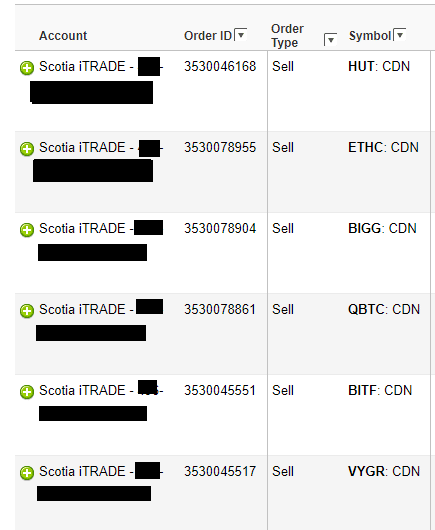

I sold one-third to one-half of my crypto stock-portfolio today (not my bitcoin and Ethereum):

Three reasons why I sold:

First reason: I made a killing over the last month on these stocks:

Hut 8 Mining is up 103% since I bought it. Ether Capital is up 86%. Blockchain Intelligence Group is up 104%. QBTC is up 57%. Bitfarms is up 168% Voyager is 160%.

If these stocks soar ever higher in the next 30 days, great, I still capture some upside. If they go down, no problem, I am playing with house money.

Second reason: Bitcoin futures contacts expire on the fourth Friday of every month.

I have written about this phenomenon in the article Speculating in bitcoin is stupid and risky, with one exception before.

If history holds true, the next seven days should be quite volatile.

And when I say volatile, I mean there’s a significant chance you will see the price of bitcoin and Ethereum drop by ten percent or more.

Nothing is guaranteed of course, but I’ve been seriously trading crypto for close to four years now and that’s the trend. And a lot of “hot” money has entered this space this month, low-convictions traders are easy prey for option sharks.

Put that combination together, forget it, I don’t want to be watching the charts this weekend, I need to get my Christmas shopping done.

Third reason:

January is usually a month of stagnating prices, if not outright reversals. I wrote about this trend in an article right here.

And again, the money flowing into crypto-stocks is very hot. If the price of bitcoin and Ethereum starts to stagnate, let alone correct 10 or 20 percent, the money will flow out.

Allowing of course, for a lovely buying opportunity in early February.

Conclusion

Could I be completely wrong? Sure. But so what? I haven’t sold any of my crypto-holding, just some crypto-stocks.

If January turns out to be a big month, I still win. If not, I just hold on a bit longer. I have been holding for four years.

DJ