I bought some Hut 8 Mining Corp. (HUT-TSXV) earlier this week at $1.11. It’s a bitcoin mining operation with facilities based in Alberta, Canada.

There are two reasons why I bought the stock. But before I get into that, let’s go over the negatives (and there are a lot of them).

First, the balance sheets of any bitcoin mining operation at present are a mess.

Very few made money in the last quarter of 2018, and I doubt that the first quarter of 2019 will show any profit for any company.

Second, as noted in this story I wrote last February, Canadian financial auditors hate cryptocurrency public companies.

I have been told that there are now only auditing three firms in all of Canada who are willing to take on any cryptocurrency clients.

Third, since the Quadriga CX fiasco, Canadian securities regulators now hate cryptocurrency public companies.

Last week I spoke with multiple sources, both in the public crypto space and one securities regulator who all said, off-the-record, that there is zero chance of new cryptocurrency listings on the Toronto Venture Exchange in the future.

And the current public crypto listings? The securities people don’t know what to do with them, but they wish they would drop off the face of the earth.

Did I forget to mention the environmentalists? Already I am seeing stories about the wasteful energy consumption of bitcoin miners and how mining is sucking up most of the world’s electricity (Not true, but debunking those assertions will be done in another story).

Everybody hates the miners, except for me. I have two reasons why.

The first is the price of Bitcoin. It’s now above $5000 USD or almost $7000 CAD.

Most if not all miners that managed to stay in business were break-even when the price of bitcoin was just under $4000. Industry-wide, all-in costs are about 7 cents per kilowatt. The very best miners have all-in costs of 5 cents a kilowatt.

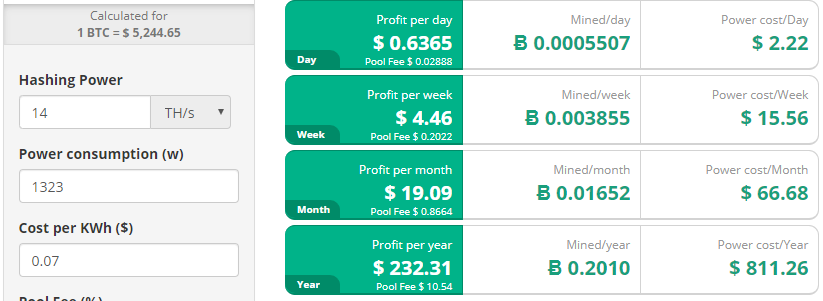

Using the online bitcoin mining calculator, we can calculate the current cash flow of the average industrial bitcoin mining operation.

Those figures are for miners using the Antminer S9, the workhorse of the industry.

A simple calculation shows that cash flow per megawatt should be $481 per day or $175,600 per year (US dollars).

Hut 8 has a market cap of just over $110 million CAD with 90 megawatts of mining capacity.

Cash flow (if costs are the same as most of the industry) should be about $20 million CAD per annum.

Not bad but not fabulous either if you take into account the volatility of the industry, especially with regard to the ever-changing bitcoin mining difficulty algorithm.

But this is the interesting part:

Right now to produce about $1000 worth of bitcoin, it costs the miners a little more than $800 in electricity and other costs. Therefore, they are making about $200 in profit.

But if the mining difficulty does not increase, that $800 is a fixed cost. Meaning, if bitcoin goes to $6000 or $7000, the additional increase is pure profit.

The multi-million dollar question is how much will mining difficulty go up in the next few quarters?

And the answer brings me to the second reason why I bought some Hut 8:

https://www.ccn.com/chinas-

I would say that Chinese regulators hate bitcoin miners just as much as the Canadian regulators.

If bitcoin goes to $10,000, the mining difficulty should go up, otherwise it becomes insanely profitable to mine bitcoin.

However, the two countries in the world (Canada and China) with the most surplus electricity are pretty much dead set against any more bitcoin mining.

I honestly don’t know what’s going to happen in the next few months. But I am willing to invest again and find out.

DJ

Editors Note: If you are interested in reading more about public bitcoin mining companies, may I suggest an article I wrote a few months earlier: What if they don’t go bankrupt? Also, don’t forget to read my article on the auditing crisis.

Nothing that I write should be construed as advice about investing in stocks