If somebody offered you $10,000 an hour to juggle sticks of dynamite, you would do it.

But you would not being excited about doing it.

It’s like with buying public companies that are in the crypto-space.

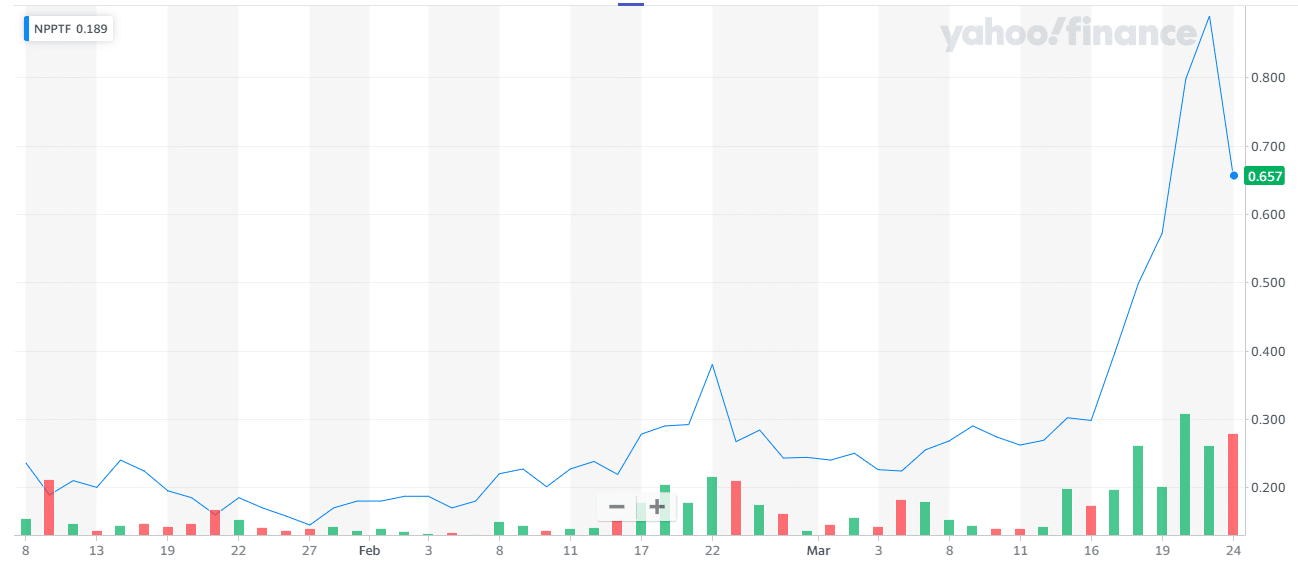

Last week I mentioned I was accumulating Neptune Digital Assets (NDA:TSXV NPPTF-PINK), a smallcap trading on the Toronto Venture Exchange.

This is the monthly chart:

I was looking like a genius trader until today when it crashed 25%.

Even worse, earlier this week, I bought two other crypto-smallcaps that looked pretty intriguing.

In two days, I am down 29% on one and 17% on the other.

Of course, that doesn’t mean anything except I have no self-control after a big win on paper. I was an idiot to buy during the last week of the month (more on that later).

It’s a cliché to say timing is everything but it’s especially so in crypto.

