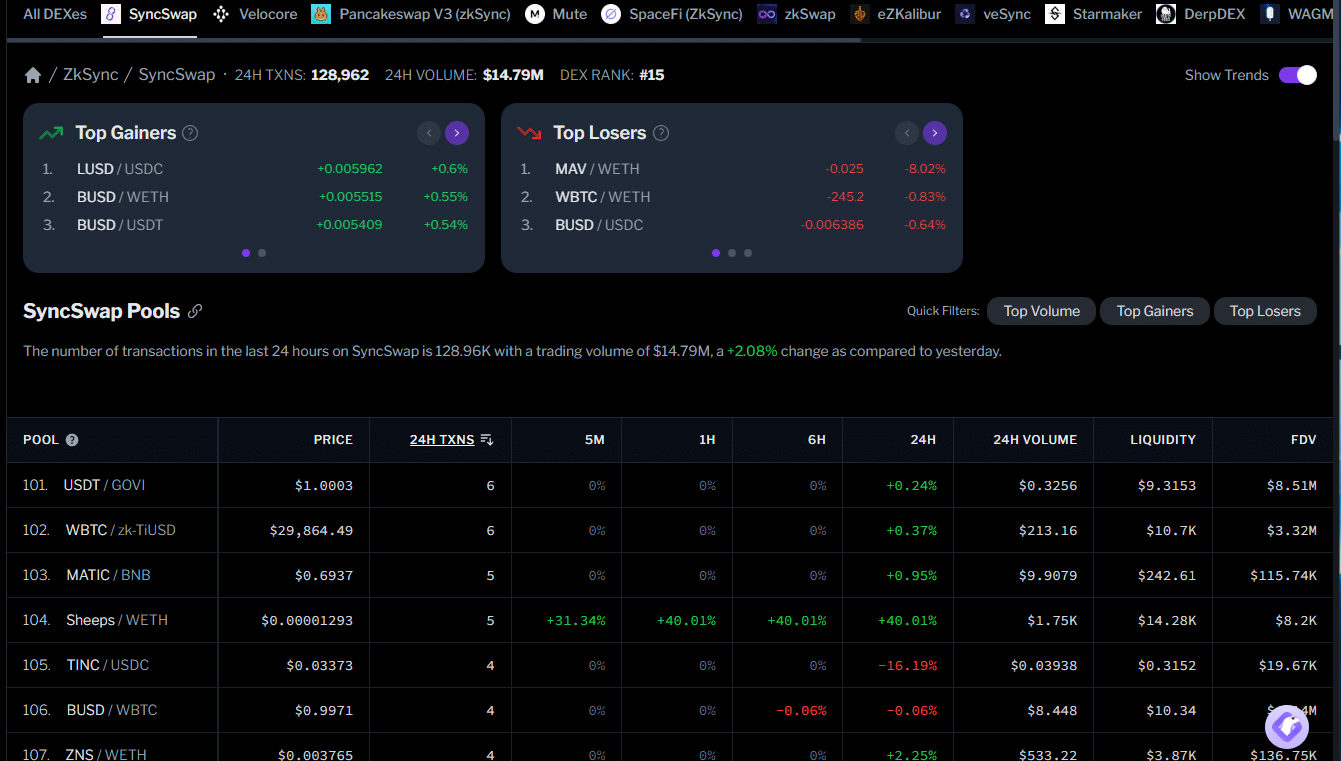

Here is a screen-snap of ONE of those applications, called Syncswap. The screen-snap is taken from geckoterminal, another website that tracks blockchain activity:

Syncswap is what’s called a DEX or decentralized exchange, allowing users to swap one token for another.

There are currently ONE HUNDRED AND FIFTY trading pairs on Syncswap.

Who is Buying This Stuff?

Good question.

It sure isn’t the average retail investor. Not even the average crypto retail investor. Even if you wanted to buy one of these tokens, it’s not easy.

Let’s say, hypothetically, you wanted to buy a token on Syncswap which as we know is on the Zksync Era blockchain.

You will have to open up your Metamask wallet (or install one if you haven’t already), then configure Metamask to operate on that particular blockchain..

Then, “bridge” some tokens to the Zksync blockchain by means of a special website (don’t ask).

And then, after you have “bridged” some tokens like Ethereum, USDC, or Tether, you would open up Syncwap and trade for what token you wanted.

That’s the simple version. I left out some steps.

So it’s not the average retail investor that uses these blockchains.

As a matter of fact, to get anybody to use these blockchains, you have to reward users with “airdrops.”

Here is how it works:

- A venture capitalist team pays for a development team to create a new blockchain (which most of the time is a copy or a “fork” of an existing blockchain).

- The development team creates the blockchain, as well as mint new tokens on that particular blockchain.

- The VCs then need “crypto-influencers” to publicize the new blockchain and get people to participate. And by participating, I mean getting them to “bridge” tokens like Ethereum and USDC to the new blockchain and use some of the DAPPs.

- The “Crypto-influencers” get paid off with new shiny blockchain tokens. Or they buy the shiny token at launch, and then hope to sell the tokens down the road at a much higher price.

- Then, they publicize the new chain saying it’s awesome and if you participate in the “community” then your wallet will get airdropped some shiny new tokens which may or may not be worth something, in the future.

Now this sounds like a scam, but not always. Both the Arbitrum and Optimistic blockchains have done airdrops in the past, and their respective tokens still have value to this day.

I personally received quite a number of Arbitrum tokens and it was a pleasant day when that happened (the coin still trades above $1.15 USD). And I still trade on Arbitrum to this day (it’s cheaper than transacting on Ethereum mainnet).

The problem now is everybody and their Mom is doing it, and most of the new blockchains are virtual clones of existing blockchains.

Fake Armageddon

By the end of the year, at the absolute latest, the game of musical blockchains will stop. Maybe as soon as next month. In my opinion, it’s already getting pretty silly. I can’t keep up with all the new blockchains that are now created at least once a week.

When that happens, expect howls of pain from the usual suspects, the crypto-influencers on Twitter who pump the latest and greatest, as their meal tickets are revoked.

You can also expect a few venture crypto capital firms to be forced to record large losses on their balance sheets, as their self-created blockchain tokens get written down to zero.

There will be negative media coverage. There will be many, many stories about the death of crypto, again.

Meanwhile, the old (and sometimes exasperated) holders of Bitcoin and Ethereum will sit in the shadows and quietly sip our Scotch, and wait.

DJ