Regular readers of my newsletter know I never indulge in buying or selling Bitcoin futures without covering my positions, or “hedging” so to speak.

It’s an iron-clad rule I never break. Never ever buy a futures contract without covering position. Never put yourself in a position to lose money.

Except for yesterday. I broke the rule.

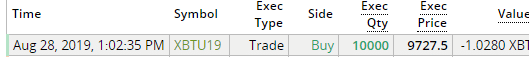

I went long on Bitcoin:

I am showing you the trade because I don’t want you to think I bet big. It’s only one bitcoin.

This is for amusement purposes only.

But here is what happened to make me break my ironclad rule.

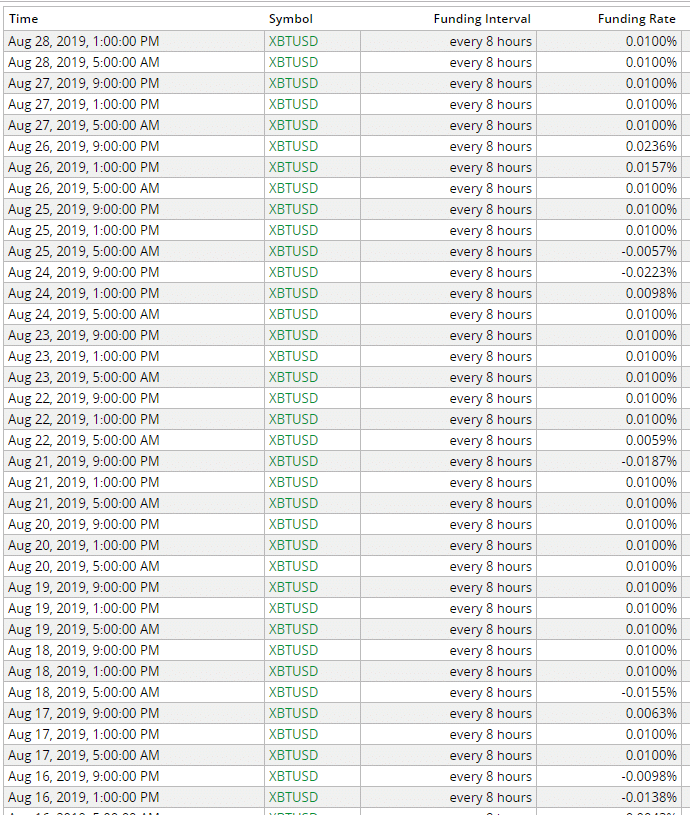

First off, the volatility in crypto has been exceptionally low for the last two weeks. Here is the funding rate for the Bitmex XBT/USD contract since August 14th.

This is one of the most boring spreadsheets you will ever see. The funding rate for XBTUSD contract has been essentially flat for the last two weeks.

That implies volatility is dead. But like the parrot in the old Monty Python sketch, it’s not dead, it’s just resting.

Low volatility frustrates speculators as they make money off swings in price. In such periods of tranquility, the best option is to go on vacation.

But many speculators are young and impatient and that leads to their downfall.

Those who don’t head for the beach need to increase their leverage to make the same amount of profit (or losses) that came so easily in the happy months of March to June.

Thus, Bitcoin price stability leads to instability, as highly leveraged futures buying attracts the sharks.

Because the speculators are leveraged so highly, they are vulnerable to a price drop below $10K.

But before we wait for the inevitable to happen, we need to check one more data point that confirms the trap is baited and ready to spring:

This is chart of the short interest on bitcoin on the crypto exchange Bitfinex, the exchange most favoured by trading “whales” when they want to move the price of bitcoin.

You will notice that short interest is at a six-month low. That implies, again, a lack of volatility.

Or it could imply that the shorts have lots of ammunition to drive the price of bitcoin down.

In any case, on August 28th, at 6:00 pm Coordinated Universal Time (UTC) the Bitmex XBTUSD contract took a dump from just over $10200 to a low of $9500 in less than 10 minutes.

The result: more than $150 million in forced liquidations:

Now What Happens?

Bitcoin options on Deribit are due to expire on August 30th, or two days from now, giving more incentive for traders to drive down (or up) the price of bitcoin.

Volatility always returns to the price of bitcoin at the end of the month. But which way?

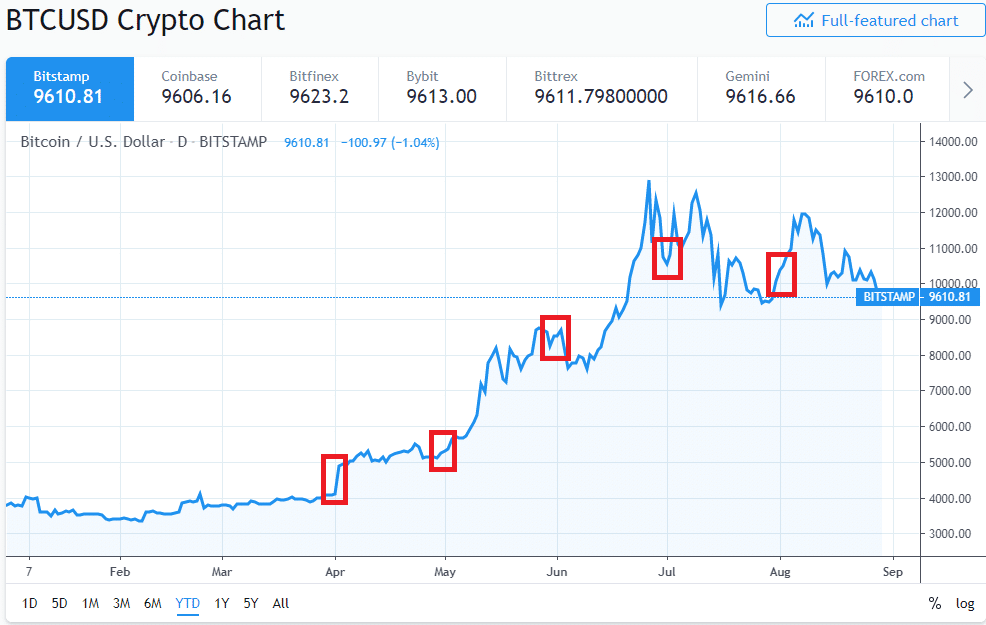

Remarkably, for the last five months, Bitcoin has ended and started the month on an upswing:

But we are not at the end of the month yet, which means we could easily see a run overnight to drive bitcoin below $9500 to catch the last of the over-leveraged longs.

However, I am obviously betting a quick return to $10K for bitcoin in less than a week.

If not, that’s fine as I have tons of leverage and one bitcoin wagered is not enough to keep me up at night.

I would have to see the price of bitcoin drop to $8K before I am stopped out. If that happens I will be sad, but only because my bitcoin mining stocks will be dumping hard as well.

In the meantime, let’s see how this trade works out. (Late Thursday evening on the west coast of Canada and I am going to bed)

DJ