Slowly but surely, American retail investors are getting banned from most cryptocurrency exchanges in the world.

A partial list of exchanges that have banned Americans would include:

1. Bitfinex

2. Binance

3. Poloniex

4. Bitmex

In the last six months, both Binance and Poloniex kicked out its US customers.

In the past, loose KYC (know-your-customers) registration policies allowed Bitmex and Bitfinex to service customers from the US, but new policies, such as IP and identity checks, has made it very difficult for a US resident to get an account.

The list of (major) exchanges where US investors can trade is quite small: Only Coinbase, Kraken, and the US subsidiary of Bitstamp have licenses that allow them to service US customers.

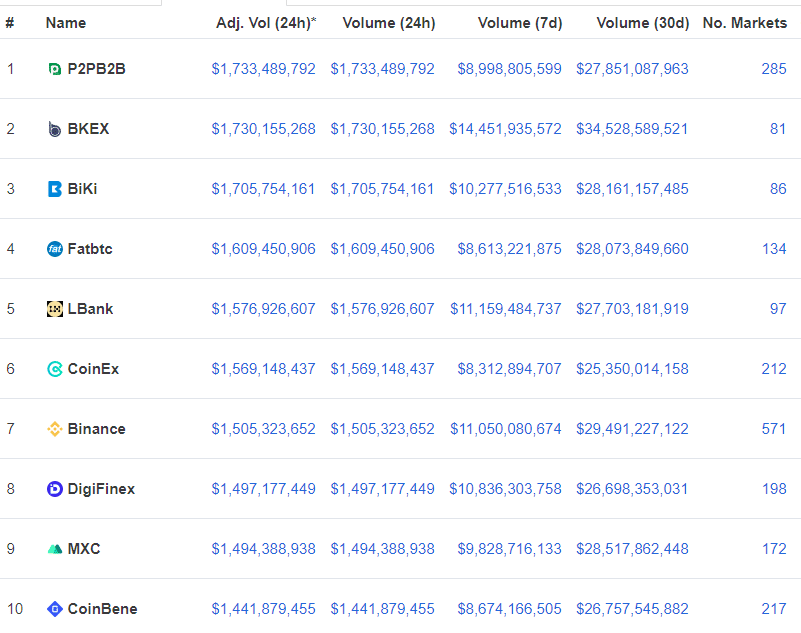

But it’s even worse than that. Let’s look at the top ten crypto exchanges by volume, according to coinmarketcap.

None of these exchanges will service US customers. Why is that?

First you need a license from the state of New York to offer cryptocurrency trading services. As the state of New York goes, so goes the rest of the US.

It’s not impossible to get the license. Coinbase, Kraken, and Bitstamp all have one.

But the conditions of the license that made most exchanges take a hard pass and decide to just ban US customers.

Because if you want US customers, then you CANNOT:

- Offer derivatives, i.e. options or futures contracts

- Offer tokens that could be construed as security offerings.

- Anything funky, like a LEO coin. (A LEO coin is usually offered by an exchange with the implicit promise of buy-backs, i.e. the “burning of coins,” with profits from the trading house).

Why are US financial regulators forcing the exchanges to ban US residents?

The short answer is that most of the exchanges are not really offering crypto-coins (digital coins with some sort of functionality) but are really operating as pseudo-securities exchanges.

And there is no way to sugar-coat the words that describe these tokens. Most of them are crap and are only on the exchange because they paid a listing fee.

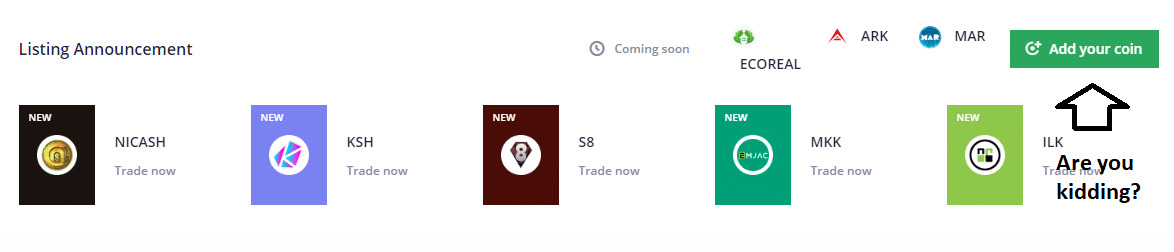

Here is what is on the front page of P2PB2B.

