Bitcoin pops above $5000 and many in the crypto community are preparing their happy dances and calling for $10,000 in no time flat.

I am all for singing Hallelujah, but before we all jump on the bandwagon, let’s take a look backwards and ask ourselves one very important question.

Why did Bitcoin crash in 2018? And if it pumps up again, will it crash again?

There is an answer to that first question: In 2018, there were more sellers than buyers. (Okay, that’s not very helpful).

A better question: Who, in 2018, who was selling bitcoin?

A clue is given in this picture below:

That is from the front page of Coindesk, and it’s yet another story about a promoter using funds from an ICO for their own personal benefit.

In this case, the ICO for Etherparty raised about $30 million CAD. Where did the money go?

It looks like at least some of the money did not go to paying the salary of software developers:

“..the court papers go on to allege that Hobbs and Cheng “acquired sudden and substantial personal wealth” around the time of the ICO, purchasing two condominiums – the one in Vancouver, another in Toronto – for about $3 million each and the two Land Rovers, and leasing a Lamborghini worth $375,000 for a three-year term.”

It doesn’t a take genius to figure that the ICO craze was both incredibly inflationary and then deflationary to the cryptocurrency ecosystem.

Inflationary as investors poured money into ICOs via Bitcoin and Ethereum.

Deflationary as the management teams and promoter cashed out the Bitcoin and Ethereum, sometimes to fund development teams but obviously, in some cases, for personal gain.

But can we put a number on the inflow and outflow?

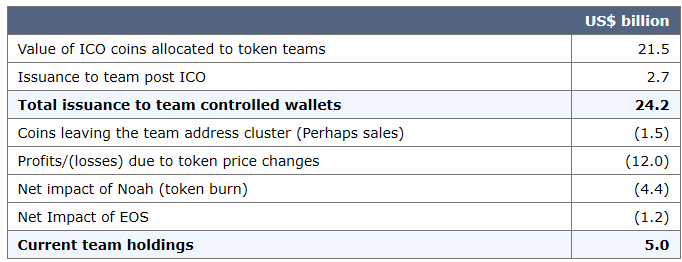

Well, according to the Bitmex Research team, we can come with some ballpark-numbers.

Having said that, we must work with the data we are given and make some assumptions.

One strong assumption to make is that token buys and sells strongly influenced the transaction volume of bitcoin during 2017 and 2018. How do I know that?

Well, there are two types of cryptocurrency exchanges in the world: exchanges that allow the account to be funded with fiat money (i.e. US dollars) and exchanges where the account can only be funded with bitcoin (or some other crypto-coin).

The vast majority of exchanges that could only be funded with bitcoin, were the only exchanges that listed ICO tokens. That is to say, exchanges like, Yobits, Kucoin, and Bittrex, can only be funded with Bitcoin.

Simply put, to buy these tokens (unless you participated in the initial ICO) you needed to buy (and sell) bitcoin at some point in time.

The reverse is true as well. The Bitmex reports shows $1.5 billion leaving team addresses.

Where did that money go?

The tokens, to be sold, must have been converted into either bitcoin or Ethereum at some point, and then converted to fiat.

Now, at this point, maybe you are thinking, how can $1.5 billion US leaving the market (at least) cause Bitcoin (and Ethereum) to crash so hard?

As I have pointed in a previous story, there is not a lot of bitcoin that is free-trading. There is at most only 1 million bitcoin that is available to buy or sell, or about $5 billion worth.

Was the ending of the ICO craze wholly responsible for the crypto-crash?

No, there was also fiat outflow to pay for mining rigs from Bitmain. We know that in the first half of 2018, Bitmain sold about $2.8 billion worth of mining rigs.

A Craze is Not a Craze if Value is Created

With bitcoin soaring, everybody is getting excited again.

Expect to the ICO hype machine start up again. Expect Bitmain to sell more miners. And there is nothing wrong with that if something of value is created.

The unforgivable sin of the Vanbex promoters was not renting a Lamborghini. Vancouver is my hometown, I see Lambos everywhere.

Their unforgivable sin was to flaunt their wealth while not creating wealth for their investors.

Have any of the 2017/2018 ICOs launched ANY products that are at least out of beta? Who made money beside the promoters and the developments? The answer is very few.

Where are the Amazons, Facebooks and Ubers of the cryptocurrency world, the 100-baggers that justify the investing in one or two dozen flops?

For the next boom to be sustainable, we need to see some winners.

If it’s the same as before, a bunch of ICOs being peddled with no chance of success then expect another crash after the boom.

Hopefully the quality of upcoming ICOs is better by an order of magnitude. Let’s pray the average cryptocurrency investor is much choosier this time.

At present, go out and buy some bitcoin. But if you see a doubling of Lamborghinis on the streets of Vancouver in the next year or so, that could be a signal to sell (again).

DJ

Editor’s note:

Coinsquare, Canada’s largest crypto-exchange, has waived deposit fees for this money. It doesn’t get any cheaper than zero. If you want to sign up for an account, click here.