In the misspent years of my youth, I spent too much time in casinos.

I know the odds of every game in Vegas.

Blackjack pays out 100%, except when you get 21 on the first two cards, then it’s 150%.

In craps, on any roll, if the dice comes up 7, it’s a 400% payout.

In roulette putting a chip on any number from one to thirty-six gets you a 3500%.

I get that Vegas vibe sometimes when I am researching crypto

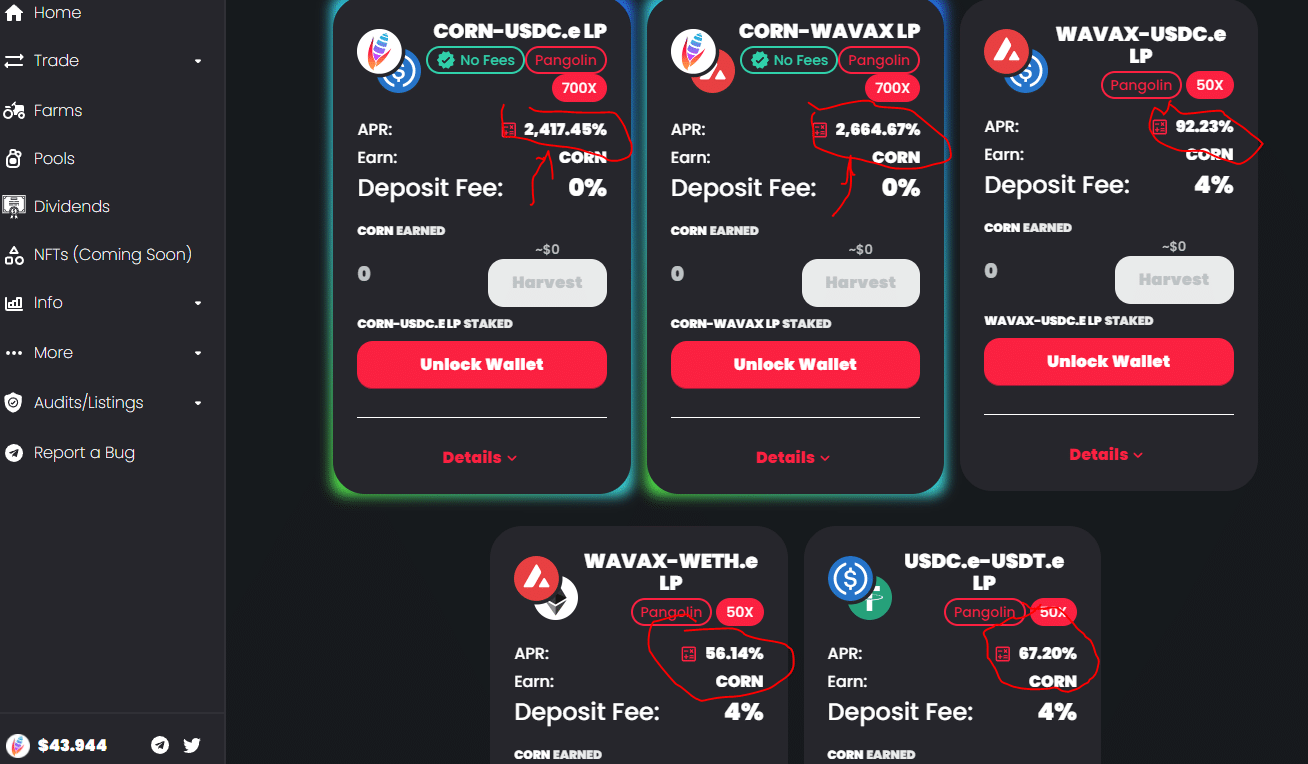

https://www.farmersonly.farm/

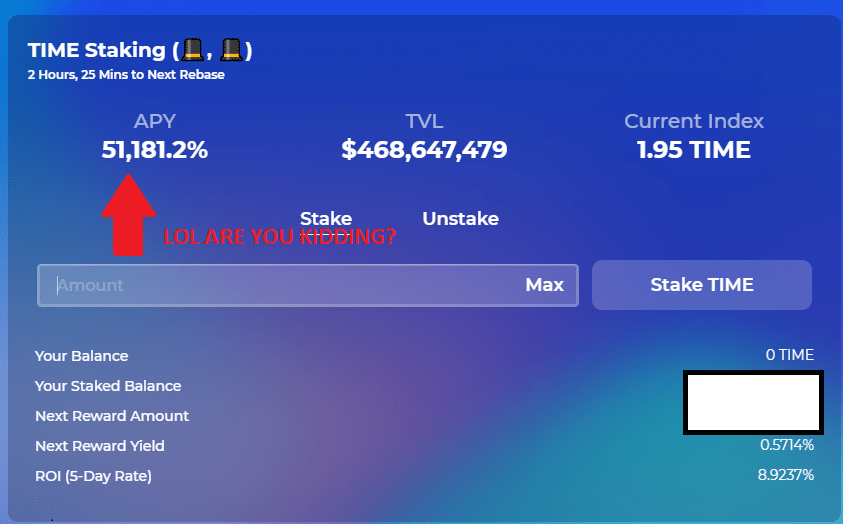

Now if a 2417% payout or a 2664% isn’t enough for you, how about this one?

https://app.wonderland.money/#

I’m not actually looking at web pages of online casinos (well maybe I am) but instead, these are contracts based on the Avalanche blockchain.

Let me tell you how I ended up there.

I’ve put a little bit of money in Ethereum trading pools, specifically Uniswap. I wrote about Uniswap more than a year ago. It’s grown up a lot since then.

