This chart says we are headed for some fun times for 2021.

Let me explain.

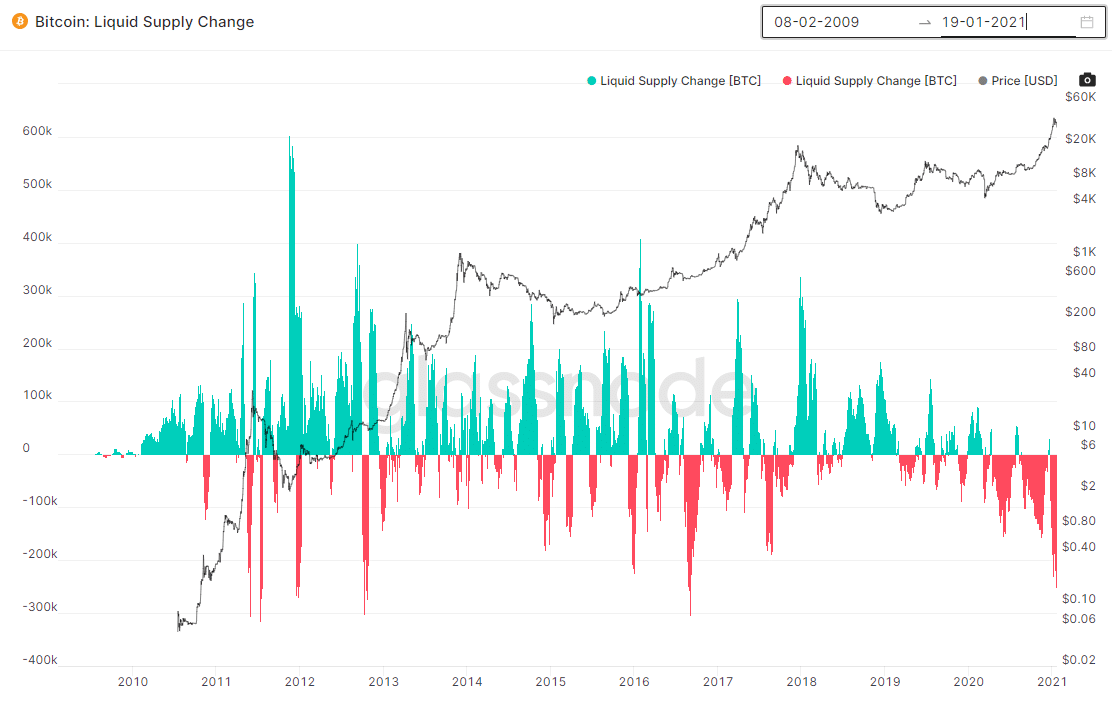

The green spikes represent bitcoin flooding into the cryptocurrency exchanges. The red inverse spikes represent bitcoin LEAVING the crypto-exchanges.

Obviously, when bitcoin is leaving crypto-exchanges, that means liquidity is drying up. The last time the market saw this much bitcoin flowing to private wallets was the last six months of 2016. In that time period, bitcoin went from about $400 to $900.

But of course, in the 12 months after the liquidity crunch, bitcoin went from roughly $1000 to a high of almost $20,000.

And you can see from the chart above, the liquidity crunch is much greater now.

That’s bullish. That’s REALLY bullish.

And of course, Grayscale Trust is playing its part in sucking up any bitcoin it can find.

I wrote about Grayscale Trust (OTC-GBTC) last week with regard to how they are dominating the market for bitcoin.

Keep in mind that only 900 new bitcoin are mined a day.

Where is Grayscale getting the money to buy all this bitcoin? Institutional investors.

Specifically, institutional investors who are not allowed to buy bitcoin directly.

In this excellent article by Ellie Frost, she outlines how Grayscale is structured to attract capital from institutional investors and how those investors themselves are pretty well guaranteed to make money.

The only risk is that the shares having to be locked for a certain amount of time, but that risk can be offset by buying hedges overseas in Asia (more on that later).

The forecast can’t get more bullish, it seems.

So why did the price of bitcoin drop from $40K to nearly $30K in the last three weeks.

Three words: Overleveraged long investors.

As I wrote in this article, speculative fever has driven up funding rates for crypto-currency future contracts to absurd levels.

But that’s invisible to most North American investors, as 65% of the bitcoin futures market and 95% of the Ethereum futures market is based in Asia, according to Messari research.

At Asian exchanges like Bitmex (closed to US investors), you can literally short Ethereum and get paid interest rate of more than 100% per annum.

That makes for serious downward pressure on the price of bitcoin, in the short-term.

Conclusion

In the long run, it’s hard to see the price of bitcoin (and Ethereum) going anywhere but up.

But in the short run, lack of liquidity in the exchanges and overleveraged speculators will make for some crazy volatility in the weeks ahead.

It’s going to be a wild ride.

DJ