Notice the red button on the far-right hand side? It’s the wildest fantasy of any penny stock promoter come true, and the SEC’s worst nightmare.

Anybody can list a “coin” in exchange for a listing fee.

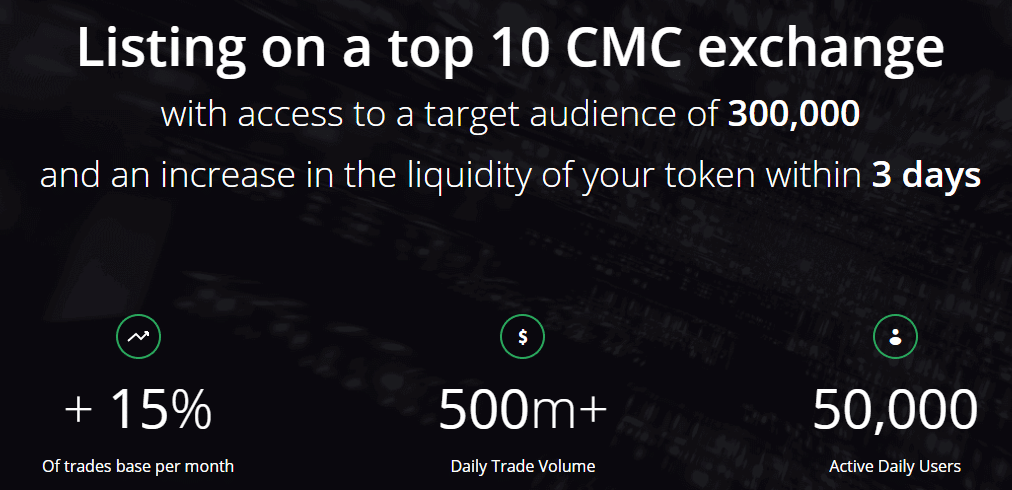

But wait, it gets better. Click on that button and see the next page:

Woohoo, pump and dump away!

Never mind that nasty paperwork and expensive legal fees to list your company on a North American stock exchange, when you don’t even need a company with real assets to list on P2PB2B!

All you need is a good story, and sometimes not even that.

On the Other Hand

US financial regulators are banning US citizens from these exchanges because they don’t want to deal with the screams of pain when the average retail investor gets burned buying the latest “coin du jour.”

The investigative division of the SEC is already working overtime trying to bust the scam operators of the 2017 ICO mania.

But not exchanges are fronts for listing scammy coins.

Some of the oversea exchanges offer features that are a must-have for the serious cryptocurrency investors.

If you want to speculate on bitcoin or Ethereum by going long or shorting, then an account with Bitfinex is an absolute must-have. Why is that?

Because the lending rates for crypto-coins (and even national currencies) are the best in the world.