Ethereum trading pools like Uniswap are nothing more than decentralized exchanges. Like Coinbase, Uniswap is a crypto exchange.

But Coinbase is centralized, in that all the trading is done on the Coinbase platform, and all the trading fees are collect by Coinbase.

Decentralized trading pools such as Uniswap allow ANYBODY to add capital to the trading pools to allow for the trading of crypto.

That means anybody can share in the trading fees of the trading pool, by providing liquidity.

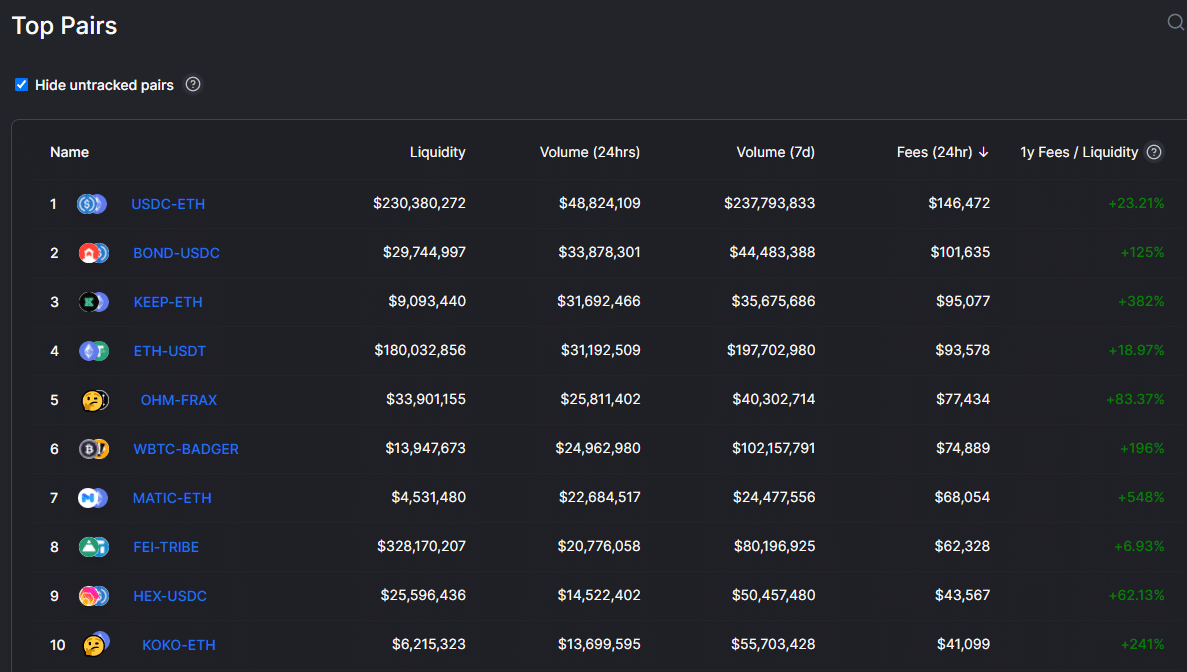

These payouts on Uniswap are quite reasonable:

Uniswap makes it hard to calculate your payout percentage-wise, so you need to calculate the yield yourself.

Take the top pairing: it’s the Ethereum-Digital US dollar combo.

The liquidity provided (amount of money in the pool) is about $230 million USD. Trading fees generated over the last 24 hours were about $150,000.

Extrapolate that over one year, and total fees accumulated would be 365x$150K = 54,750,000.

Therefore your annual yield is 54.75 million divided by 230 million which is 23.8%.

That kind of yield is quite reasonable, generous even, in the non-crypto financial world. But it’s the most conservative yield out there.

You only have to hold Ethereum and the USDC digital dollar coin.

But if you are willing to engage in riskier speculation, look at the Bitcoin-Badger trading pair, current at #6.

Liquidity is $14 million. Trading fees are $75k daily.

Total fees accumulated over one year: $27.38 million.

The annual yield is 95%.

It’s impossible to look over these trading pools without at least a twinge of greed.

But There’s One Problem

Actually, there are several. The biggest is assessing risk. It would take pages of analysis just to determine an approximation of the risk in some of these trading pairs, and that is beyond the scope of this article.

Another immediate problem in learning how to participate in Ethereum trading pools are the transaction (gas) fees.

They are stupidly high right now.

It’s easily anywhere from $150 to $350 to add liquidity to a trading pool, and anywhere from $50-$75 to collect the trading fees.

Let’s say you want to be cautious and only throw $1000 on the table to start because deep down inside you recognize you don’t really know what you are getting into, and you suspect you can lose all your money (and you are right about that).

Well, 35% of your investment is gone on the first day. And suppose you want to pull your money out in a week or two? That’s another 35% gone off the original investment.

To have any chance of making a return, you have to invest $10k or more. That sets a very high barrier to entry.

That’s why I decided to research other blockchains.

A shortlist of Ethereum competitors includes: Solana, Binance Smart Chain, and Avalanche.

Transactions fees on these other chains are anywhere from five to fifty CENTS.

That means for $10 you can be part of a trading pool on these other chains.

Are these alternate trading pools sort of scammy? Of course. If you put $10 in one of these pools, will you really make 50,000% in one year?

I really, really doubt it.

But you just lost $10. I’ve spilled drinks that cost more than that.

Interesting I learning more? At my next month subscriber update held on zoom, I will be talking more about trading pools.

DJ

Usual disclaimer: Nothing I write here should be taken as advice on investing, etc, etc. If you put your money into any of these trading pools (especially outside Uniswap), there is a significant risk that one day you wake and the development team has vanished, taking your $$$ into parts unknown.