Nobody is Going to Tell You When the Levee Will Break

Deprecated: preg_split(): Passing null to parameter #3 ($limit) of type int is deprecated in /home/newcurrencyfront/public_html/wp-content/themes/jannah/framework/functions/post-functions.php on line 805

Déjà vu, pronounced day-zhaa voo,

is French for “already seen.” It describes the fascinating and strange experience where you feel that something is very familiar but you also know that this feeling of familiarity should not be as strong as it is.

Back in 1999, I nearly broke my arm patting myself on the back because I bought BCE Emergis just under six dollars. I sold most of it at $120 which sounds pretty smart except it reached a high of $180 before heading down.

If you have never heard of that stock before, don’t worry about it. It was some internet stock. There were a ton of them back then and all of them were going to change the world. Until they disappeared.

In 2009, the warm brown stuff had already impacted the moving propellers, and would have devasted my portfolio except I had already raided it years before to buy some Vancouver real estate so my family could have a place to live.

The decision to move into real estate worked out better than the whole internet stock craze, once again proving Napoleon right: It’s better to be lucky than smart.

Both decades have two things in common. Financial markets went into a tailspin, and nobody in the mainstream media called it, even though in hindsight, it was obvious the levee was buckling and water was pouring around the sandbags.

In 2019 the repo market broke. The Fed has loaned hundreds of billions of dollars to the big banks to shore up their balance sheets. The total tab should be close to half-a-trillion by the end of January, if not sooner.

But hey, things are alright, no need to worry:

“Monday’s 15-day action that spans the end of the year was undersubscribed, the second straight operation to come in under the amount on offer — a possible sign that year-end funding pressures have eased.”

Bloomberg, December 23rd.

I like to think that I’m not some conspiracy nut, but in times like this, I feel like I’m K (Tommy Lee Jones) in the movie Men in Black, who picks up a copy of the National Enquirer when he wants the latest news on what the aliens are up to.

“best investigative reporting on the planet

And so we turn to Zerohedge for the latest updates on the repo crisis, taking care not to be distracted by other stories such as Washington Post Denies Claim New Estrogen-Packed ‘Impossible Whopper’ Will Make Men Grow Breasts.

But even Zerohedge, in the latest article, says that doomsday has been averted and the last term repo on December 30th should go off “without a hitch.”

I guess throwing $500 billion at a problem does make it go away, at least for a little while.

Conclusion

Well I’m glad to hear that everything is okay but I hope you don’t mind that I’m changing my investment strategy somewhat.

I now like cash. I’m putting more of that in my portfolio. Commodities like gold and oil look attractive as well.

I sold my Amazon.

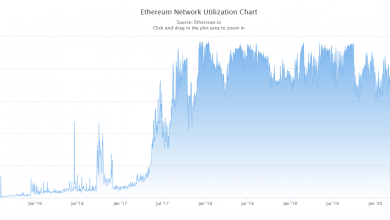

Altcoins were horrible in 2019 and they will continue to suck. Except for some Ethereum and a tiny bit of Ripple (a mistake soon corrected), I didn’t buy any in 2019 and I won’t in 2020.

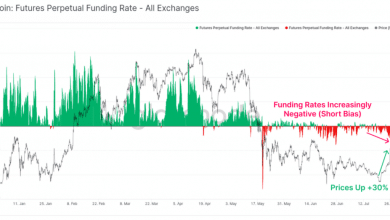

Bitcoin? That’s an interesting one. Is a commodity or a highly speculative tech investment? We are going to find out in the coming year.

I have sold some, but still own a lot. I think of it as a long-term investment, meaning, of course, there are going to be some days when I don’t want to look at the price.

The levee will break sometime in 2020. I will tell you the exact day two weeks after it happens.

DJ

You can follow me on Twitter https://twitter.com/CurrencyFront