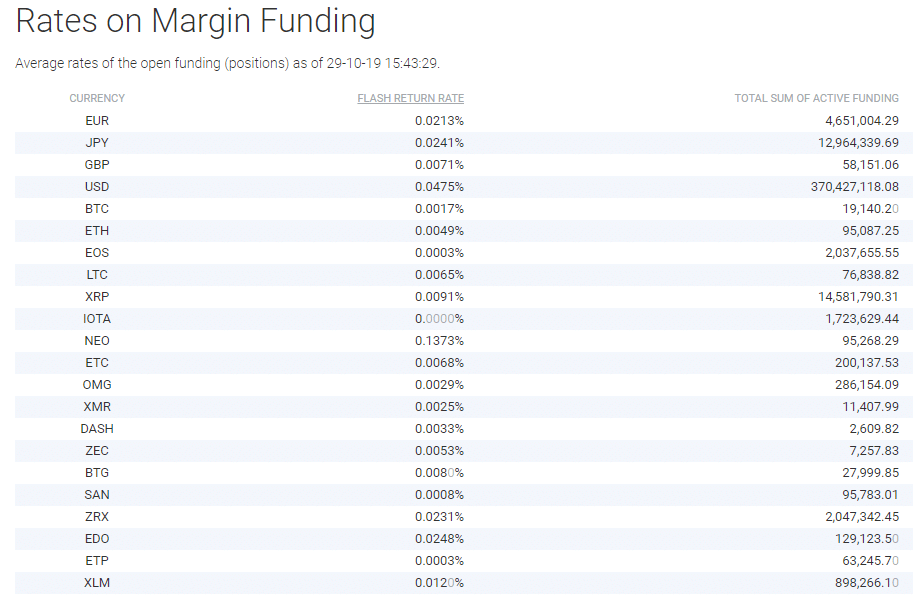

Source https://www.bitfinex.com/stats

The “flash return rate” (middle column) is the daily interest rate for those who want to borrow various national currencies such as the US dollar and for cryptocurrencies such as bitcoin.

The per annum interest rate for US dollars is 17.33% but the per annum interest rate for bitcoin (as of October 29th) is only 0.62%.

Bitfinex is the only crypto-exchanges that offers peer-to-peer lending marketplace. All other exchanges charge a flat fee if you want to borrow bitcoin on margin, and the fees range anywhere from 15% to 35% per annum.

Americans are also locked out from the biggest futures exchanges in the world, such as Bitmex and Deribit.

I have written about Bitmex many times in the past. It’s the Goliath of the crypto-exchange derivative industry

.

Volume last Monday on Bitmex was almost $4 billion USD.

In comparison, Bakkt (the bitcoin futures exchange backed by Wall Street and open to Americans), traded $11 MILLION USD on Monday, and that was big news.

When trading futures, liquidity is the killer feature of any exchange where a quarter-point can mean the difference between a pro trader and a loser.

Bitmex is the king of liquidity. Bitmex sets the price of Bitcoin, worldwide.

Lastly, a few words about the elephant in the room: trading fees.

Coinbase is the largest exchange in the world that allows Americans to trade. The average trading fee to buy and sell bitcoin is 4%.

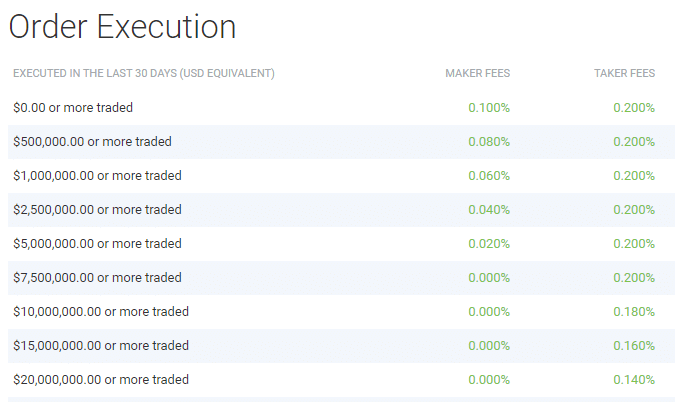

Look at the trading fees on Bitfinex:

There is no comparison. It is obvious that Bitfinex is geared toward large institutional investors while Coinbase is out to screw the average US retail investor.

It’s no wonder that Asia is embracing crypto while the US is moving towards it at a snail’s pace.

Conclusion

It’s too easy to say that American financial regulators are over-protective of the average US retail investor.

There is a long list of ICOs currently being investigated by SEC that in hindsight were nothing more than scams.

But an argument can be made that if you want to try to make a living doing sophisticated (or even reasonably intelligent) trading in crypto, the US is the worst place in the world to make your home.

In a future article, I will write how US investors are being driven towards making bad investment decisions because of the crypto-exchange bans.