That’s according to the latest report on the global payment systems by McKinsey.

I make a habit of reading this yearly report, as boring as the title may suggest. I first wrote up the findings back in 2017.

Their best estimate of dead money in the banking system is $35 trillion. Back in 2016, it was “only” 27 trillion.

But now? With inflation running at seven percent this year, collectively depositors are going to take a haircut of $2.45 trillion dollars, unless they can coax some yield out of the banks.

Good luck with that.

In crypto, there is a sub-tribe of people who believe that the whole financial system is a conspiracy run by the elites to exploit the common citizens of the world.

I don’t believe that. To me, it’s just a bloated and inefficient industry that has fallen in love with regulatory capture and always hated innovation.

Traditional finance guys hate crypto. Don’t ever forget that. They pretend to “find it interesting,” but deep down inside, they hate and fear it.

The McKinsey annual report on global payments didn’t even mention bitcoin until 2021.

From the latest report:

Not only could they not ignore crypto anymore, but they also devoted an entire section of the report to it.

They even uttered the blasphemous word bitcoin. First time the report has done that. Only three times, and always in a negative light, but it is mentioned.

But I don’t think bitcoin is public enemy #1 for the bankers. It’s private stablecoins.

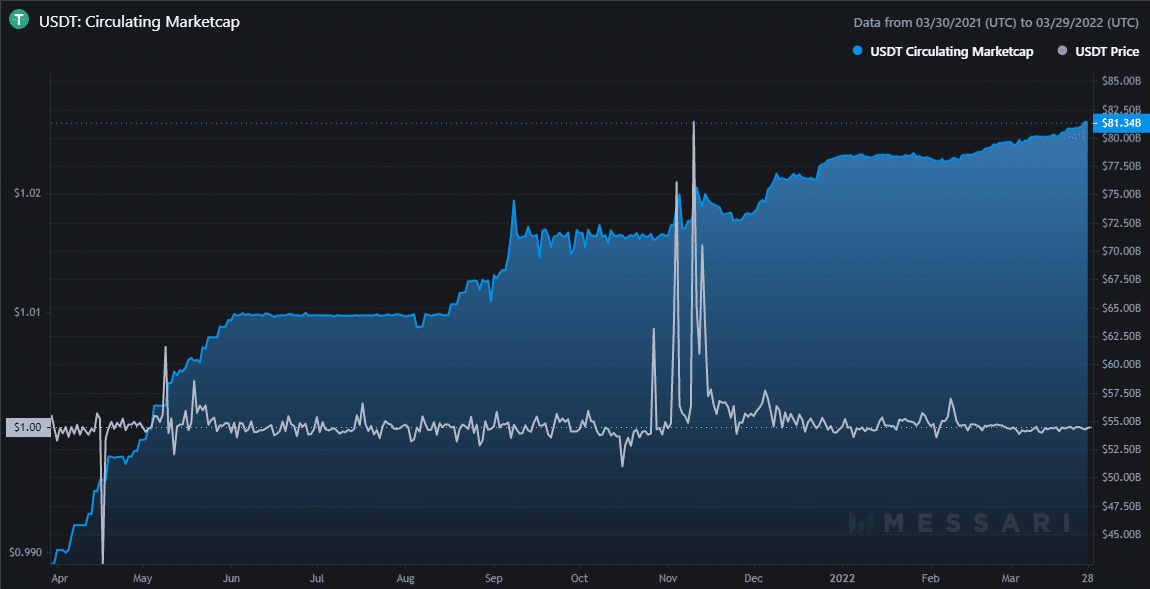

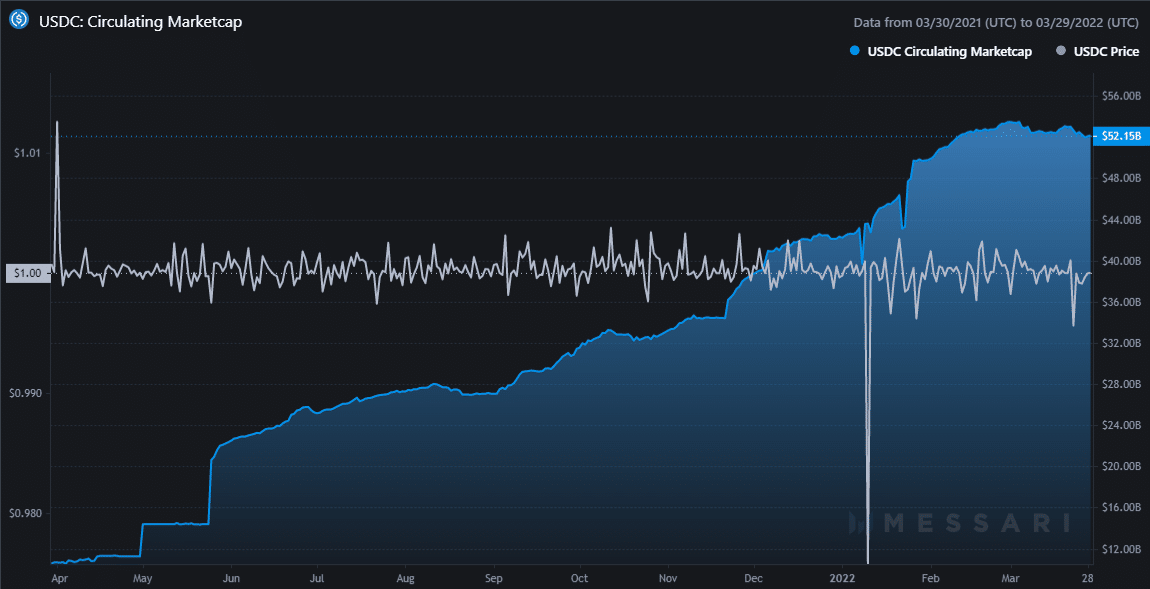

The world wants digital US dollars, and private industry is stepping up to meet demand:

Meanwhile, the central bankers are doing… something. Or thinking about doing something. From the report:

Private industry have now issued more than $150 billion in stablecoins and central bankers have issued none.

It’s having an effect. More comments from the report:

The public is cutting back their use of cash. Yes, the money flow is going mostly to credit cards. But some of it is going to crypto.

You can plot the transaction volumes of stablecoins alongside total crypto, and the trends are very similar. Both skyrocketed in 2021, but there wasn’t a stampede to stablecoins by cryptophiles desperate to escape the evils of Bitcoin. Nor one in the direction.

The money is coming in from the outside.

Now, remember the 2021 report was written BEFORE we had seven percent inflation.

Even without inflation, deposits from the banking system were “leaking” into crypto in search of higher yield.

But until now it was a very small leak. The market cap of ALL crypto today is just slightly more than 2 trillion dollars.

There are still 35 trillion dollars sitting in bank accounts, doing nothing but losing purchasing power.

Is that money going to stay there or move somewhere else? I’m betting at least a very big chunk of it will go into crypto over the next decade.

That’s why I’m here.

DJ