Nothing energizes the soul of a crypto-trader like punting on a ridiculous long shot.

You want options trading? You want penny stocks? I give you both: penny options!

Earlier in the week. I bought 600 Bitfarms (BITF:NASDAQ) call option contracts, in the money at $1.50 (Bitfarms is currently trading at $1.02).

The options are set to expire on October 21st or two weeks away.

As you can imagine, the options were cheap. Not dirt-cheap, sewer cheap.

That’s $2400 USD worth of lottery tickets set to evaporate in 14 days.

Why did I do it (besides being bored)?

Well, it’s one-half of a hedged trade, to start. But I will talk about the other half later.

Because I think there’s a chance that bitcoin could go up dramatically in the next two weeks.

In a subscriber bulletin that I sent out earlier in the week, I said we could see a super-spike in the price of bitcoin if there was a currency crisis in Europe or Japan.

I think that a currency crisis in one of two regions will eventually happen.

But I said in a bulletin that the odds are against it. It’s a long shot that the crisis will happen in the next two weeks.

Ergo, this is a long shot. But I picked this long shot for a reason. It’s a massive payout if I get lucky.

Bitfarms is a bitcoin mining company that has massive torque. When the price of bitcoin moves up, it moves up much higher.

(Of course, when the price of bitcoin goes down, the Bitfarms stock price usually plummets).

These options right now are trading at 2 cents. If Bitfarms doubles in price, that is a 25x bagger. If bitcoin goes to $25K in the next two weeks, you would see Bitfarms trading at $2.

To summarize, if we see a European or Japanese currency failure, then bitcoin goes up in price, Bitfarms stock price goes up even more, and my Bitfarms options go up much, much more.

But chances are low that is going to happen. Chances are I’m going to lose my money.

Therefore, I need to hedge. I need to offset this longshot trade.

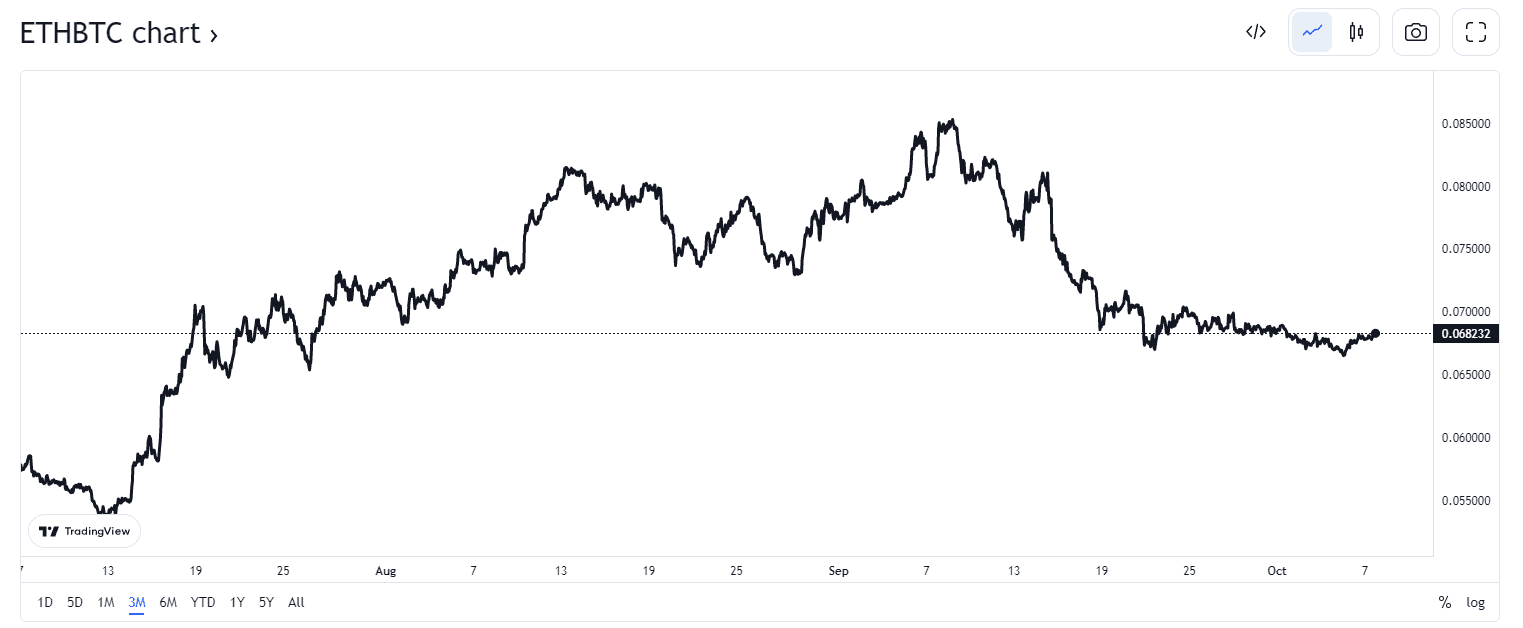

And this chart tells me where I need to go:

This is chart of the price of Ethereum marked against bitcoin. The correlation between the two crypto-currencies is quite strong, especially in the last month.

Well, the correlation is strong enough for what I want to do.

What is more risky than bitcoin derivative trading? That’s right, trading in Ethereum options.

Therefore, I take the other side of the trade. I assume that the price of Ethereum will not go up. It will stay flat or even go down.

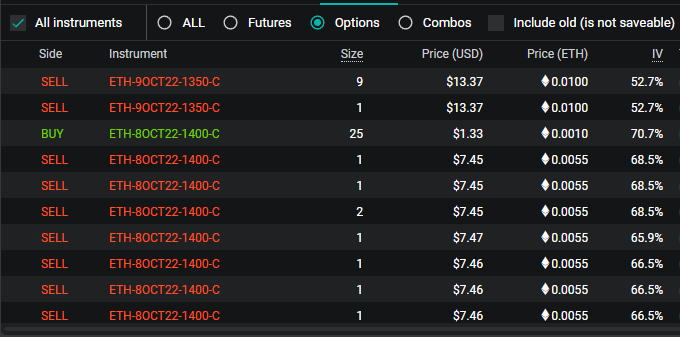

Every day this week, I have been selling 24-hour Ethereum call options on Deribit (yes, they exist).

I have been clearing about $100 to $120 USD a day. I have 14 more days of trading before my Bitfarms options expire.

If the trend continues (the market stays flat or goes down), then I should clear $2000-$2200 in profit by October 21st.

That would offset my loss on the Bitfarms options.

But what if the price of Ethereum skyrockets? If that happens, then most likely the price of bitcoin will skyrocket as well, and I should make (cross fingers) more profit on my Bitfarms options than the loss of my short-term Ethereum options.

Is it a perfect hedge? No. But according to my spreadsheet and some high-school math, the volatility has been reduced considerably, but I still retain most of the opportunity for considerable upside.

In the long run, playing longshots while hedging to reduce the costs to nothing or very little is not risky at all. I can do this all day, all week, all next quarter until something breaks and then I can cash out.

Conclusion

What I have done here is take two very risky trades with very significant upsides, and combine them to lessen the risk considerably.

Think of chemistry.

Sodium by itself is a poisonous, highly reactive metal prone to exploding upon contact with water.

Chlorine is a deadly gas.

Combine the two and you have sodium chloride aka table salt.

In the world of finance, you can sometimes find two toxic trades and combine the two to make something edible.

DJ