Big news this week is the upcoming Bitcoin Cash hard fork, scheduled for November 15th.

A hard fork occurs when two separate development teams can’t agree on how to move forward with coding enhancements, and decide to go separate ways.

Two different code bases: two different coins. It’s a coin split.

Hard forks are more common than you think. Ethereum forked a couple of years ago (Ethereum/Ethereum Classic). Bitcoin cash itself is a fork off bitcoin in August of 2017.

And now Bitcoin Cash is splitting in tow.

That means wild price gyrations, as the holders of Bitcoin Cash will be holding two coins a few days from now.

If history repeats itself, the two coins together will be worth more than one coin of Bitcoin Cash today.

Ironically, even though a hard fork signifies developer in-fighting (which is bad), it’s usually a good sign for the coin price.

At the beginning of November, Bitcoin Cash was trading at $411 and today it’s trading at $536, a nice 23% jump in less than two weeks.

How Traders Are Profiting

On the assumption that two coins will be worth more than one, traders are borrowing on margin on the major exchanges and buying up as much Bitcoin Cash as they can.

To cover their exposure, they have been shorting Bitcoin Cash futures.

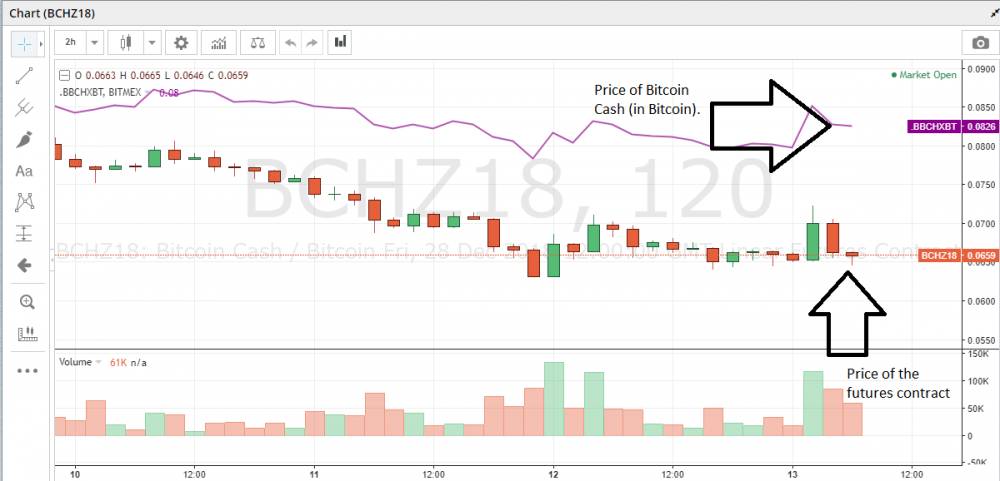

Evidence of this is show by the spread in Bitmex’s Bitcoin Cash futures contract set to expire on December 28th, 2018. It has gone into backwardation:

Backwardation is the market condition wherein the price of a commodities’ forward or futures contract is trading below the expected spot price at contract maturity.

In this case, the future contract price is 20% below the spot price.

That sets up an interesting counter-trade.

A trader who goes long on the Bitmex Bitcoin Cash futures contract is guaranteed a 20% return on investment by December 28th.

Remember that on the day of settlement, the spot price and the price of the futures contract are the same.

The only problem is that the trader is exposed to the price of Bitcoin Cash, which we know is extremely volatile.

Therefore, to reduce exposure, the trader must find an exchange where he or she can short Bitcoin Cash, and only Bitcoin Cash.

That is to say, the trader must find an exchange that is not supporting the Bitcoin Cash hard fork, i.e. will not pay out its member two coins after the split.

If the trader can’t find an exchange willing to do this, then the next best thing is to find a Bitcoin Cash futures contract on another exchange where the price is not in backwardation.

In any case, that’s what I’m doing. The counter-trade is too tempting to ignore. I will let you know how it turns out in a week or so.

DJ

Editor’s Note: Well that was quick. Three hours after placing my trade, I was stopped out. Volatility went through the roof. Maybe next time.