With bitcoin up 58% this year and Ethereum also having a great year (up 193%), stocks with exposure to crypto are riding the wave.

But there’s problem: Finding publicly traded companies with serious exposure to crypto.

One of the very few pure “crypto-stocks: is Riot Blockchain (RIOT-NASDAQ), which is up 225%:

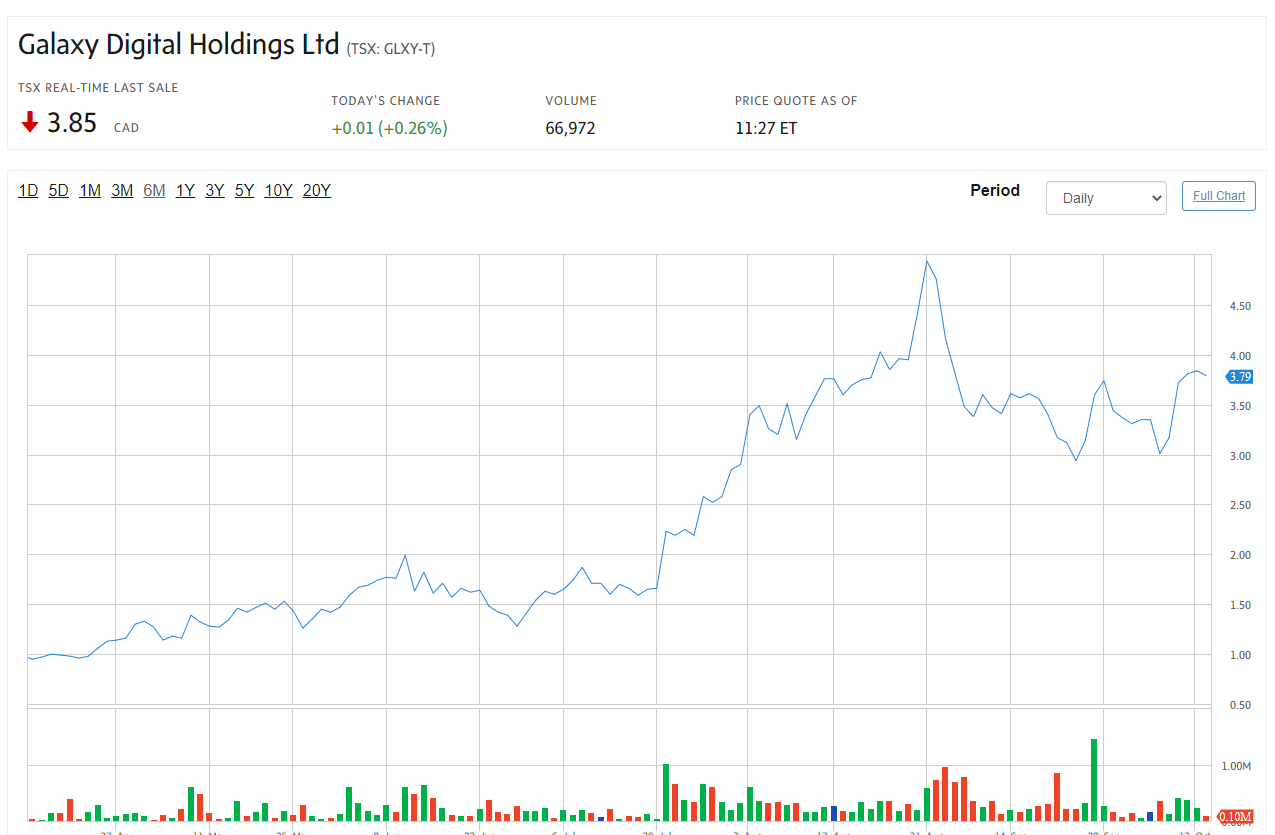

And another one has been Galaxy Digital Holdings (TSX-GLXY-T):

Meanwhile, gold sector has woken up from its near decade-long slumber.

Gold is up “only” 25% this year but the junior exploration stocks have been on an absolute tear since June.

Those stocks are not outliers. Our sister publication Investing Whisperer has mentioned many other junior explorations such as Kodiak on June 17th. Here is the chart for that one (up 400%!):

The charts of these junior exploration stocks are remarkably similar to RIOT and Galaxy Digital. AND THERE ARE A LOT MORE OF THEM.

The junior exploration niche is wide, deep, and familiar territory to experienced investors. Hence, they are getting all the attention and retail money.

Meanwhile, you should note that I haven’t mentioned bitcoin mining stocks at all, because why should I?

The returns this year have been mediocre to lousy: Hut 8 Mining is down 35%, Bitfarms is down 40%. HIVE Blockchain is a notable exception, up from 12 cents to 43 cents but remember that stock traded as high as $5.00 during the 2017 mania.

There are still a few crypto-stocks with VERY LOW market caps listed on the junior exchanges, but they are NOT getting any financings i.e. love from accredited investors or institutions.

And that’s bad because start-up companies always burn cash. Without injections of cash, they cannot operate and fall into zombie mode. Most of them are just shells now.

So Where is The Money Going in Crypto?

Short answer: Ethereum tokens.

If you are a development team building the next great application in crypto and need funding, you sure as heck don’t go through the hassle of a public listing, which can take months, cost lawyers’ fees, and include many conversations with those joy-killing securities regulators.

Instead, you create a token on the Ethereum chain, flog it on Uniswap, lock your lawyer in the closet to muffle the screams, and pray the SEC is too busy beating up on Bitmex to pay any attention to your operation.

Your reward? Two to 10 million dollars with no strings attached. It’s easier to beg forgiveness than to ask permission.

What then should be the strategy of the average retail investor (i.e. you and I)?

Traders who have been in the penny stock business for awhile have a saying: “I wouldn’t buy that stock at 10 cents, but I would buy it at a buck.”

The reality is that a whole bunch of development teams raised a bunch of cash over the summer to fund their projects.

Most will fail. Some will fail spectacularly, with the founders heading to parts unknown with the whatever cash is left over fromtheir failed projects.

But not all will fail. The ones that succeed will eventually want to go “legit.” They will need to become public companies.

They will let their lawyers out of the closet and let those lawyers do their jobs, which is to get them listed on the junior public exchanges and then finally graduate to NASDAQ nirvana.

Investors jumping in at the right time could be greatly rewarded for their patience.

Well, that is my plan anyway.

DJ