It’s been a fantastic December for bitcoin (up 39%) and Ethereum (up 18%)!

For the year, bitcoin is up 375% and Ethereum 560%.

But how did the rest of the world of crypto perform?

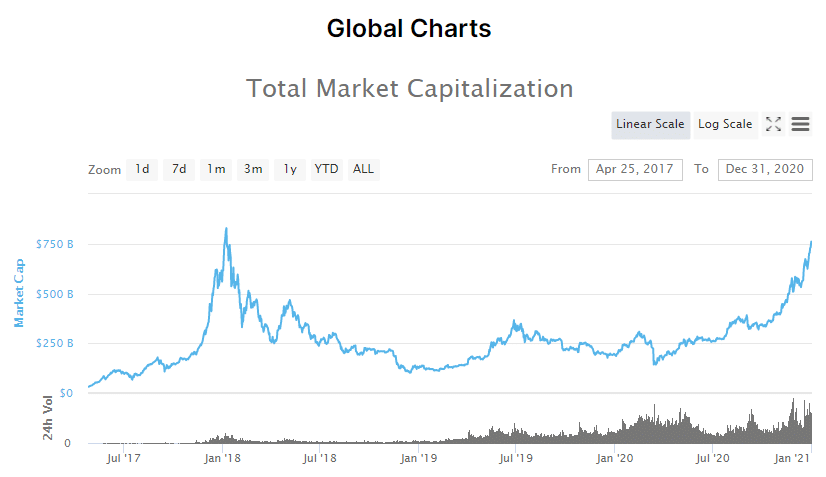

Two charts tell the story:

This is the total marketcap of all cryptocoins in the universe: $750 billion. Note that’s not the all-time high, which was $800 billion briefly in December 2017, even though the marketcap of bitcoin is at an all-time high.

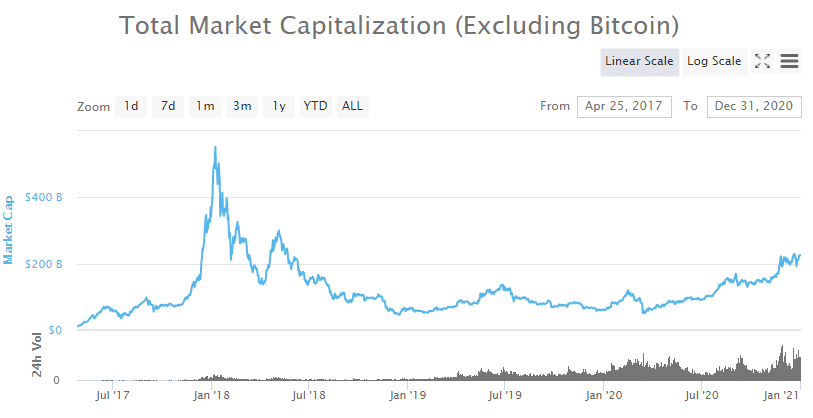

Now look at this chart:

That’s the market cap of all crypto EXCLUDING bitcoin. At beginning of 2018, the marketcap was briefly $500 billion USD. It’s now just a little more than $200 billion.

For sure, Litecoin has a wonderful rally this month. It’s up 60% in December and it’s a triple for the year.

However, Bitcoin Cash went up only 75% for the year.

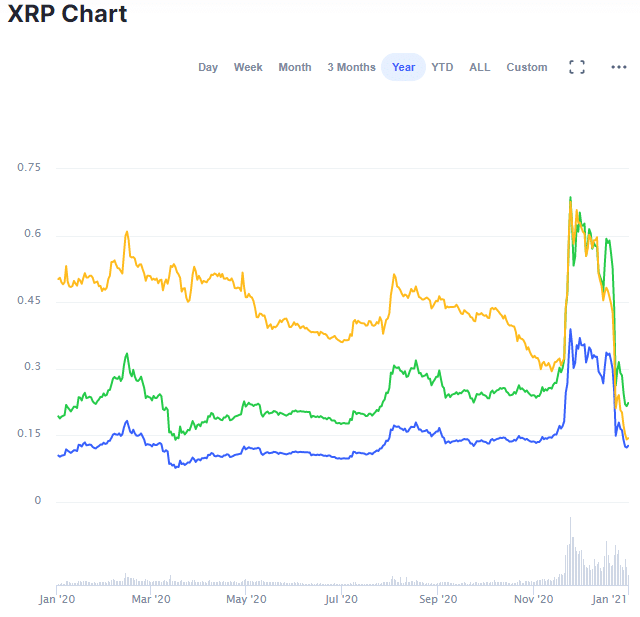

And December for XRP has been a complete disaster, with the SEC dropping the bomb on Ripple calling it an unlicensed security.

And so it goes. There is no more persistent myth in the world of crypto than “Altcoin season,” or the belief that when Bitcoin goes on a big run, the altcoins go up even more.

That may have been true at some point in 2017 when the world of crypto was shiny and new for most investors. But things have changed.

Bitcoin has proven itself to be robust, unhackable, and more widely accepted by world financial institutions than any other cryptocurrency, by far.

Ethereum has the most developers of any crypto-coin and the most exciting roadmap. It’s big problem is that demand for the services offered by the token has been throttling bandwidth for months now. It’s a nice problem to have.

Everybody else? Sure, if you got lucky, you picked up a Defi token like Yearn.finance that went up 1000% in a few weeks.

But how many of those who got in on the ground floor were average retail investors, and how many were insiders and team developers?

Conclusion

The crypto marketplace is starting to pick winners. Bitcoin is a winner. Ethereum is on the comeback trail. The new Defi tokens are worth watching.

But everything else?

My bet is in another three or four years, you are not going to see fifty coins with a marketcap of more than $1 billion. We may not even see ten.

In 1908, there were 253 car manufacturers in North America. In 1929 there were 44 with Ford, GM, and Chrysler accounting for 80% of the market.

How many search engines had significant market share before Google came along and swallowed up the world? The answer is seven: Excite, Webcrawler, AskJeeves, Dogpile, Yahoo, Lycos, and Altavista.

In the long run, in every industry, the marketplace demands consolidation. Crypto will be no different.

Altcoin season is a myth.

DJ