Setting up a printing press in your basement to print pictures of dead US presidents on bits of paper is to invite a visit from some men/women dressed in black.

But do you want to create some virtual US dollars? No printing press is needed, just a keyboard, computer, and mouse.

And don’t expect a visit from the Secret Service anytime soon.

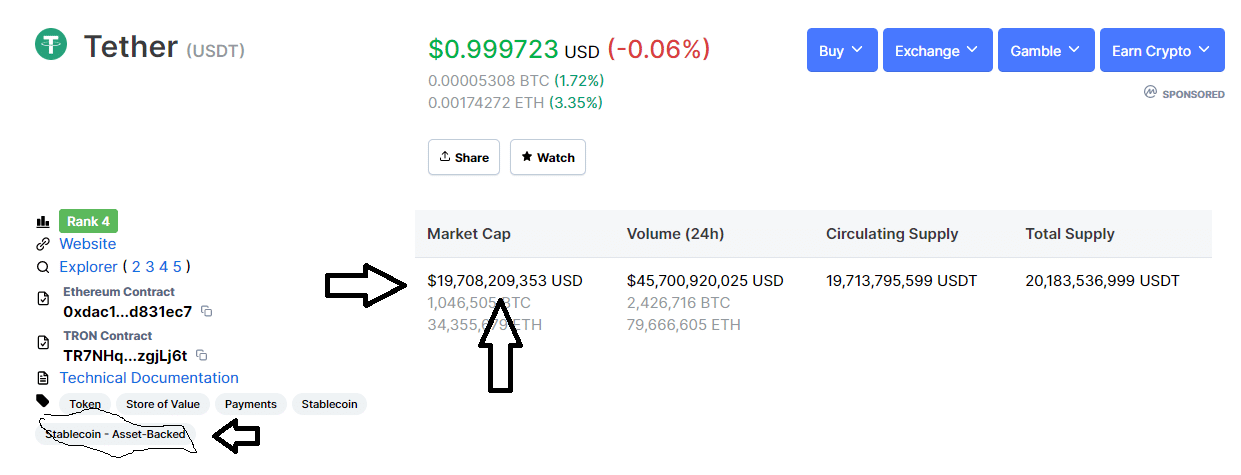

Think I am joking? Behold the market cap of Tether, a token minted and distributed via the Ethereum ecosystem:

https://coinmarketcap.com/

The whole functionality of Tether – it’s sole purpose in life – is to act as a digital US dollar.

By the way, did you read the fine print? Tether has a market cap of 20 BILLION US DOLLARS.

These types of Ethereum tokens are called stablecoins.

The business model of a stablecoin issuer is as follows:

1. Start off with financing, let’s say a million dollars or ten.

2. Put that money into Treasury bonds or short-term notes.

3. Issue your stablecoin that is backed by your reservers.

4. Get your stablecoin listed on the major exchanges.

5. Sell the coins you issued for real US dollars. Rinse and repeat.

6. Your profit is the interest earned on those Treasury bonds minus marketing and admin expenses.

But of course, your profit margin is greater if you employ the trick of fractional reserve, where all you have to do is keep enough real U.S. dollars on hand to pay out people who try to redeem it, which never happens.

Fractional reserve kind of shady but because there are no financial regulations that mandate that stablecoins need to keep 100% of the issuance in reserve.

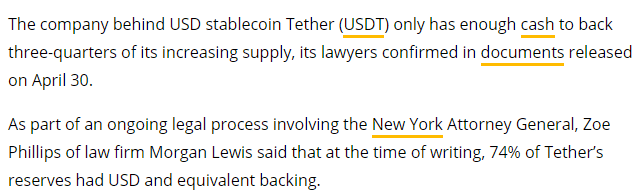

Does the Tether have 20 billion USD on hand to hand out if people want to redeem their Tether? Tether has admitted that they do not.

Assuming that the Tether organization is continuing to back their Token with only 74% reserves, that means $5 billion USD has been created out of thin air.

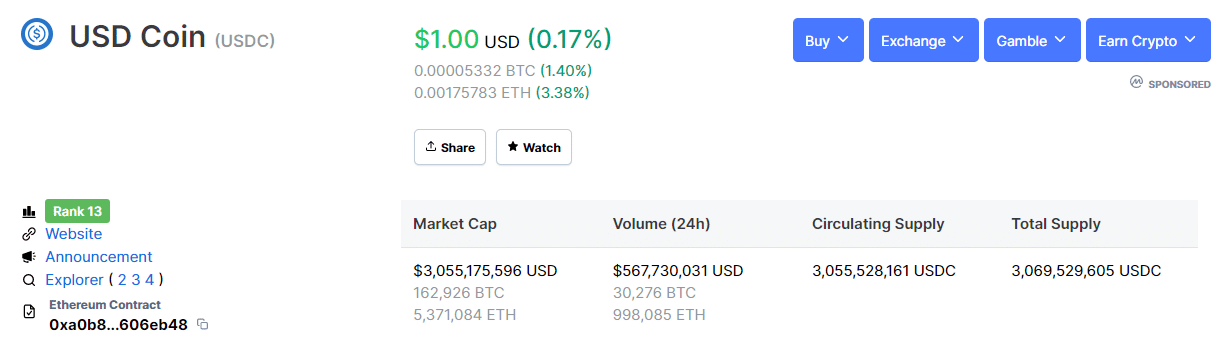

Its a lucrative business, and US-based competitors have appeared.

The Ethereum token USD is backed by US based Circle and has a market cap of $3 billion USD.

Note that Circle claims that there is not backed by fractional reserve, i.e., for every coin issuance, there are real assets to back it up.

Which brings us to the next question…

Where are the Regulators?

The stablecoin business has been booming in the last year and a half and has finally attracted attention from US authorities. There is now proposed legislation on the table called the Stablecoin act:

https://tlaib.house.gov/media/

Highlights of the proposed legislation:

- Require any prospective issuer of a stablecoin to obtain a banking charter;

- Require that any company offering stablecoin services must follow the appropriate banking regulations under the existing regulatory jurisdictions;

- Require that any company or bank issuing a stablecoin to notify and obtain approval from the Fed, the FDIC, and the appropriate banking agency 6 months prior to its issuance and maintain an ongoing analysis of potential systemic impacts and risks;

- And require that any stablecoin issuers obtain FDIC insurance or otherwise maintain reserves at the Federal Reserve to ensure that all stablecoins can be readily converted into United States dollars, on demand.

But of course, the legislation must first be passed, then tested in the courts, and then finally US regulatory authorities must be prepared to enforce such legislation around the world, especially in Asia.

Until then, issuing stablecoins in the world of crypto will remain a very lucrative business. And just a touch bit shady.

DJ