The New Currency Frontier newsletter exists solely for analyzing cryptocurrency ventures that have potential to generate outsized investments returns.

This year, to the point of tedium, we have been banging the drum on bitcoin and bitcoin mining stocks.

If 200% plus returns don’t excite you, then reading the newsletter has been a chore for my readers in 2019.

If you want entertainment, book a ticket to Cirque du Soleil.

But today we make an exception. Let’s talk about Overstock (OSTK).

Should you consider buying this company?

There a lot of positives about this stock but the CEO is not of them.

His name is Patrick Byrne. Last Monday, he confessed to bedding Maria Butina, Russian woman in jail for failing to register with the US to work as a foreign agent.

“In fact,” Byrne said. “I am the notorious ‘missing Chapter 1’ of the Russian investigation.”

Byrne also claims that in 2015 he “assisted in what are now known as the Clinton investigation and the Russian investigation.”

It just doesn’t get any more crazy than that (Okay, John McAfee is the king of crazy, but he is not a CEO anymore).

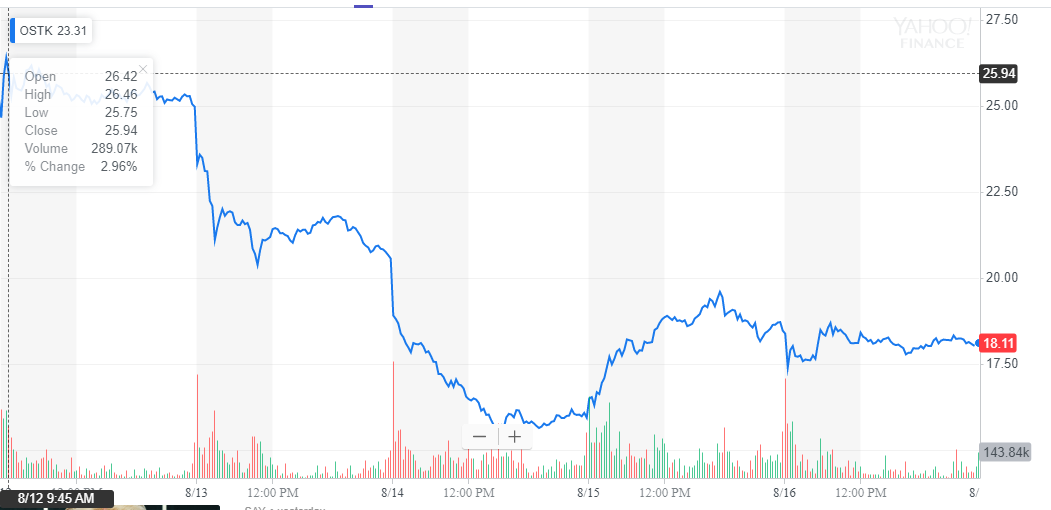

Here is the five-day chart of Overstock:

A drop from $26 to $16 in less than 48 hours is nearly 40%.

Today it has rebounded 21%.

And people call me a gambler for buying bitcoin.

Reasons to Love Overstock

Summary of bad news: the CEO is a wingnut.

But here is the good news: the fundamentals of the stock are very solid with huge upside in the Tzero subsidiary.

First let’s talk about the stock. It’s oversold, way oversold:

According to shortsqueeze.com, there 14,736,000 shares sold short. There are only 24,240,000 shares of Overstock in total.

There are a lot of people who think Overstock is going to zero (or at least drop below $10).

However, there are a few analyst who disagree. One of them is Keith Schaefer, publisher of Investing Whisperer (our sister publication) who has put out a few reports on Overstock.

Schaefer thought Overstock another good quarter with e-commerce business showing improvement and the blockchain initiatives continuing to move forward.

Overstock is a story of two businesses: a struggling e-commerce and a number of blockchain companies looking to disrupt a number of verticals.

Starting with e-commerce, Overstock put together a solid quarter.

Contribution margin, which is gross margin less sales and marketing expense, was $38 million in the quarter, which is a marked improvement over -$3 million in the second quarter of last year.

Gross margins of e-comm were steady at 19.7% as were contribution margins at 10.3%.

So the second quarter was good, but that was pretty much expected. What was not expected, or at least not fully understood, was just how good things are expected to get in the coming quarters.

Overstock provided the following slide that implied third and fourth quarter guidance:

Overstock is expecting fourth-quarter monthly retail contribution margin of $16 million. That works out to $48 million for the quarter. I have to go back to the fourth quarter of 2016 to find a stronger fourth quarter

The fourth quarter of 2016 was in fact the best fourth quarter in Overstock’s history with contribution margin of $53 million.

It looks like the turnaround is well along.

On the blockchain side, tZero is making lots of progress. The app is available for use, they are integrating additional broker-dealers on the platform, have launched the OSTKO token as a second security on the platform and are in discussions with other potential token issuers.

There were further updates on other blockchain initiatives. The most interesting were the updates on Medici Land Governance (MLG)and Bitt.

MLG uses the blockchain to record and track land ownership in countries where land titles are not well defined. With clear land ownership, citizens have better access to loans and banking because they have collateral.

MLG finished their first titling project in Zambia and that went well enough to initiate a second phase around Zambia’s capital city of Lusaka. A second project will be started in Liberia. The company also finished up a land titling project in Wyoming.

Bitt is focused on creating digital currency. But this isn’t Bitcoin. These are national currencies that have been digitized and put on the blockchain.

Think of a digital wallet that holds your Canadian dollars. Bitt has put together and launched a digital currency product in Barbados. Just this week they passed through the regulatory review of the Barbados Central Bank. People of Barbados can access digital wallets where they can use the currency held to pay for purchases, make transfers to family, all the sort of things you’d do with the cash in your pocket.

The revenue from these projects, as with many other blockchain initiatives, are small to nil right now.

But you can see how these businesses could really grow into something significant as the technology takes hold and begins to disrupt.

In summary Overstock is a turnaround story with a huge short but also exposure to blockchain. Lots of analysts like the story and have been buying it.

But wow, that CEO…

Do I own any? No, not yet. But I confess I look at it every week, and could change my mind at anytime.

DJ

P.S. Obviously this article should not be construed as advice on investing but for entertainment only