For the last two months, I have been obsessed with Ethereum trading pools on Uniswap Level 3.

That’s where you provide liquidity to a trading pool that allows users to swap tokens.

It’s a decentralized exchange.

If the transaction volume is high enough, you can make anywhere from 0.5% to 2% a day of your initial investment.

That’s an annual yield of 180% to 730%.

Amazing return on your investment, no?

There is only one small problem.

To set up a trading pool on Uniswap, you must buy the two tokens that you want to add to the pool.

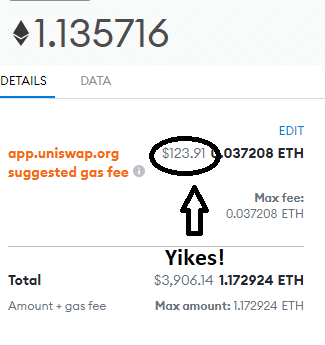

Then you open the position by creating an Ethereum contract. You can see from the screen snapshot that the currenct cost is $123. It’s been as high as $245.

Then, at a certain point in time, you want to collect the trading fees generated by your contribution to the pool. That’s going to be another $50-$100 in gas fees.

Do you want to pull your money out of the pool to chase a better trading opportunity? That will cost you another $100-$200.

The gas fees over the lifecycle of a typical Ethereum trading pool can be anywhere from $300 to $500.

For your trading fees just to cover the cost of the gas fees, you need a pool with higher than normal volume AND a minimum investment of $25k.

To repeat, you have to drop $25k on an unregulated investment vehicle that didn’t exist two years ago, to start getting decent yield after one or two weeks.

The rewards can be great. But the risk and the amount of capital that has to be wagered means only three types of investors are interested in Uniswap trading pools right now.

1) Investors who think nothing of risking $25K

2) Degenerate gamblers.

3) Investors interested in the cutting edge of technology, who use their superior intellect to correctly assess the risks and payoffs involved, combined with nerves of steel.

I am still wondering which investor I am, although I’m pretty sure it’s not #1.

It Wasn’t Supposed to Be This Way

With the London upgrade last August, there was some hope that gas fees would become less expensive. Instead, with the NFT craze, they are MORE expensive.

Ethereum is now like the most popular nightclub in town, the one where your friends insist you have to go, the one that takes two hours of waiting to get into and the beer costs $15, if you can find a waitress to serve you.

Hence the rise of other blockchain networks, like Solana, of which I bought some yesterday.

To test out the network, I scooted over to the hottest blockchain game on Solana, https://play.staratlas.com/Star Atlas, and bought a couple of space ships.

I think I got a really good deal on the Opal Jetjet, it only cost me $300 USD. And only 18,000 will ever be minted!

But the transaction cost was very cheap, less than ONE penny.

The Solana network is supposed to be capable of 45,000 transactions per second, which absolutely beats the pants off Ethereum, still stuck under 100 transactions per second.

However, besides Star Atlas, there is not much else out there on the Solana blockchain (and even with Star Atlas, all you can do so far is buy ships and skins, you can’t go out on missions yet).

Conclusion

So now it’s a race. Ethereum has applications that everybody wants to use like Uniswap and games like Axie.

But Solana has the speed and you can do execute transactions without having to take out a second mortgage on the house.

In the near future, Ethereum has rollup implementations and proof-of-stake upgrades which are supposed to cut gas fees down to a reasonable size and boost transaction speeds.

But if the schedule for Ethereum upgrades starts to slip, and developers start moving their apps to Solana, things could get interesting.

Ethereum isn’t the only smart contract blockchain in town anymore.

DJ