It’s no coincidence that the stock market crash oftentimes signals the “end of an era.”

In the roaring twenties, the big boys of the Dow were trains, utilities and mineral exploration companies.

By the late thirties, car and plane companies took the stage. “Tech” also started to make its appearance as well with the rise of IBM (one of the few companies to grow during the Great Depression).

And so it was with the first stock market crash of the 21st century.

It was a slow-moving as the market need almost three years to hunt the losers and set the stage for the new industries to come forward and drive the economy of the Western world.

In 2000, the Nasdaq lost 39.28% of its value, then it dropped 21% in 2001 and 31% in 2002.

In 2000, the Dow lost 6.17% of its value , then it dropped 5.3% in 2001 and 17% in 2002,.

At the turn of the century, big telcos and tech hardware dominated the NASDAQ.

Lucent had a market cap of $258 (now $916 million after merger with Alcatel in 2007). CISCO had a peak market cap of $557 billion (now $228 billion)

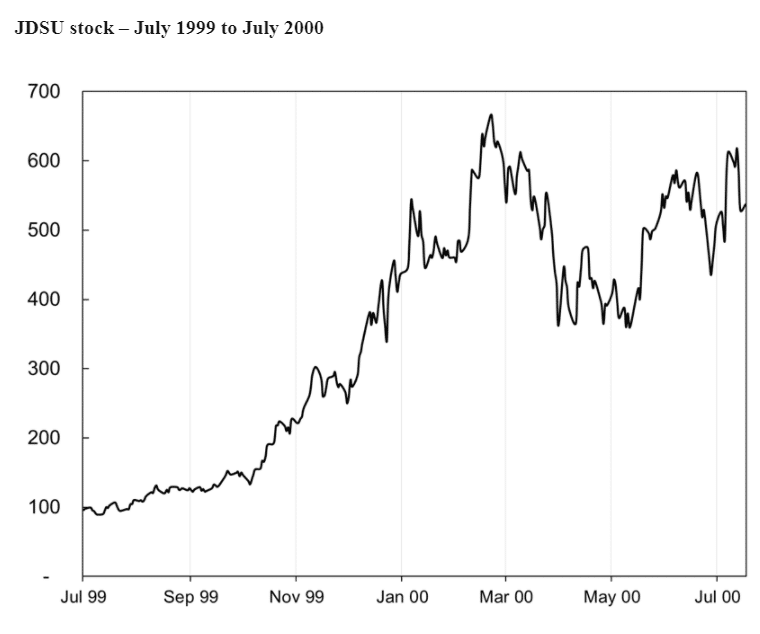

Does anybody remember JDS Uniphase? It went from $1 to $1200 and then back again.

Today, neither of these companies exist (Nortel went bankrupt in 2009 and JDS Uniphase split in two in 2015).

Those companies were just two of the boat anchors that dragged down the tech for much of the first half of the 2000s.

But what about the winners?