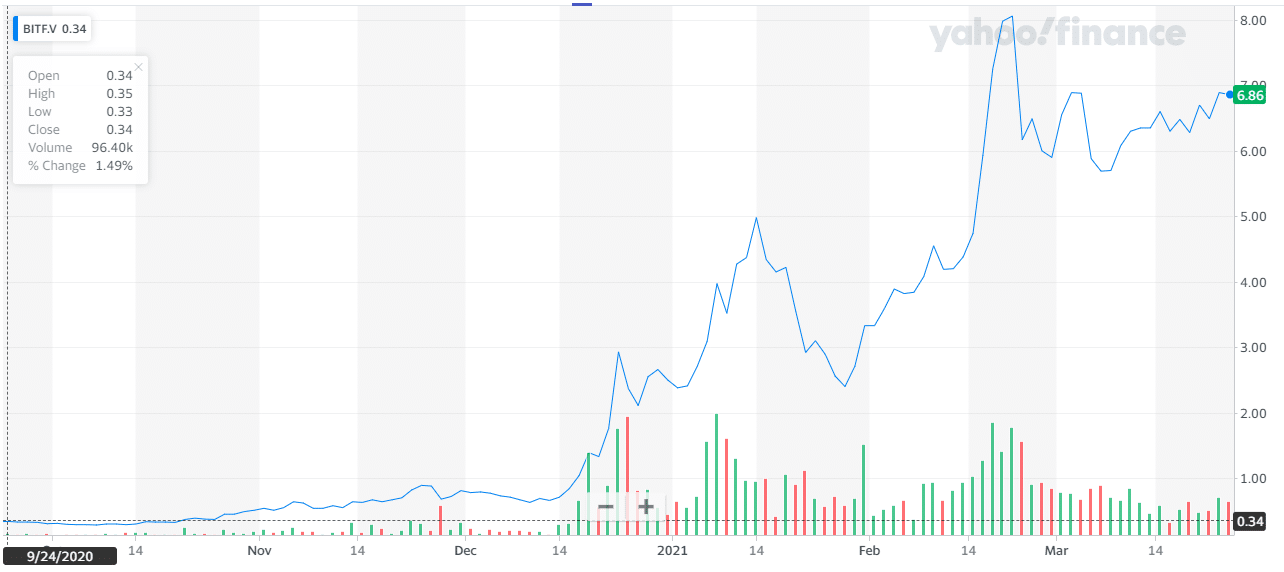

Let’s take the case of Bitfarms (BITF-TSXv) Great stock with an amazing chart over the last six months.

I wrote up the company in May of 2020 and it had a nice run to 64 cents. Then it crashed down to 35 cents in July.

Oh sure, if you had bought it and forgot about it through the spring and summer of 2020, you made an absolute killing, but how many people do that nowadays?

(Fortunately, I did jump back in December and caught most of the wave).

Why am I talking about this?

Because I just love the stocks that I bought that just crashed on me. And I love that a bunch of positive news is coming to crypto in the next few months, such as:

- Uniswap announced it’s going to launch Version 3 in May. Last evening I checked out the products and boy oh boy, I think I’m going to make a LOT of money trading in DeFi this summer. Hello super-duper turbocharged hedged trading.

- Ethereum is moving ahead with EIP 1559 (network upgrade), scheduled for July, which should restore some sanity to the gas fees in Ethereum and supercharge the Defi sector again.

Meanwhile, we just need to remember to NOT touch the keyboard during the week leading up to the end of monthly futures and option contracts for bitcoin (I broke that rule and am paying for it now).

The last week of the month is an especially dangerous time to trade anything crypto-related, as bitcoin/Ethereum crypto-contracts expire on the last Friday of this month.

And the traders love to bounce the prices of said coins/tokens up and down like a yoyo.

How bad is it during “witching week”?

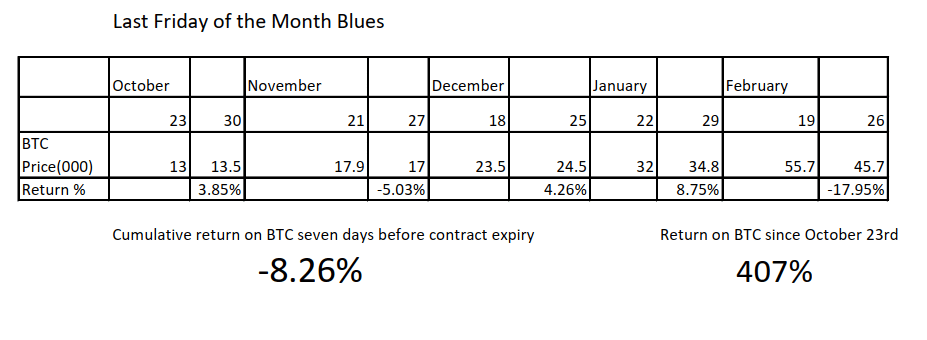

Look at the chart below:

Let me explain. This is a spreadsheet of the price of bitcoin during the seven days before the last Friday of each month, going back to October 2020, when this massive bull run started.

Since October 23rd, the price of Bitcoin has soared more than 400%.

However, during the seven days of the month leading up to the last Friday of the month (when contracts expire) the cumulative return on Bitcoin has been NEGATIVE -8.26%.

During one of the greatest bull markets in history.

Obviously, every pro in the room is aware of this phenomenon. It is hard not to notice when you get whacked in the head month after month during witching week (and trust me, this has been going on for years).

Now you are a pro because I have told you about this. Go and invest accordingly.

In meantime, I am waiting for the beginning of April, and can’t wait for summer.

DJ