Time for a sanity check.

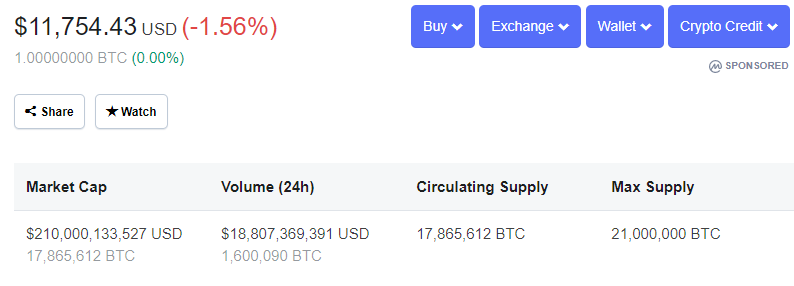

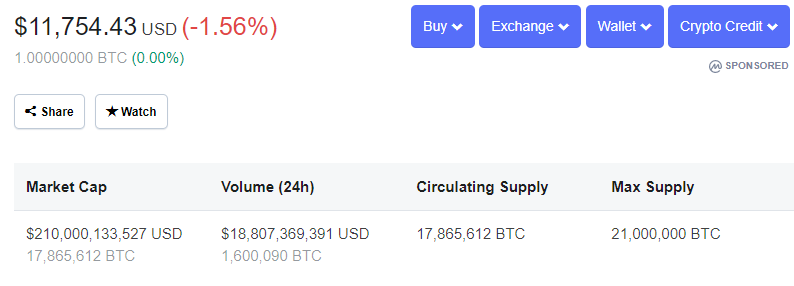

With Bitcoin above $11 K USD (at least for now), market cap is $210 billion.

Let’s compare bitcoin with other world currencies:

1. The M1 supply of Canada’s currency was $777 billion USD in May 2019.

2. M1 supply of Singapore was $137.5 billion in the same month.

3. M1 supply of Japan, second-largest economy in the world: $7.42 trillion.

4. And finally, the biggest fish in the pond: The M1 supply of the United States of America is estimated to be $3.8 trillion dollars In June of 2019

(I found it interesting that Japan has a higher M1 money supply than the US)

If Bitcoin were to increase in value ten times from today, it would have a market cap of $1.85 trillion.

That is less than triple the money supply of Canada and less than half the money supply of the US.

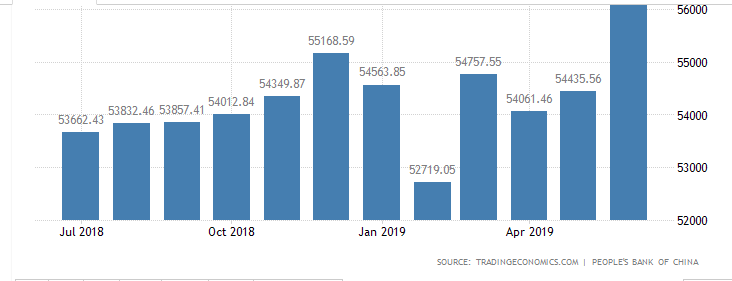

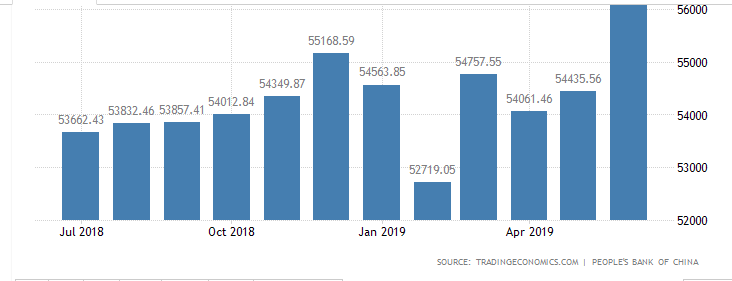

But as there seems to be some inverse correlation between the price of China’s currency and bitcoin (As it declines, the price of bitcoin goes up), let’s look at the M1 supply of the yuan:

If the price of bitcoin were to quadruple, the sum total value of bitcoin in the world would be greater than the M1 supply of Canada, but still far less than the M1 supply of countries like the US, China, and Japan.

But bitcoin at $100,000 would give it a market cap of $2.1 trillion, roughly a quarter of the M1 supply of China and Japan, and more than half the M1 supply of US dollars.

That seems optimistic, considering at present that bitcoin is by no means an accepted world currency.

Another metric is we can use is the sum value of popular precious metals in the world i.e. those rare metals used as a store of value:

For silver, at beginning of 2016, there were

2.3 billion ounces available for purchase (i.e. excluding silver in landfills). With silver at costing $16.95 per ounce, there is only $39 billion worth of silver in the world.

In 2015, it was estimated there is

2.69 million ounces of platinum in global inventory. With platinum now cheaper than gold at $869 per ounce, there is only $2.33 billion worth of platinum in the world.

With gold it’s a different story. It is estimated that

$7.5 trillion USD of gold has been mined since the beginning of history, or slightly greater than the M1 supply of the yen and slightly less than the M1 supply of the yuan.

If bitcoin were to have the same market cap of gold (and the M1 supply of the yen and the yuan), that would give it a value of $360-$390K.

I would argue that’s the ceiling, at least for the next ten years.

But I would also argue that surpassing the M1 supply of Canada in market cap is eminently reasonable in the next year or so. That would mean a bitcoin price of about $40,000 USD, or $800 billion USD.

In conclusion, a fast move to $100K bitcoin is possible given the manias of the past but any move past $50K would be very vulnerable to a pull-back.

DJ

P.S. Quick note about the price of bitcoin this month. Historically, August has been very volatile. From August 2011 to 2018, here are the price fluctuations: -57%,4%,33%,-20%,-19%,-6%,81%,-5%. Hold on to your hats, it could get interesting.