Uniswap is a decentralized Ethereum token exchange. It is also the hottest thing going in crypto.

I have written stories about Uniswap here, here, and here.

To research on those stories, last month I dumped two Ether into an Ethereum wallet conducted two trades.

One trade is break-even. I’m down on the other trade.

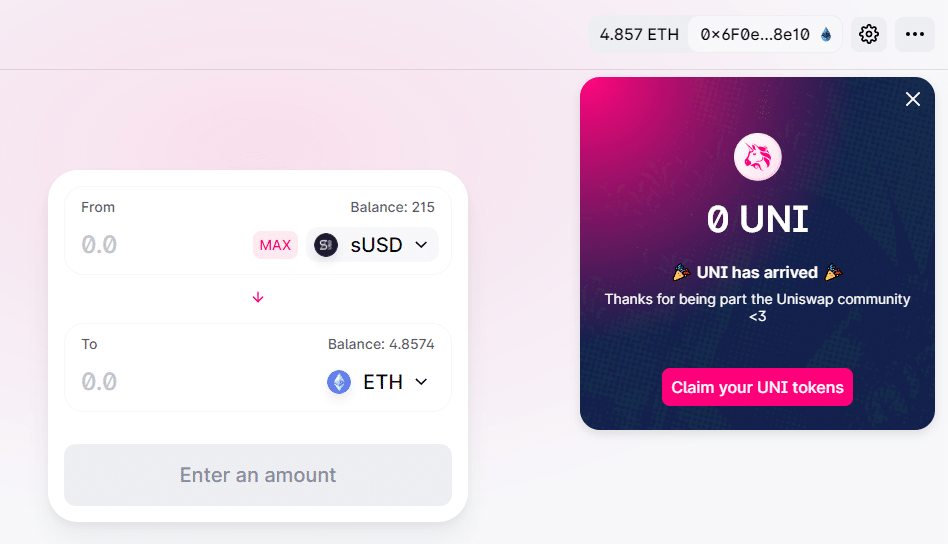

However, this is the state of my wallet today:

As you can see, I have 4.8574 Ether in my wallet, or a gain of 143%. What happened?

Earlier this week, Uniswap announced an “airdrop” of 1 billion UNI Governance tokens, of which I received 400 as a thank-you for a being a customer of Uniswap.

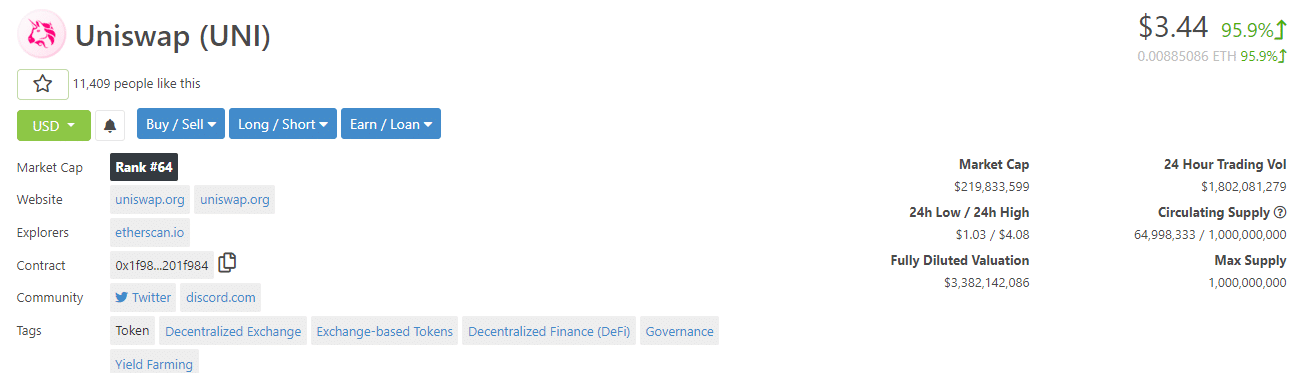

I sold them for about $3.66 last Wednesday.

https://www.coingecko.com/en/coins/uniswap

That’s almost $1500 USD.

You should note that I dumped the coins as soon as I claimed them for my wallet.

Of course, today UNI is at $7.50. But that’s life.

Why did I dump so fast? Two reasons:

Dumping the coins allowed me to get my original investment out.

This is a hard-and-fast rule for me, and really should be for anybody who plans to invest in highly speculative assets.

If you can get your money out, do it. You get piece of mind, and no matter what happens, you get to fight another day.

And if you REALLY BELIEVE the investment is going to the moon, then just buy it back. But sleep on that first.

Which brings me to the second reason. Do I think the UNI is going to the moon? I don’t know. I never do.

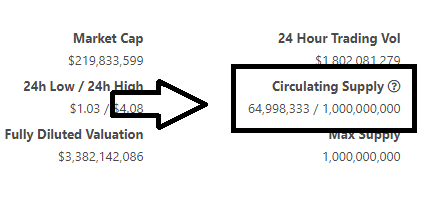

But I think if does make it to the moon, its going to have problems staying there. Look at this:

One billion tokens have been issued. That means the total value of all tokens is more than $7 billion. However, only 6.5% of those coins are currently in circulation.