In the summertime, I like to catch up on my reading:

But Alpha Trader came with a strong recommendation and so far it’s quite good. The author, Brent Donnelly, has more than 30 years of experience trading foreign currencies.

How applicable is the book to a crypto-trader? Well, the sections on the psychology of a trader are a must-read, especially for young traders who like their dopamine hit.

But what caught my eye today was this paragraph:

“For every 100 trading books available on Amazon, I would estimate that one is about risk management, 29 are about trading psychology and the remaining 70 are mostly focused on on trading systems or how to come up with trade ideas. And half of those “How to come up with trade ideas” books describe simple strategies that have no edge.” (p.167)

And why is that?

Because if you ever want to make some casual small talk at a dinner party, bring up the latest hot altcoin and how it can go 10x. You’ll get an audience.

(Well maybe not nowadays, as everything is in the dumpster, but give it a year.)

But if you want to clear the room, talk about risk management.

It’s not that risk management is hard, it’s just tedious. And nobody does risk management when the market is hot.

Nope, the time to bring out the spreadsheets and grind out your portfolio only happens after the bear starts to growl. Like now.

In 2017 I didn’t open up Excel even once. But by the summer of 2018, I was spending hours on my spreadsheets, grinding out an income selling calls on Deribit.

What am I doing now? Faithfully tallying up my hourly payouts from Uniswap liquidity pools and reporting the results to my paid subscribers.

Are they reading the reports? Are they mimicking my trades? I don’t know. But what matters is making those numbers in Excel columns go up a little higher each day.

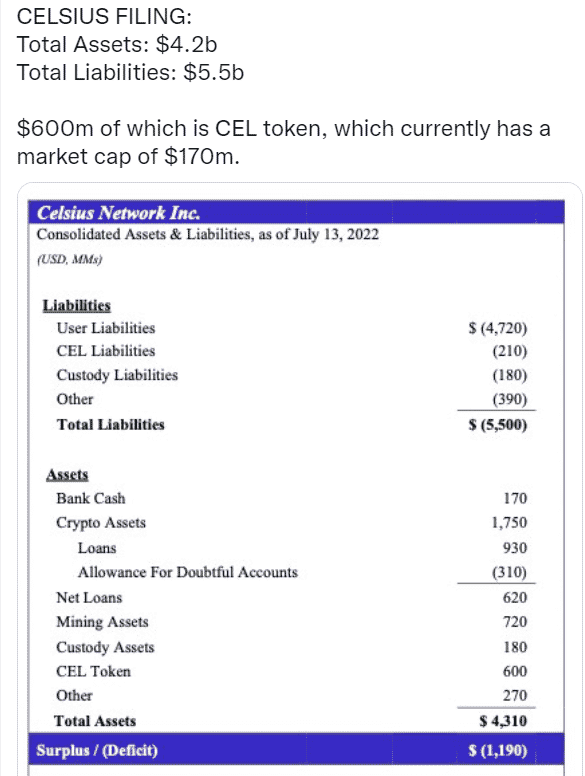

It seems even the big boys don’t like to do risk management, as the news has come out that Celsius has filed for Chapter 11 bankruptcy:

ttps://twitter.com/DylanLeClair_/status/1547662918459658245

In case you missed the fine print, they literally used customer funds for collateralized loans to invest in their mining arm.

Having gone big into bitcoin mining back in 2018, I could have told that was not a good idea.

But wait, there’s more. They are also listing the value of the CEL token at $600 million (along with their mining assets at $720 million).

Maybe they have $3 billion in liquid assets to pay back their customers (who are owed $5.5 billion).

How did Celsius screw up so bad? How did we all screw up so back?

Risk management, or lack thereof.

Well, no more NFT shopping for me. It’s back to the spreadsheets.

DJ

Editor’s note: Going on holidays starting this weekend. Back at the desk on August 2nd. I may post between bouts of wine tastings and snorkel expeditions. Or not.