It’s a hypothetical question unless you are a money manager.

Deposit it at your local bank?

Interest rates on deposits in most Western countries are essentially zero, except for countries like Denmark, Switzerland, and Japan, where interest rates on deposits are negative.

Ask this question around the dinner table with your teenage kids and you will get funny answers: Store it in your mattress?

Ten million dollars in $100 hundred-dollar bill weighs 220 pounds and takes up 10 suitcases. You are going to need a bigger mattress.

And a very well-secured bedroom.

Most people do not think it is a problem to “own” ten million dollars. Until they have it.

Or, I should say, they have custodial ownership of the money and need to justify their management fees.

Where can we put the money?

US Treasury bonds? The one-year bonds are paying 0.16% APY right now.

So you put the money in large-cap equities?

But what if you have a client that absolutely does NOT want you to lose money?

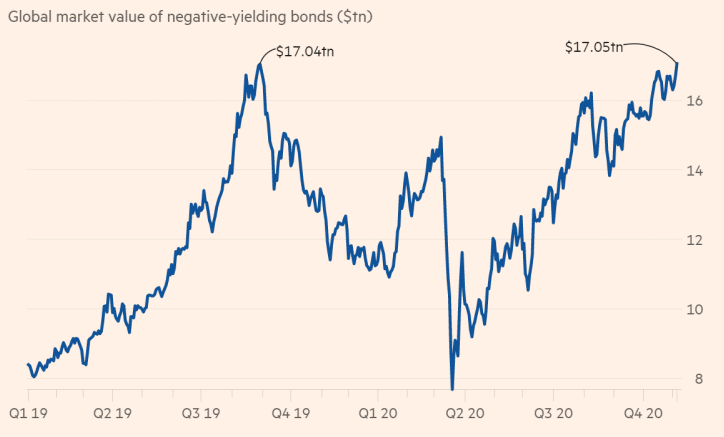

This is such a real problem today for money manager that they have parked $17 TRILLION dollars in negative-yielding bonds:

Source: Financial Times

However, what if I told you about an investment that:

1. Has a positive interest rate?

2. Had no equity risk?

3. Had no exposure to currency risk (other than USD)?

At this point in the economic cycle, with the options available, if you are a money manager, you must at least look at it.

And here is a risk-free investment that pays you more than 10% a year.

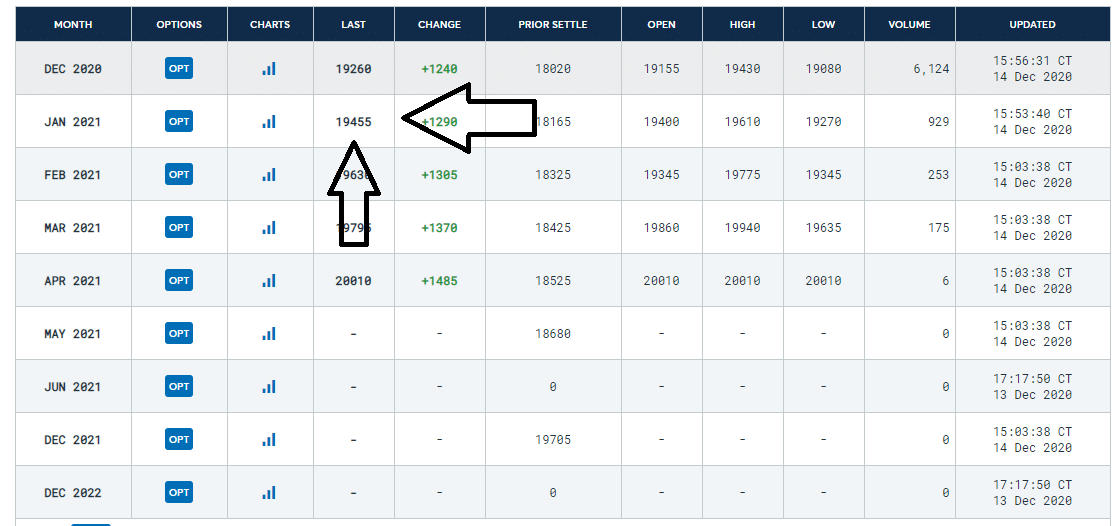

The price highlighted by the arrows is $19,455, the future contract price of bitcoin futures as determined by the Chicago Mercantile Futures (CME) exchange. The price of bitcoin at the of this snapshot was $19,174.

This contract settles on January 29th.

Selling short this contract will give an investor an effective return of 11.6% APY, minus trading fees (which should bring it down to 10%).

Here how the return is calculated.

Divide the value of the futures contract ($19,445) by the current price ($19,174). The futures price is trading at a 1.47% premium to the present price.

There are 46 days until the contract settles or expires. Divide the number of days in a year (365) by 46, and you end up with the number 7.935.

Times that number by 1.47%, and you get 11.6% APY.

Put your $10 million in that contract, and you make a million in one year.

BUT, BUT I hear you say.

You have exposure to BITCOIN and that is RISKY. Your client won’t like that.

No, you do not.

When you short a bitcoin futures contract that settles in US dollars, you are purchasing what’s called a quanto contract, which has no exposure to the price of the underlying asset.

Two examples that prove this:

If you short one bitcoin at $19,000 and the price of bitcoin doubles to $38,000, the value of that short contract is now only one-half bitcoin.

However, because the price of bitcoin has doubled, the value of that one-half bitcoin is worth….$19.000.

Conversely, if the price of bitcoin falls to $9500, because you have shorted bitcoin, the contract is now worth 2 bitcoin.

But the value of the contract itself is still $19.000.

To summarize, if you are shorting bitcoin futures contracts priced in USD (and you are not leveraging), you have no exposure to the price of bitcoin.

You do, however, get to collect the price premium of the futures contract.

BUT, BUT, (I hear you say) what about the risk that the contract itself will not be honoured? IT JUST SOUNDS RISKY.

And that’s why there is a price premium for bitcoin futures. IT SOUNDS REALLY RISKY to a lot of investors.

The risk that the guy on the other side of the table walks off with your money is called counter-party risk.

Most, if not all institutional money managers would not touch futures contracts offered by the overseas crypto exchanges with a ten-foot pole, because of counterparty risk.

But this futures contract is guaranteed by the Chicago Mercantile Exchange, which has been in business since 1898, or for 122 years.

Is there a chance that the contract will not be honoured, or settled, by the CME? In theory yes. In practice, absolutely not.

The CME has survived two World Wars, two global pandemics, and one Great Depression. I think we are good here.

And the final question you might have is, why are not more wealthy investors shorting bitcoin futures contracts?

I know the answer to that question. Most investors with $10 million USD in their pocket tend to be somewhat conservative. Mention bitcoin to them and their eyes glaze over.

Mention bitcoin futures contracts and they will get up from their seat and walk to the door.

Until the last six months.

The perception of bitcoin as being “risky” is changing. Fast.

DJ