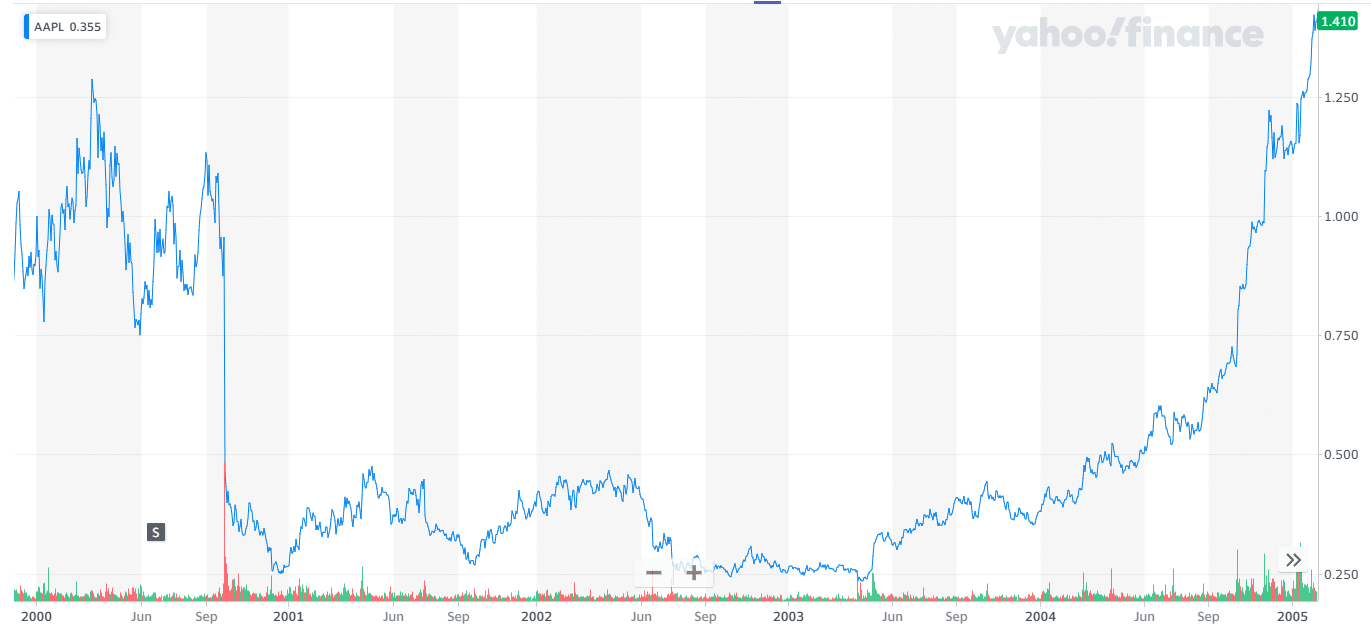

Apple tanked during the stock market crash but didn’t start to go back up until 2003:

Google is the oldest public company, with the IPO in September of 2004.

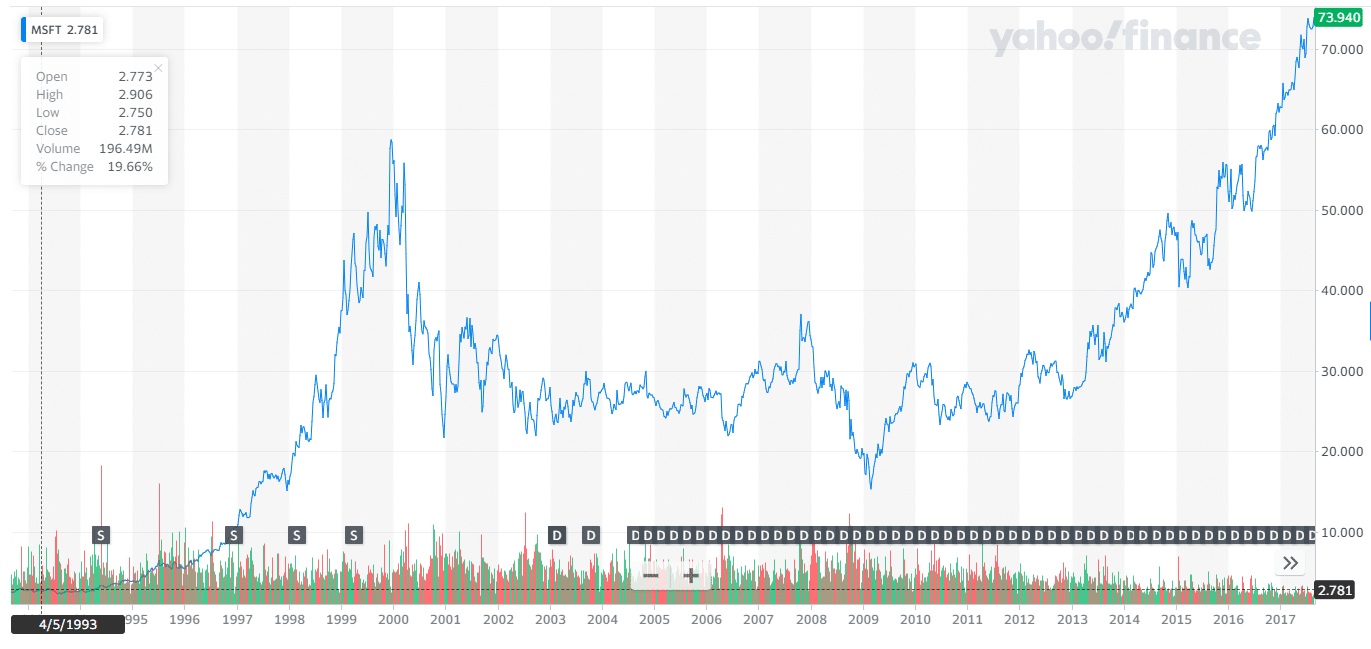

Only Microsoft is still a “player” in today’s market and was also a public company during that period:

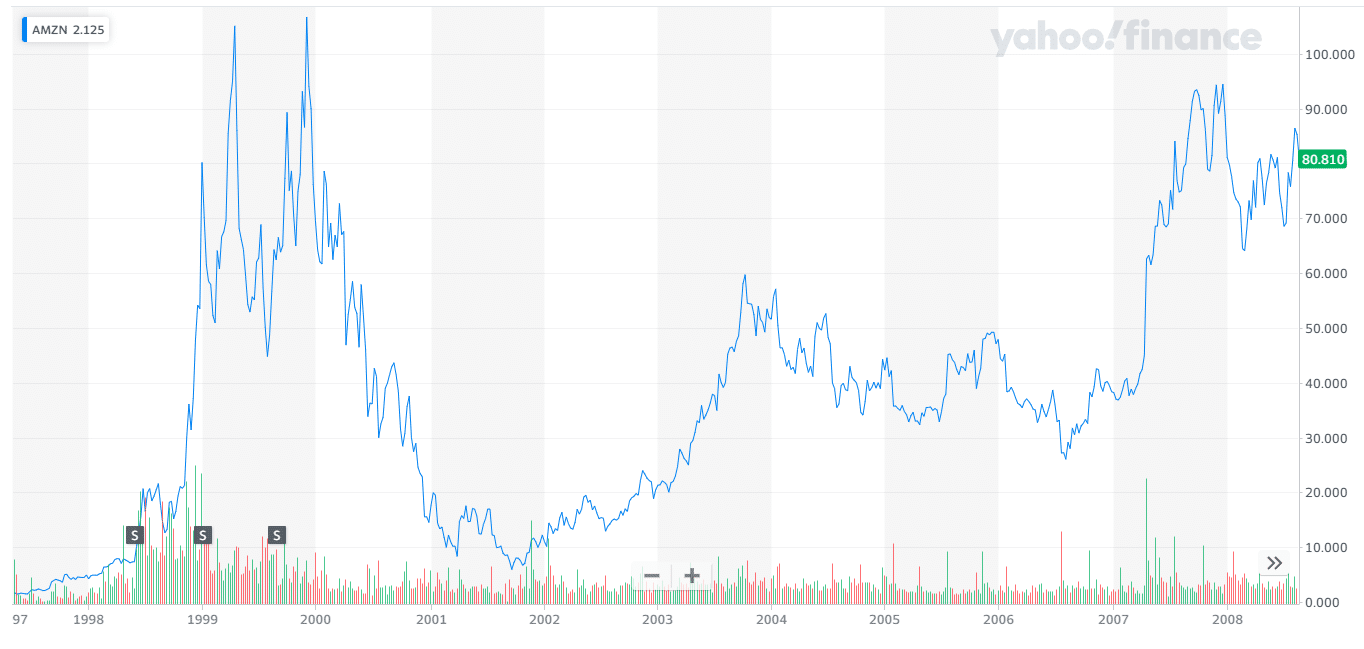

Finally, you may ask, what about Amazon?

But if you started buying the stock in 2002 and just held on, it was pretty much a lock you made a handsome return year over year.

If you held on during the 2008 crash, then the returns were amazing.

Lessons for 2022

All stocks tank after a crash. Good, bad, quality, fluff, they all tank, and a lot never come back.

For the ones that do eventually come back it can take years and years to reach all-time highs (but are good buys eventually (Apple and Microsoft).

None bounce back to their all-time in one or two years, but are still excellent no-brainer buys as soon as the crash is over. (Amazon).

But the big winners, the ten-baggers, are the ones that weren’t even public during the crash.

Applying these lessons to crypto, what conclusions can we draw?

All crypto-assets are going to tank (i.e. even more than today) Good, bad…etc.

A lot are never going to come back, i.e. the truly flaky, no-value garbage is going to zero and will stay there.

It’s going to take some time to reach all-time highs. LIke bitcoin is not going to hit $60k or Ethereum hitting $5000 anytime.

I don’t think it will take three years to come back (markets move a LOT faster nowadays) but if you think bitcoin is going to double by the summer, you should stop smoking the hopium.

Some crypto-assets are going to be good buys out of the gate and some will be excellent. But those assets will be really hard to find.

But the ten-baggers don’t even exist yet or haven’t been released to the public.

Do these conclusions seem simplistic to you? Are they obvious?

If they are, then you must be like me:

I’m in cash. But I won’t be in cash forever.

But I’m looking forward to the next decade when the wonderful technology of crypto brings forward new products and assets that will change people’s lives for the better.

After the tank, I’m back in.

Long-term, I see a glorious future.

Short-term, I’m writing cranky articles prophesying gloom-and-doom, and planning my next walk to the gym.