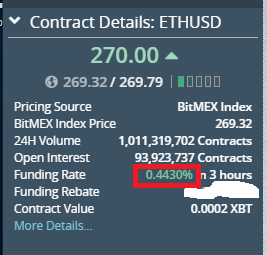

The funding rate for the ETHUSD contract on Bitmex yesterday is 0.443% for one eight-hour period on May 16th, 2019.

There is so much demand for Ethereum futures that traders willing to short the contract i.e. meet demand, will be compensated almost a half-percent for covering the longs for just eight hours.

If you take that number and times It by three (24 hours in a day), then times it by days in a year (365), that works out to a per annum return of 485%.

But that’s if you don’t use any leverage.

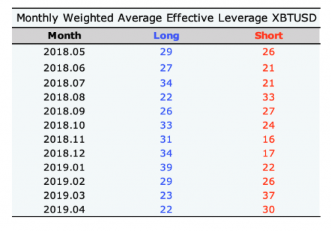

Can we find out how much leverage is used by the average Bitmex trader? Yes.

That data is helpfully supplied by the Bitmex Research Blog.

As you can see from the chart, the average Bitmex trader uses about 27x leverage.

Multiply 0.443% by 27, and you get a very nice return of 11.96% return on your investment for one eight-hour period. The annualized return is an absurd 13,096%.

An explanation for those readers who have not been following my newsletter for a while.

The ETHUSD futures contract is a perpetual contract, meaning it has no settlement date. Therefore, to maintain equilibrium (one buyer for every seller), there is a redistribution of funds every eight hours.

If there are more buyers than sellers, then the shorts get paid out. If there are more sellers than buyers, then the longs get paid out.

This payout is called the funding rate.

How often are there payouts of this magnitude? This 0.443% funding is the largest I have ever seen.

But during the month of May, there have been many payouts well north of 0.1%.

One-tenth of a percent doesn’t sound like much until you multiply it by three and then by 365. Then it’s a 109.5% annual return unleveraged.

And nobody trades unleveraged futures on Bitmex, including myself.

The best part about this trading is that it’s possible to hedge, meaning a trader can offset the risk of sudden price increase or declines in the futures contract.

Traders who hedge are just in the market for the funding payouts and are making extremely good returns on their investments, with very little risk.

Like me. Right now.

DJ